filmov

tv

How the partial U.S.-China trade deal may impact the U.S. economy

Показать описание

The U.S. and China have entered a new chapter in their economic relationship now that "phase one" of the trade deal has been signed, but questions remain about the economic impact of the deal. CNBC's Steve Liesman reports.

President Donald Trump signed a partial trade deal with China on Wednesday as the world’s two largest economies try to contain an economic struggle.

Through the deal, the Trump administration aims to resolve some longstanding American concerns about Chinese trade abuses. However, the accord appears to leave questions about how Washington and Beijing will enforce its terms and prevent further tensions.

The deal takes steps to root out several practices that irked the White House and bipartisan members of Congress, including intellectual property theft and forced technology transfers, in exchange for Chinese market access, according to text released by the White House. It also details a $200 billion increase in Chinese purchases of U.S. goods over two years — a priority for Trump.

The president said the U.S. and China are “righting the wrongs of the past and delivering a future of economic justice and security for American workers, farmers and families.” He added that the deal has “total and full enforceability.”

The president signed the deal as the House prepared to send articles of impeachment to the Senate and kick-start a trial on whether to convict Trump and remove him from office.

Here are some of the deal’s core pieces (read the full agreement here):

It calls for China to submit an “Action Plan to strengthen intellectual property protection” within 30 days of the agreement taking effect, according to the trade pact. The proposal would include “measures that China will take to implement its obligations” and “the date by which each measure will go into effect.”

The deal says companies should be able to operate “without any force or pressure from the other Party to transfer their technology to persons of the other Party.” Technology transfers “must be based on market terms that are voluntary and reflect mutual agreement,” it reads.

The agreement says China will increase purchases of U.S. manufacturing, energy and agricultural goods and services by at least $200 billion over two years.

It makes commitments to try to root out the sale of counterfeit goods.

The deal includes provisions to boost Chinese market access to financial services firms.

Ahead of the signing, the Trump administration also revoked its decision to label China a currency manipulator.

U.S. stocks rose Wednesday before the deal signing. Trump signed off on the agreement after lengthy remarks dishing on impeachment, golf, his 2016 victory, stock market gains, the Federal Reserve’s interest rate policy and July 4 fireworks.

The president thanked administration officials, Republican lawmakers, Republican megadonor Sheldon Adelson, Fox Business Network host Lou Dobbs, former Secretary of State Henry Kissinger and current and former businessmen Steve Schwarzman, Nelson Peltz and Hank Greenberg, among dozens of people he recognized. Chinese officials stood silently next to the U.S. delegation as Trump spoke for nearly an hour before Chinese Vice Premier Liu He delivered a message from Chinese President Xi Jinping.

The Chinese leader called the trade deal “good for China, for the U.S. and for the whole world,” according to a translation. He wrote that “in the next step, the two sides need to implement the agreement in earnest.”

The phase one agreement marks a major step in efforts to rein in a more than 18-month trade war between Washington and Beijing. Trump has pushed to crack down on what he calls China’s abusive trade practices and follow through on one of his core campaign promises.

Investors have looked for signs the U.S. and China want to dial back a tariff crossfire that threatens to wallop the global economy. The deal signed Wednesday brings some welcome relief for businesses that feared the duties — though the bulk of them will stay in place.

“We’re leaving tariffs on, but I will agree to take those tariffs off if we are able to do ‘phase two.’ In other words, we’re negotiating with the tariffs,” Trump said.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBC TV

President Donald Trump signed a partial trade deal with China on Wednesday as the world’s two largest economies try to contain an economic struggle.

Through the deal, the Trump administration aims to resolve some longstanding American concerns about Chinese trade abuses. However, the accord appears to leave questions about how Washington and Beijing will enforce its terms and prevent further tensions.

The deal takes steps to root out several practices that irked the White House and bipartisan members of Congress, including intellectual property theft and forced technology transfers, in exchange for Chinese market access, according to text released by the White House. It also details a $200 billion increase in Chinese purchases of U.S. goods over two years — a priority for Trump.

The president said the U.S. and China are “righting the wrongs of the past and delivering a future of economic justice and security for American workers, farmers and families.” He added that the deal has “total and full enforceability.”

The president signed the deal as the House prepared to send articles of impeachment to the Senate and kick-start a trial on whether to convict Trump and remove him from office.

Here are some of the deal’s core pieces (read the full agreement here):

It calls for China to submit an “Action Plan to strengthen intellectual property protection” within 30 days of the agreement taking effect, according to the trade pact. The proposal would include “measures that China will take to implement its obligations” and “the date by which each measure will go into effect.”

The deal says companies should be able to operate “without any force or pressure from the other Party to transfer their technology to persons of the other Party.” Technology transfers “must be based on market terms that are voluntary and reflect mutual agreement,” it reads.

The agreement says China will increase purchases of U.S. manufacturing, energy and agricultural goods and services by at least $200 billion over two years.

It makes commitments to try to root out the sale of counterfeit goods.

The deal includes provisions to boost Chinese market access to financial services firms.

Ahead of the signing, the Trump administration also revoked its decision to label China a currency manipulator.

U.S. stocks rose Wednesday before the deal signing. Trump signed off on the agreement after lengthy remarks dishing on impeachment, golf, his 2016 victory, stock market gains, the Federal Reserve’s interest rate policy and July 4 fireworks.

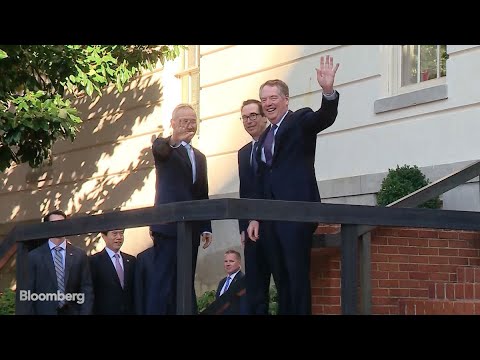

The president thanked administration officials, Republican lawmakers, Republican megadonor Sheldon Adelson, Fox Business Network host Lou Dobbs, former Secretary of State Henry Kissinger and current and former businessmen Steve Schwarzman, Nelson Peltz and Hank Greenberg, among dozens of people he recognized. Chinese officials stood silently next to the U.S. delegation as Trump spoke for nearly an hour before Chinese Vice Premier Liu He delivered a message from Chinese President Xi Jinping.

The Chinese leader called the trade deal “good for China, for the U.S. and for the whole world,” according to a translation. He wrote that “in the next step, the two sides need to implement the agreement in earnest.”

The phase one agreement marks a major step in efforts to rein in a more than 18-month trade war between Washington and Beijing. Trump has pushed to crack down on what he calls China’s abusive trade practices and follow through on one of his core campaign promises.

Investors have looked for signs the U.S. and China want to dial back a tariff crossfire that threatens to wallop the global economy. The deal signed Wednesday brings some welcome relief for businesses that feared the duties — though the bulk of them will stay in place.

“We’re leaving tariffs on, but I will agree to take those tariffs off if we are able to do ‘phase two.’ In other words, we’re negotiating with the tariffs,” Trump said.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBC TV

Комментарии

0:04:24

0:04:24

0:03:05

0:03:05

0:34:50

0:34:50

0:07:48

0:07:48

0:06:28

0:06:28

0:00:32

0:00:32

0:05:15

0:05:15

0:02:29

0:02:29

0:35:43

0:35:43

0:00:31

0:00:31

0:05:16

0:05:16

0:04:50

0:04:50

0:02:48

0:02:48

0:01:48

0:01:48

0:02:57

0:02:57

0:14:21

0:14:21

0:02:26

0:02:26

0:02:12

0:02:12

0:07:38

0:07:38

0:05:45

0:05:45

0:02:38

0:02:38

0:11:24

0:11:24

0:01:00

0:01:00

0:05:24

0:05:24