filmov

tv

26AS Malayalam Tax Credit Income Tax Malayalam -CA Subin VR

Показать описание

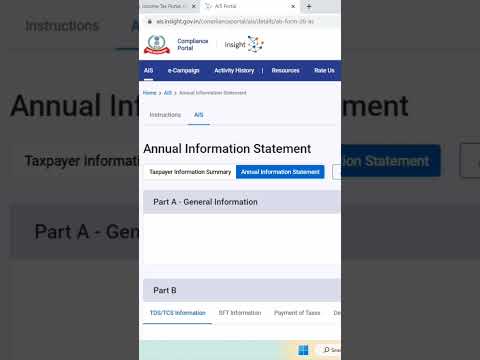

Explains Form No 26AS in Malayalam, and the details of your financial information collected by Income Tax Department from banks, financial institutions, etc. And how you can positively utlise form no 26AS to avoid Income Tax notice.

If you need any clarification/opinion viewers may send message to the below direct link

Channel's WhatsApp Number 7012243098

Viewers may also check for other articles and similar contents at the below links.

For share trading inputs:

Disclaimer: This video is intended for education purpose only and not for the purpose of soliciting business. The viewers shall take professional advice before taking any decisions on the matters specified in the video. The matters discussed in the video may subject to change due to amendments in various Acts/Rules etc. This channel will not responsible for any damages caused to the viewers.

for the detailed information on disclaimer please visit the link below.

malayalam,malayalam finance tips,thommichan tips,malayalam investment tips,money tips malayalam,malayalam finance,finance tips malayalam,share market malayalam,personal finance,money saving tips malayalam,investment tips in malayalam,money saving tips in malayalam,money saving tips 2021 in malayalam,malayalam motivation,money saving tips for young adults in malayalam,financial planning malayalam,indianmoney malayalam,financial diet tips in malayalam,investments malayalam,tips malayalam,

income tax malayalam,income tax filing malayalam,income tax malayalam tutorial,income tax e filing registration malayalam,income tax notice malayalam,efiling of income returns in malayalam,income tax,income tax malyalam,income tax e filing malayalam,income tax return filing malayalam,income tax malayalam class,income tax slabs malayalam,income tax return malayalam,income tax return,income tax in malayalam,malayalam income tax,income tax rates malayalam

If you need any clarification/opinion viewers may send message to the below direct link

Channel's WhatsApp Number 7012243098

Viewers may also check for other articles and similar contents at the below links.

For share trading inputs:

Disclaimer: This video is intended for education purpose only and not for the purpose of soliciting business. The viewers shall take professional advice before taking any decisions on the matters specified in the video. The matters discussed in the video may subject to change due to amendments in various Acts/Rules etc. This channel will not responsible for any damages caused to the viewers.

for the detailed information on disclaimer please visit the link below.

malayalam,malayalam finance tips,thommichan tips,malayalam investment tips,money tips malayalam,malayalam finance,finance tips malayalam,share market malayalam,personal finance,money saving tips malayalam,investment tips in malayalam,money saving tips in malayalam,money saving tips 2021 in malayalam,malayalam motivation,money saving tips for young adults in malayalam,financial planning malayalam,indianmoney malayalam,financial diet tips in malayalam,investments malayalam,tips malayalam,

income tax malayalam,income tax filing malayalam,income tax malayalam tutorial,income tax e filing registration malayalam,income tax notice malayalam,efiling of income returns in malayalam,income tax,income tax malyalam,income tax e filing malayalam,income tax return filing malayalam,income tax malayalam class,income tax slabs malayalam,income tax return malayalam,income tax return,income tax in malayalam,malayalam income tax,income tax rates malayalam

Комментарии

0:05:47

0:05:47

0:00:38

0:00:38

0:13:13

0:13:13

0:05:02

0:05:02

0:04:51

0:04:51

0:04:04

0:04:04

0:00:55

0:00:55

0:17:07

0:17:07

0:00:22

0:00:22

0:03:15

0:03:15

0:01:23

0:01:23

0:00:21

0:00:21

0:00:06

0:00:06

0:00:51

0:00:51

0:05:01

0:05:01

0:00:40

0:00:40

0:00:16

0:00:16

0:01:49

0:01:49

0:01:34

0:01:34

0:01:01

0:01:01

0:00:14

0:00:14

0:02:53

0:02:53

0:08:35

0:08:35

0:03:18

0:03:18