filmov

tv

4 Covered Call ETFs that pay you every single month!... JEPI, JEPQ, DIVO, IDVO

Показать описание

Today I have 4 covered call ETFs that pay you every single month. Many more videos coming in this series so follow along as we build out a monthly paying dividend (and distribution) portfolio!

SEEKING ALPHA AFFILIATE LINK:

If you are interested in joining Seeking Alpha you can use the link below.

Use this special link to get a reduced price versus the regular rate of $239:

As an affiliate of Seeking Alpha, I do receive compensation for signups with this link. My opinion is my own and does not reflect those of Seeking Alpha and this video is not a recommendation or advice for any particular security.

Start the day off right with a 10% return!

Earn $10 for signing up and depositing $100 on M1 with this link:

0:00 Intro

0:37 JEPI

2:48 JEPQ

4:06 DIVO

5:36 IDVO

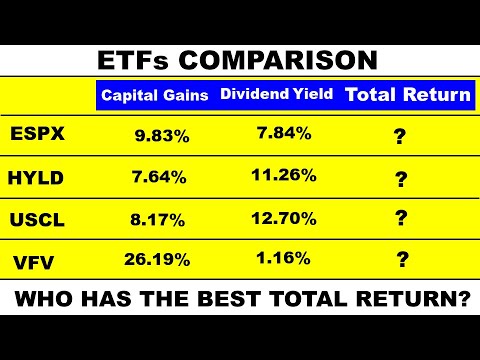

7:00 Summary chart

Related videos:

4 Monthly Paying REITS

4 Monthly Paying Bond ETFs

4 Monthly Paying Stock ETFs

Top ETFs for Income Investors

Top ETFs for Older Investors

Top ETFs for Young Investors

4 Forever ETFs

Understanding ITM call options

Playing offense in a bear market

Protective Puts:

Buying Calls

Answering Option Questions

Closing covered calls

Trading Options on Fidelity - Basic options and how they work with live examples on Fidelity

Selling Covered Calls

I just bought an option... now what?

SCHD Review

VOO DOWN 13% YTD

Buy ETFs on the dip

Understanding Buy to Open

Monthly Dividend Stock Meets Covered Call

Understanding Basic Options

NUSI Review

QYLD Review

JEPI Review

XYLG and QYLD Review

Buying ETFs with options

REIT meets covered call

Selling QQQ Options

Selling SPY Options for Monthly Income

Additional Tags:

Monthy paying REITs, Best REITS, Bond ETFs, Monthly paying dividend ETFs, Best monthly dividend ETFs, XLV, Best ETTs, Income ETFs, International ETFs, Bond ETF, High Yield ETF, Best ETFs, ETFs for young investors, Best growth ETF, Best growth ETFs, ITM calls, SCHD and options, Dollar cost averaging, beating a bear market, Top 10 ETFs, Top 10 Inflows, Top 10 US ETFs, Option time value, Extrinsic value, Intrinsic value, option assignment, Covered puts, profiting in a bear market, Bear markets, protective puts, VOO vs SCHD. Best ETF. Best dividend ETF. Buying call options, Buying put options, Option profits, Option breakeven, Selling covered calls, When to close a sold option, Options for beginners, How to write an option, Option basics, Selling options, JEPI, JEPQ, NUSI Income ETF, Income ETF, JEPI, DIVO, IDVO, High dividend ETF, option strategies, cash secured puts, simple option trades, Covered call options, ATM covered calls. SPY ETF, Selling Options, QQQ Options, QQQ vs VOO, Options for Income, Options during earnings.. Best dividend ETF. VYM versus SCHD. KO Stock. Buying the dip. Using put options.

SEEKING ALPHA AFFILIATE LINK:

If you are interested in joining Seeking Alpha you can use the link below.

Use this special link to get a reduced price versus the regular rate of $239:

As an affiliate of Seeking Alpha, I do receive compensation for signups with this link. My opinion is my own and does not reflect those of Seeking Alpha and this video is not a recommendation or advice for any particular security.

Start the day off right with a 10% return!

Earn $10 for signing up and depositing $100 on M1 with this link:

0:00 Intro

0:37 JEPI

2:48 JEPQ

4:06 DIVO

5:36 IDVO

7:00 Summary chart

Related videos:

4 Monthly Paying REITS

4 Monthly Paying Bond ETFs

4 Monthly Paying Stock ETFs

Top ETFs for Income Investors

Top ETFs for Older Investors

Top ETFs for Young Investors

4 Forever ETFs

Understanding ITM call options

Playing offense in a bear market

Protective Puts:

Buying Calls

Answering Option Questions

Closing covered calls

Trading Options on Fidelity - Basic options and how they work with live examples on Fidelity

Selling Covered Calls

I just bought an option... now what?

SCHD Review

VOO DOWN 13% YTD

Buy ETFs on the dip

Understanding Buy to Open

Monthly Dividend Stock Meets Covered Call

Understanding Basic Options

NUSI Review

QYLD Review

JEPI Review

XYLG and QYLD Review

Buying ETFs with options

REIT meets covered call

Selling QQQ Options

Selling SPY Options for Monthly Income

Additional Tags:

Monthy paying REITs, Best REITS, Bond ETFs, Monthly paying dividend ETFs, Best monthly dividend ETFs, XLV, Best ETTs, Income ETFs, International ETFs, Bond ETF, High Yield ETF, Best ETFs, ETFs for young investors, Best growth ETF, Best growth ETFs, ITM calls, SCHD and options, Dollar cost averaging, beating a bear market, Top 10 ETFs, Top 10 Inflows, Top 10 US ETFs, Option time value, Extrinsic value, Intrinsic value, option assignment, Covered puts, profiting in a bear market, Bear markets, protective puts, VOO vs SCHD. Best ETF. Best dividend ETF. Buying call options, Buying put options, Option profits, Option breakeven, Selling covered calls, When to close a sold option, Options for beginners, How to write an option, Option basics, Selling options, JEPI, JEPQ, NUSI Income ETF, Income ETF, JEPI, DIVO, IDVO, High dividend ETF, option strategies, cash secured puts, simple option trades, Covered call options, ATM covered calls. SPY ETF, Selling Options, QQQ Options, QQQ vs VOO, Options for Income, Options during earnings.. Best dividend ETF. VYM versus SCHD. KO Stock. Buying the dip. Using put options.

Комментарии

0:09:52

0:09:52

0:16:04

0:16:04

0:15:26

0:15:26

0:17:44

0:17:44

0:12:11

0:12:11

0:07:11

0:07:11

0:11:43

0:11:43

0:14:22

0:14:22

0:11:55

0:11:55

0:12:49

0:12:49

0:24:32

0:24:32

0:22:02

0:22:02

0:12:42

0:12:42

0:10:10

0:10:10

0:14:09

0:14:09

0:08:18

0:08:18

0:11:10

0:11:10

0:11:37

0:11:37

0:21:41

0:21:41

0:26:00

0:26:00

0:24:23

0:24:23

0:08:36

0:08:36

0:08:23

0:08:23

0:25:28

0:25:28