filmov

tv

Why aren't we all getting rich from compound interest?

Показать описание

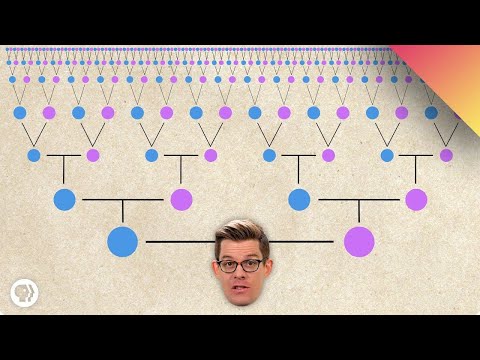

Just let your wealth compound over time and you'll be a millionaire, the advice goes. If this is true why aren't more people rich?

UNDERSTAND, SHARE & PUSH BACK

SUBSCRIBE, SHARE & START A CONVERSATION

Performed by Gary Stevenson

@garyseconomics

UNDERSTAND, SHARE & PUSH BACK

SUBSCRIBE, SHARE & START A CONVERSATION

Performed by Gary Stevenson

@garyseconomics

Why aren't we all getting rich from compound interest?

If Compounding Growth is Easy Why Aren't We All Rich?

Didn't We Almost Have It All - Whitney Houston | with Lyrics the Best of 80's Most Favorit...

Why Don't We All Have Cancer?

All-Female Celebrity Trip Gets The ROAST Treatment

Keane - Somewhere Only We Know (Lyrics)

Charlie Puth - We Don't Talk Anymore (feat. Selena Gomez) [Lyrics/Vietsub]

Conservatives Appear To Have Lost All Faith In Trump

Blake Lively Is Time's Most Influential | Katy Perry Goes To Space | Candace Ep 178

You got it, dude #shorts

Fox Host HUMILIATED by AOC On Stage... She Won't Like This!

Didn't We Almost Have It All

'I Don't Get What The Fuss Is About!' Simon Jordan On Declan Rice's Performances...

Why don’t we have more nuclear power plants?

This is the REAL reason we aren't having more kids!

[ENG SUB]✨After Divorce, the CEO Couldn’t Let Go of Daily Intimacy #DRAMA #PureLove

Poor Teacher Spent All Saving To Feed Struggling Student!Now They Became Rich CEO&Back To Repay ...

Are We All Related?

Why hasn't Apple invented this yet?!

Ella Langley - Don't We All – Official Visualizer

3 Reasons Why We DON’T Recommend Rottweilers

Charlie Puth - We Don't Talk Anymore (feat. Selena Gomez) [Official Video]

She’s Having Some BIG Changes, But Does This Mean She’s Close?

We Can't Accept Your Surrender - A Bridge Too Far

Комментарии

0:22:56

0:22:56

0:04:19

0:04:19

0:05:11

0:05:11

0:09:23

0:09:23

0:15:01

0:15:01

0:03:54

0:03:54

0:03:38

0:03:38

0:04:01

0:04:01

0:43:31

0:43:31

0:00:15

0:00:15

0:10:40

0:10:40

0:05:06

0:05:06

0:10:49

0:10:49

0:00:59

0:00:59

0:00:13

0:00:13

![[ENG SUB]✨After Divorce,](https://i.ytimg.com/vi/4OjkbLc1B8o/hqdefault.jpg) 2:04:52

2:04:52

1:58:14

1:58:14

0:06:26

0:06:26

0:01:00

0:01:00

0:02:42

0:02:42

0:00:42

0:00:42

0:03:51

0:03:51

0:25:12

0:25:12

0:00:42

0:00:42