filmov

tv

FS and Deferred Tax_Deferred Tax Liability

Показать описание

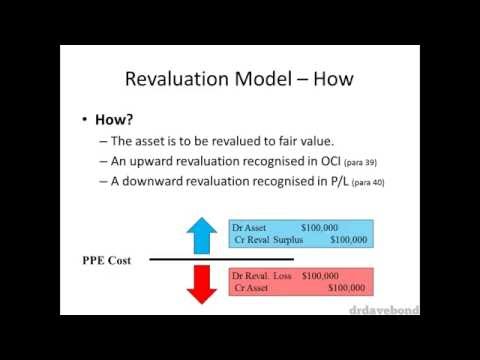

Deferred Tax

Tax on the temporary (Timing)differences between the AP and TP

• DT = Tax Rate * Temporary difference

• DT is accounting adjustment to show the temporary difference

Accounting for Tax and Financial Statements

• In the IS

o Divide tax into two components

• Current Tax (IT)

• Deferred Tax (temporary differences)

• In the CFS

o Payment: Current tax paid

• In the BS

• Deferred Tax Liability, or

• Deferred Tax Asset

Tax on the temporary (Timing)differences between the AP and TP

• DT = Tax Rate * Temporary difference

• DT is accounting adjustment to show the temporary difference

Accounting for Tax and Financial Statements

• In the IS

o Divide tax into two components

• Current Tax (IT)

• Deferred Tax (temporary differences)

• In the CFS

o Payment: Current tax paid

• In the BS

• Deferred Tax Liability, or

• Deferred Tax Asset

0:12:54

0:12:54

0:23:35

0:23:35

0:28:21

0:28:21

1:36:27

1:36:27

1:14:04

1:14:04

0:08:06

0:08:06

0:36:10

0:36:10

0:19:22

0:19:22

0:35:48

0:35:48

0:19:43

0:19:43

0:02:21

0:02:21

0:06:36

0:06:36

0:05:06

0:05:06

0:09:57

0:09:57

0:45:38

0:45:38

1:41:17

1:41:17

0:00:18

0:00:18

0:47:42

0:47:42

0:21:16

0:21:16

2:37:48

2:37:48

0:15:45

0:15:45

0:07:57

0:07:57

0:33:40

0:33:40

0:16:47

0:16:47