filmov

tv

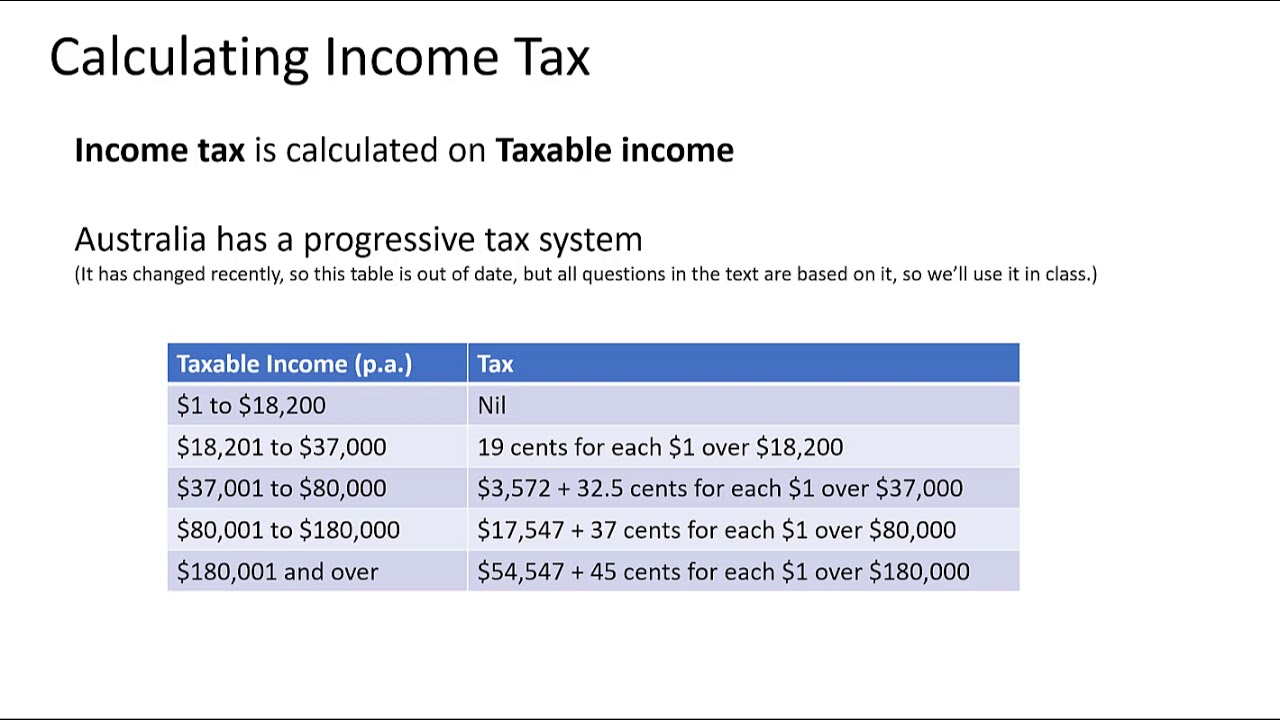

Australian Income Tax

Показать описание

Essential Mathematics Earning and spending, calculating income tax using an Australian tax table

How Australian Tax Brackets Work in 2024 | Income Tax Explained For Beginners

How The Australian Tax System Works in 2024 (Explained in 5 Minutes)

Australian Income Tax

A Beginner's Guide to Understanding Australian Income Tax 2024

Tax System in Australia | Income Tax in Australia | More money more tax?? @Sovikvlogs

Australian Income Tax Explained | Accountant Perth - NewGDR

Australian Income Tax for Beginners (from July 2024)

Guide to Australian Income Tax System

UK vs Australia Employment: Key Differences You Need to Know Before Moving!

How much tax you pay on a $1m income in Australia

Three ways to make tax free income in Australia

How does income tax work? | Everyday Money | ABC Australia

INCOME TAX SYSTEM IN AUSTRALIA | TAX SLABS 2022 | INDIAN STUDENT

Explained: How does tax work in Australia (video)?

How much tax you pay on a $120k income in Australia

Personal tax is voluntary & the ATO is illegal

Australia Tax: Personal Income Tax

12 Easy Ways To MAXIMISE Your Australian Tax Return in 2024

Federal Budget 2020 | Income Tax Cuts confirmed! (Australian Economy)

Australia Income Tax Malayalam | Yearly Money REFUND

How High Income Earners Reduce Taxes In Australia - Smart Tax Reduction for High-Income Aussies

Australian Income Tax Explained | How Tax Brackets Work | Tax Basics

Australia vs New York income tax. New York vs Australi in cost and taxes.

How much tax you pay on $180k income

Комментарии

0:08:53

0:08:53

0:06:04

0:06:04

0:05:16

0:05:16

0:09:57

0:09:57

0:10:44

0:10:44

0:01:00

0:01:00

0:09:38

0:09:38

0:04:26

0:04:26

0:13:20

0:13:20

0:00:51

0:00:51

0:01:01

0:01:01

0:02:15

0:02:15

0:10:02

0:10:02

0:02:30

0:02:30

0:00:58

0:00:58

0:01:49

0:01:49

0:02:19

0:02:19

0:17:21

0:17:21

0:09:05

0:09:05

0:16:17

0:16:17

0:11:51

0:11:51

0:10:51

0:10:51

0:00:43

0:00:43

0:01:01

0:01:01