filmov

tv

How to Manage GST Tax Liability on Advance Receipts

Показать описание

The Advance Receipts – Tax Liability report in GSTR-1 of Tally.ERP 9 will help you ensure that the values captured in Tax Liability table fully reflect the advance receipts for the period. It enables you to manage tax liability for advances, partially adjusted advances, and advances with incomplete or mismatch in information.

GST Masterclass | Save GST Tax | Learn #GST Rates | Types of Goods & Services Tax & Benefits

GST Basics in Tamil | CGST, SGST, IGST | Return Filing Details | Taxation in Tamil | GST Rate |

How to avoid GST LEGALLY on the purchase of a PRODUCT? | GIVEAWAY VIDEO | Aaditya Iyengar

Biggest Issue with GST in India | Business | Sarthak Ahuja

How to Find Actual Price Before GST - Goods and Services Tax

GST Compliances for Small Business - A to Z Guide | ConsultEase with ClearTax

How Businessman Pay Low/Zero Taxes & Still Become Rich? | Financial Education

What is GST & Income Tax? Difference between both taxes I Indirect & Direct Tax I Startroot ...

How To Save Tax Legally in India? For Small Business Explained By CA Rachana Ranade

complete gst return filing explanation in hindi | Gst Return Filing

Is GST mandatory for everyone? #QPShorts 42

GST Easy Explanation (Hindi)

Shocking GST Rules | New Tax by Nirmala Sitaraman on Middle Class

GST Return Filing in Hindi 2023 | gst return kaise bhare | gstr 1 filing | gst kaise file kare

How to Calculate GST / Tax part in Billed Value in Excel | MS Excel

A to Z Tax Planning Guide for Small Businesses, Professionals & Freelancers | How to save taxes?

GST input Adjustment

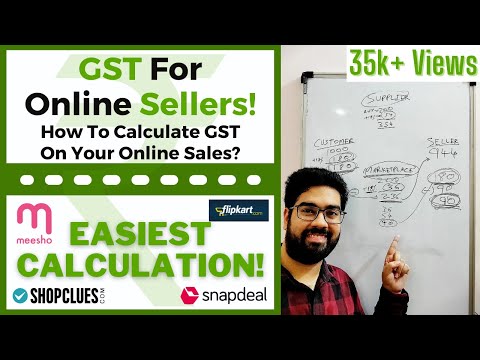

GST Calculation For e-Commerce Online Sellers | Step-By-Step Tax Explanation | Know How Much To Pay

What You Need to Know About GST

Can you claim GST input on mobile phones? #QPShorts 44

When GST registration is required for a business | Limit of GST registration

Export of Goods and services is exempt from GST | Taxation in India | Sarthak Ahuja

GST CALCULATION KARNA SIKHE

Restaurant Scam Exposed || Never Pay GST on Bill || Hotels & Dhaba #marketing #shorts #finance

Комментарии

0:24:11

0:24:11

0:22:31

0:22:31

0:08:22

0:08:22

0:01:22

0:01:22

0:03:34

0:03:34

0:14:45

0:14:45

0:18:07

0:18:07

0:03:55

0:03:55

0:05:50

0:05:50

0:11:15

0:11:15

0:00:46

0:00:46

0:06:51

0:06:51

0:10:47

0:10:47

0:13:09

0:13:09

0:00:59

0:00:59

0:22:40

0:22:40

0:01:01

0:01:01

0:07:13

0:07:13

0:00:34

0:00:34

0:00:55

0:00:55

0:00:59

0:00:59

0:00:27

0:00:27

0:04:25

0:04:25

0:00:41

0:00:41