filmov

tv

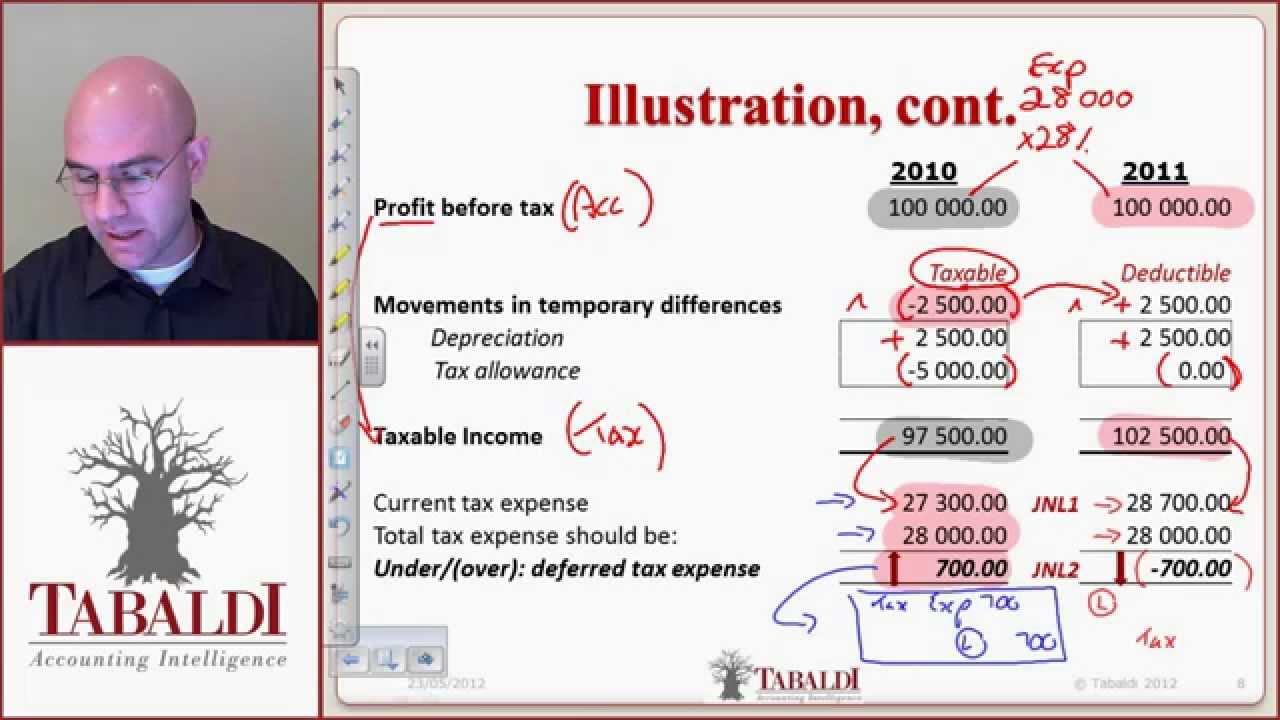

IAS 12 - Deferred Tax Basic Principles (IFRS)

Показать описание

HOW DOES TABALDI HELP YOU PASS FAC3701?

#FAC2601 #FAC3764 #UNISASupport

#FAC2601 #FAC3764 #UNISASupport

Deferred Tax (IAS 12) | Explained with Examples

IAS 12 Income Taxes: Summary - applies in 2024

IAS 12 - Deferred Tax Basic Principles (IFRS)

IAS 12 - deferred tax - ACCA Financial Reporting (FR)

IAS 12 - deferred tax accounting - ACCA Financial Reporting (FR)

DEFERRED TAX IAS 12 ACCA

DEFERRED TAX LIABILITIES EXPLAINED (IAS 12 INCOME TAX)

Tricky SBR topic: IAS 12 'Deferred tax'

IAS 12 - INCOME TAX (PART 1)

Deferred tax (IAS 12) - Group accounts - ACCA (SBR) lectures

IAS 12 - DEFERRED TAX SIMPLIFIED | ACCA - FR / SBR | MALAYALAM | KEVIN BINOY

IAS 12-Income taxes-Deferred tax concepts

Deferred tax in 2 minutes ! IAS12

IAS 12 - Introduction - ACCA Financial Reporting (FR)

CIMA F2 Taxation (IAS 12) - Deferred tax - Example

ACCA I Strategic Business Reporting (SBR) I IAS 12 - Income Taxes - SBR Lecture 8

IAS 12 - Example (incl. deferred tax) - ACCA Financial Reporting (FR)

IAS 12 - INCOME TAX (PART 2)

IAS 12 Income Taxes part 1

CFA Level I FRA - Tax Base, Deferred Tax Assets, Deferred Tax Liabilities

STRATEGIC BUSINESS REPORTING AND FINANCIAL REPORTING - IAS 12 (DEFERRED TAX)

Deferred TAX IAS 12 , CA Professional and Advanced Level

IAS 12 - Prepaid Expenses Deferred Tax (IFRS)

IAS-12 Income Taxes: Simplest Discussion with Practical Examples | Lecture - Deferred Tax (Part-1/3)

Комментарии

0:30:26

0:30:26

0:14:26

0:14:26

0:23:35

0:23:35

0:10:54

0:10:54

0:11:30

0:11:30

0:32:04

0:32:04

0:29:21

0:29:21

0:23:36

0:23:36

0:29:38

0:29:38

0:08:57

0:08:57

0:16:09

0:16:09

1:00:35

1:00:35

0:01:52

0:01:52

0:10:57

0:10:57

0:20:01

0:20:01

2:22:40

2:22:40

0:12:38

0:12:38

0:19:30

0:19:30

2:50:21

2:50:21

0:07:17

0:07:17

0:53:02

0:53:02

2:05:10

2:05:10

0:12:53

0:12:53

1:08:16

1:08:16