filmov

tv

Accounting for Construction Contracts

Показать описание

This video outlines how to account for fixed price construction contracts pursuant to AASB 111 Construction Contracts (please note that AASB 111 is equivalent to IAS 11 Construction Contracts).

Published 26/03/2014

Published 26/03/2014

Construction Accounting Vs Regular Accounting

Accounting for Construction Contracts

AFAR: LONG TERM CONSTRUCTION CONTRACTS (LTCC)

AS 7 in ENGLISH - Construction Contracts || CA Inter/IPCC || ADVANCE ACCOUNTS

AS 7 Construction Contracts Revision | With Questions | CA Inter | Advanced Accounts | Aakash Kandoi

IFRS 15 Construction Contracts Simple Explanation

10 important things to know about construction accounting

Accounting for Construction Contracts - IFRS 15

AS 1 | AS 2 | AS 4 | AS 5 | AS 12 | AS 17 | AS 18 | AS 24 | AS 25 | AS 29 | Adv. Accounting Revision

Accounting for construction contracts

What is accounting for construction contracts? | Bookkeeping for Contractors

Works Contract /construction Accounting Tally Prime class 8

long-term construction contract accounting

Ch 8 Unit 1 | AS 7 Construction Contracts | CA Inter Advanced Accounting by CA Parag Gupta

AS 7 Construction Contracts Full Revision + Questions | CA Inter Advanced Accounting

AS-7 | Construction Contracts Revision | Advanced Accounts | CA Inter |What is Construction Contract

#casalimarakkal AS 7 CONSTRUCTION CONTRACT ACCOUNTING in 12 minutes AS 7

Accounting Standard 7 | ACCOUNTING FOR CONSTRUCTION CONTRACTS | AS 7

Long-term construction contracts

Construction Contract | Accounting Standard

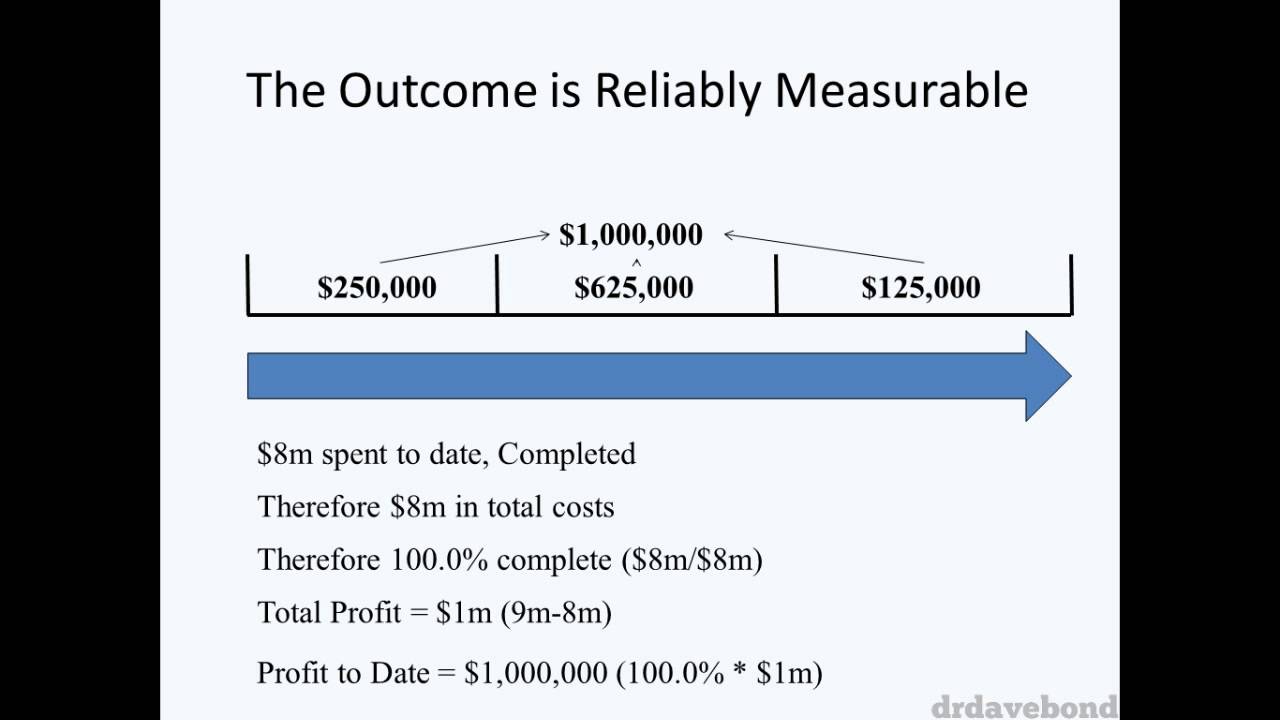

CIMA F2 Construction Contracts (IAS 11) - Profitable contracts

Fixed Priced OR Cost Plus Construction Contracts

#1 Contract Costing - Concept - B.COM / CMA / CA INTER - By Saheb Academy

Revenue Recognition For Long Term Contracts | Percentage Of Completion | Intermediate Accounting

Комментарии

0:05:24

0:05:24

0:08:39

0:08:39

0:33:57

0:33:57

0:18:36

0:18:36

1:31:50

1:31:50

0:08:11

0:08:11

0:10:08

0:10:08

0:19:17

0:19:17

1:24:15

1:24:15

0:00:16

0:00:16

0:01:31

0:01:31

0:20:28

0:20:28

0:20:30

0:20:30

1:37:32

1:37:32

1:15:04

1:15:04

0:28:59

0:28:59

0:12:39

0:12:39

0:04:21

0:04:21

0:14:04

0:14:04

0:05:31

0:05:31

0:17:05

0:17:05

0:00:29

0:00:29

0:34:15

0:34:15

0:09:37

0:09:37