filmov

tv

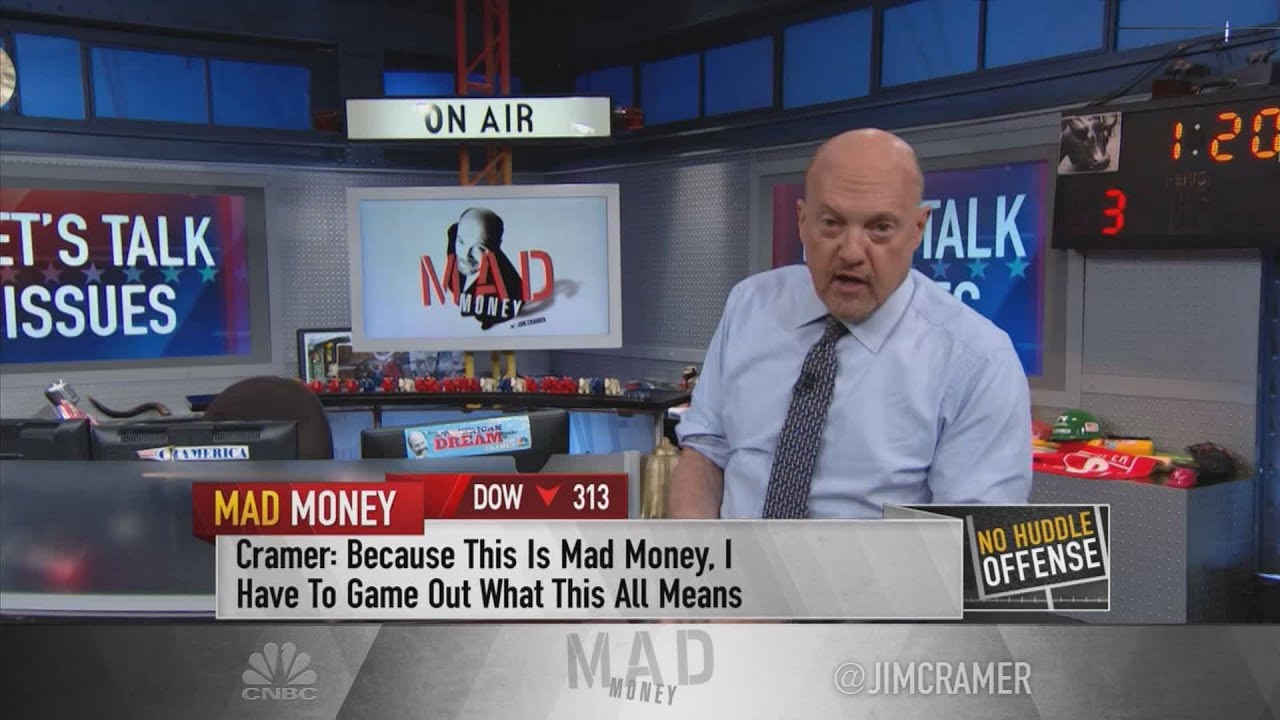

Jim Cramer discusses the potential market impact of geopolitical issues in China and Russia

Показать описание

On Thursday's episode of "Mad Money," host Jim Cramer explained why he believes U.S. equity investors need to keep track of ongoing geopolitical issues in China and Russia.

Jim Cramer discusses the potential market impact of geopolitical issues in China and Russia

Jim Cramer explains why a potential U.S. recession would start in the West

Jim Cramer says put these profitable, newly public stocks on your potential buy list

Jim Cramer explains why investors shouldn't give up on companies they believe in

Jim Cramer explains why Boeing might be a potential buy

Jim Cramer: The pandemic led to 'one of the greatest wealth transfers in history'

The difference between cyclical and secular growth stocks: Jim Cramer

Cramer: Food and consumer packaged goods have potential in this market

AMC STOCK UPDATE: PROOF: APE WAS CREATED TO CRUSH THE SHORTS!

Jim Cramer breaks down 3 possible recession scenarios

Jim Cramer talks the potential fallout of a debt default

Jim Cramer explains why investors should be prepared for a possible market recovery

Cramer explains the fundamentals of evaluating stock moves

The 12 profitable, newly public stocks Jim Cramer says should be on your potential buy list

Jim Cramer: How is it possible that 'ultimate consumer products company' Apple only has a ...

8-3-21 Mad Money with Jim Cramer and the DeMARK Indicators

Jim Cramer discusses Monday's remarkable market comeback and the need for investment discipline

Jim Cramer sees 2 possible 'speed bumps' for stocks. Here's how he is preparing

Jim Cramer breaks down Nvidia's acquisition of Arm and the potential upside for investors

Jim Cramer explains which stocks he believes will inevitably rally

Jim Cramer breaks down how to discover overlooked stock picks in this bull market

Jim Cramer explains why he's short Nvidia: 'It's a loser'

Jim Cramer explains why big tech stocks aren't currently investable

Jim Cramer's Inside Look at Constellation Energy Stock #shorts

Комментарии

0:04:03

0:04:03

0:04:34

0:04:34

0:10:06

0:10:06

0:11:35

0:11:35

0:04:36

0:04:36

0:12:07

0:12:07

0:04:19

0:04:19

0:02:43

0:02:43

0:09:31

0:09:31

0:15:19

0:15:19

0:12:31

0:12:31

0:10:54

0:10:54

0:09:04

0:09:04

0:03:42

0:03:42

0:03:35

0:03:35

0:07:45

0:07:45

0:11:53

0:11:53

0:08:36

0:08:36

0:09:34

0:09:34

0:10:36

0:10:36

0:11:43

0:11:43

0:03:30

0:03:30

0:11:44

0:11:44

0:00:17

0:00:17