filmov

tv

Payment Gateway System Design | Payment Processing | System Design

Показать описание

Payment Gateway is a software used by ecommerce website to help buyer make payment online. It is usually integrated with a payment ingestion and payment processing unit. In this video I have talked about how card payment works, how 3D secure card payment works, how will you design your own system like Razorpay, Paypal etc. High level software design of payment gateway has been discussed here along with relevant APIs which each service will use.

Payment is a very big domain hence capturing each details in one video is tough and same goes for system design interview or coding interview. Do discuss with your interviewer the topic where focus is required from interviewer's point of view and drill deep into it.

0:00 Introduction

0:45 Content

02:15 Terms to Note

06:03 How Card Payment works?

10:08 How 3D secure Card Payment works?

14:21 Requirements for System Design of Payment Gateway

15:43 Design Considerations

17:46 High Level Design

25:30 Relevant APIs

27:42 Payment Processor

32:55 Susbcribe

Payment is a very big domain hence capturing each details in one video is tough and same goes for system design interview or coding interview. Do discuss with your interviewer the topic where focus is required from interviewer's point of view and drill deep into it.

0:00 Introduction

0:45 Content

02:15 Terms to Note

06:03 How Card Payment works?

10:08 How 3D secure Card Payment works?

14:21 Requirements for System Design of Payment Gateway

15:43 Design Considerations

17:46 High Level Design

25:30 Relevant APIs

27:42 Payment Processor

32:55 Susbcribe

Design a Payment System - System Design Interview

What is a payment gateway and how does it work? | emerchantpay

Payment Gateway System Design | Payment Processing | System Design

Introduction to Payment Gateway System Design | Design Payment System | Stripe Product Design

29: Amazon Payment Gateway | Systems Design Interview Questions With Ex-Google SWE

System Design: Payment Gateway

Payment Gateway, Payment Processor and Payment Security Explained

System Design of Payment Gateway

Security & NAT Policies Demystified:A Complete Guide to Firewall Configuration @GuiNet _Technolo...

How Does Apple/Google Pay Work?

System Design Global Payment Processing | Paypal

Payment gateway system design

How to build a robust Payments service?

How to build payment gateway? Stripe, Braintree, PayPal clone

UPI System Design Mock Interview with Gaurav Sen & @sudocode

Here's why implementing a Payment System can be so hard

Scan To Pay in 2 Minutes

What is API Gateway?

Payment Gateway - All you need to know! - Yadvendra Tyagi, PayU

Payment Processing Credit/Debit Cards (Authorization, Clearing and Settlement Basics)

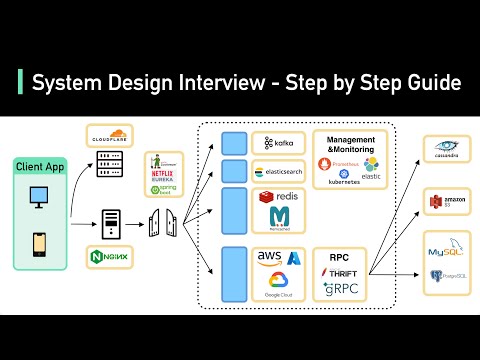

System Design Interview: A Step-By-Step Guide

How Does UPI work? UPI process flow explained !

System Design Interview: Design Amazon Kindle Payments

Reverse Proxy vs API Gateway vs Load Balancer

Комментарии

0:31:40

0:31:40

0:03:24

0:03:24

0:33:02

0:33:02

0:18:58

0:18:58

0:26:44

0:26:44

0:52:31

0:52:31

0:06:55

0:06:55

1:44:13

1:44:13

1:43:26

1:43:26

0:06:13

0:06:13

0:22:23

0:22:23

0:28:18

0:28:18

0:16:36

0:16:36

0:28:14

0:28:14

0:37:10

0:37:10

0:11:27

0:11:27

0:02:20

0:02:20

0:03:26

0:03:26

0:46:47

0:46:47

0:08:55

0:08:55

0:09:54

0:09:54

0:09:21

0:09:21

0:33:50

0:33:50

0:03:06

0:03:06