filmov

tv

Trading The Hammer CandleStick Pattern | Quick Tutorial

Показать описание

A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period. In this video we explore this pattern and how you can trade it efficiently.

In today's video I wanted to talk about the Hammer CandleStick Pattern. One of the most popular price patterns that traders use to identify a bottom. A hammer occurs after a stock has been declining, suggesting the market is attempting to determine a bottom.

In today's video I wanted to talk about the Hammer CandleStick Pattern. One of the most popular price patterns that traders use to identify a bottom. A hammer occurs after a stock has been declining, suggesting the market is attempting to determine a bottom.

BEST Hammer Candlestick & Shooting Star Candlestick Pattern Trading Strategy (Pro Instantly)

Trading The Hammer CandleStick Pattern | Quick Tutorial

#1 Candle Stick for Day Trading! 'HAMMER CANDLE'

The ONLY Candlestick Pattern Guide You'll EVER NEED

The Hammer Candlestick Pattern 🔨 Master the Hammer Pattern (In JUST 4 Minutes)

Hammer Candlestick Pattern Explained

Das einzige Candle Stick Pattern welches du zu 100% kennen musst...! (Hammer Candle/Shooting Star)

Bullish Hammer Pattern | Bullish Reversal Candlestick | Hammer candlestick pattern

How to Trade the Inverted Hammer Candlestick for Bullish Reversals | #derivativecry #invertedhammer

Candlestick Pattern Trading #7: What is a Hammer by Rayner Teo

Hammer Candlestick Pattern (Secrets) - Bullish Pin Bar

Complete Theory of Hammer Candlestick Pattern | What It Is | How Traders Use It in Market analysis

Bulish Reversal Hammer Candlestick Pattern, Trend Reversal Hammer, #shorts #stockmarket #Hammer

Hammer vs Hanging Man Candlestick Pattern | Candlesticks Trading for Beginners | Trade Brains

Powerful hammer and hidden hammer trading strategy guide

BEST Hammer Candlestick Pattern Trading Strategy Hindi | Pro Instantly

The Hammer Candlestick Pattern - Trading Bullish Pin Bar

Hammer Candlestick Pattern | How To Trade Hammer Candle #shorts

The Common MISTAKE Traders Make With Doji Candles #Shorts

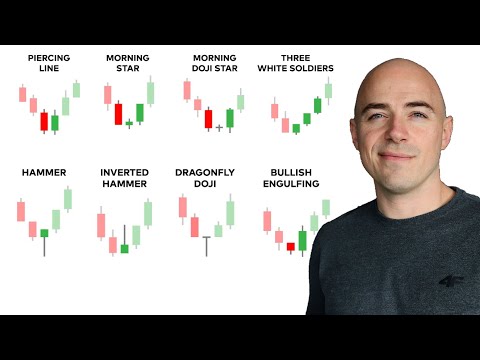

Bullish Candlestick Patterns (that work) - Day Trading

How to Trade the Inverted Hammer Candlestick Pattern 🔨

HAMMER CANDLESTICKHow to Work #ChartPatterns Candlestick | Stock | Market | Forex | crypto #Shorts

Hammer Candlestick Pattern | candlestick Trading | Forex For Trading Beginners |Forex Price Action

A Beginner's Trading Guide to Inverted Hammer and Hanging Man Candlestick Pattern

Комментарии

0:10:07

0:10:07

0:03:16

0:03:16

0:09:38

0:09:38

0:11:45

0:11:45

0:03:50

0:03:50

0:00:57

0:00:57

0:13:53

0:13:53

0:00:59

0:00:59

0:00:51

0:00:51

0:03:55

0:03:55

0:03:54

0:03:54

0:08:15

0:08:15

0:00:14

0:00:14

0:00:53

0:00:53

0:19:01

0:19:01

0:03:42

0:03:42

0:04:54

0:04:54

0:00:53

0:00:53

0:00:47

0:00:47

0:06:04

0:06:04

0:08:21

0:08:21

0:00:20

0:00:20

0:04:02

0:04:02

0:08:40

0:08:40