filmov

tv

Absolute Convergence, Conditional Convergence, and Growth Regressions

Показать описание

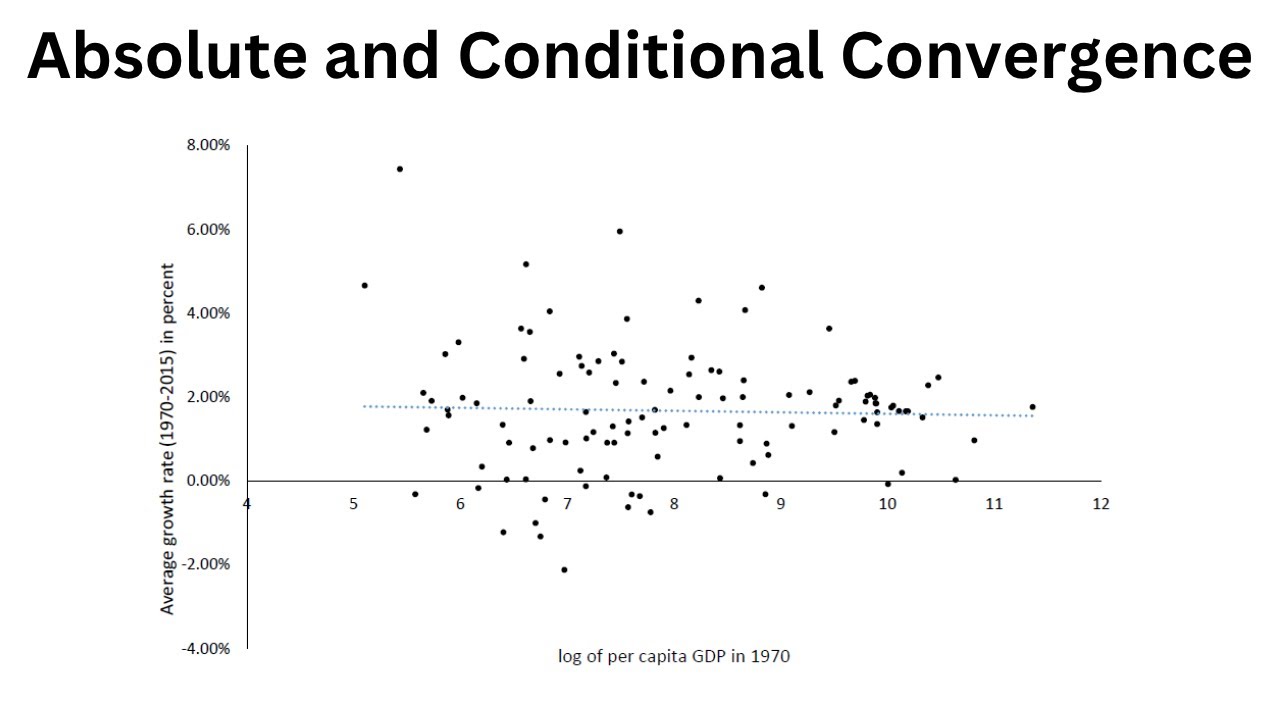

I use the Solow model to describe the process of convergence. In doing so, I show that the Solow model predicts "conditional convergence" (that countries sharing the same steady state will converge in terms of their per capita incomes) but not absolute convergence (that all countries irrespective of their steady state will converge). I then move on to explain the main idea behind growth regressions and how they are used to test for convergence. Finally, I dicuss problems in the context of growth regressions such as reverse causality, omitted variables, and p-hacking and highlight some potential solutions.

Absolute Convergence, Conditional Convergence, and Divergence

Absolute Convergence vs Conditional Convergence vs Convergence

Absolute Convergence, Conditional Convergence and Divergence

Absolute and Conditional Convergence

Absolutely and Conditionally Convergent Series

Conditional & absolute convergence | Series | AP Calculus BC | Khan Academy

Calculus BC – 10.9 Determining Absolute or Conditional Convergence

Absolute Convergence, Conditional Convergence, Another Example 1

Absolute Convergence | Conditionally Convergent | Infinite Series

Absolute & Conditional Convergence | Calculus 2 Lesson 28 - JK Math

Testing for Absolute & Conditional Convergence | Easy Explanation! | Math with Professor V

Absolute and Conditional Convergence of an Infinite Series

Checking for absolute convergence (5 examples)

Absolute and Conditional Convergence

Absolute & Conditional Convergence - Example 1

How to Determine Absolute or Conditional Convergence

Absolute & Conditional Convergence - Infinite Series

👊Absolute vs. 🤷🏻♀️conditional convergence 🤔🤔 #apcalculus #apcalc #unit5 #shorts...

Absolute vs. Conditional Convergence

Absolute Convergence, Conditional Convergence, and Growth Regressions

Introduction to Absolute Convergence and Conditional Convergence

What Is Conditional Convergence?

24. Absolute and Conditional Convergence of a Series | Complete Concept & Problem#1| Infinite Se...

Conditional Convergence and Alternating Series - Video 1 - Absolute and Conditional Convergence

Комментарии

0:13:07

0:13:07

0:03:41

0:03:41

0:11:21

0:11:21

0:05:26

0:05:26

0:08:33

0:08:33

0:05:00

0:05:00

0:16:04

0:16:04

0:02:35

0:02:35

0:13:02

0:13:02

0:24:46

0:24:46

0:29:49

0:29:49

0:15:36

0:15:36

0:19:15

0:19:15

0:05:37

0:05:37

0:11:22

0:11:22

0:12:42

0:12:42

0:05:29

0:05:29

0:01:00

0:01:00

0:11:39

0:11:39

0:23:20

0:23:20

0:05:22

0:05:22

0:01:56

0:01:56

0:14:57

0:14:57

0:06:34

0:06:34