filmov

tv

Perpetuity Lesson/Tutorial: Definition, Present Value of a Perpetuity Formula & Examples

Показать описание

In this Perpetuity Lesson I define what a perpetuity is, how to calculate the present value of a perpetuity, and also provide you with some examples of solving the present value of a perpetuity.

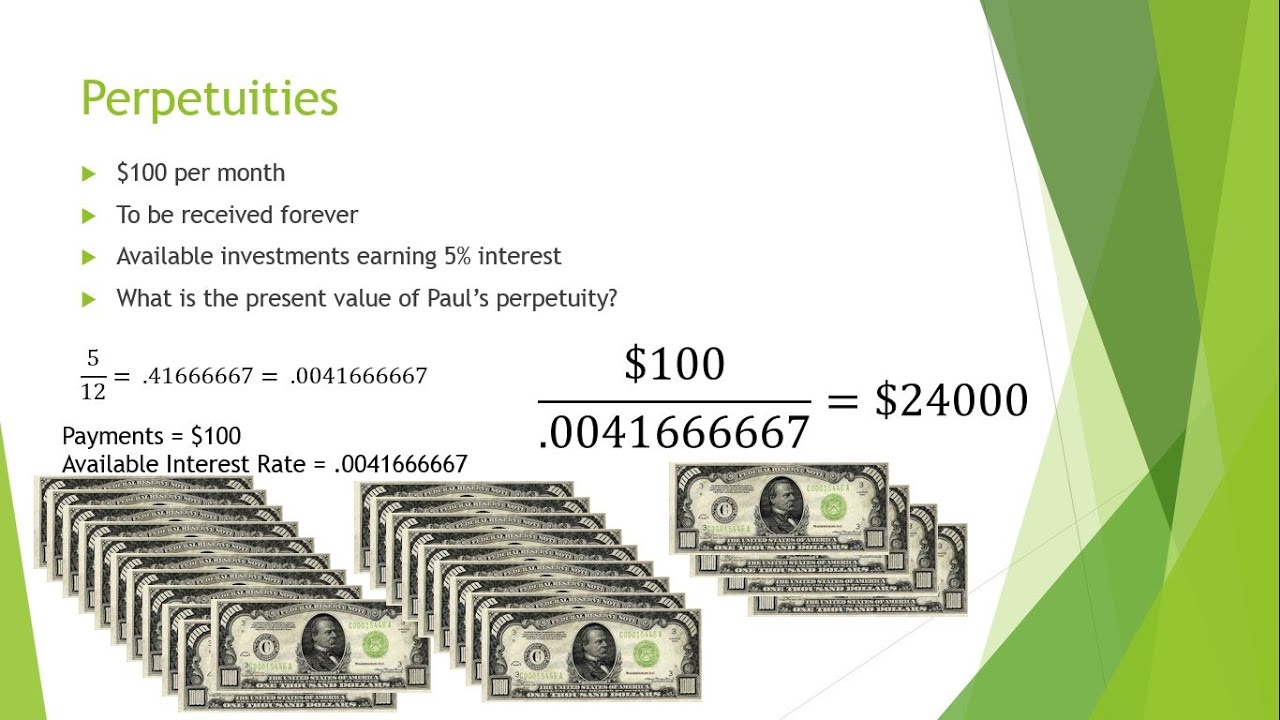

A perpetuity is a steady stream of Cash Flow s of equal amounts that are to be received or paid indefinitely. A perpetuity is a form of an ordinary annuity and is sometimes called a perpetuity annuity. A true perpetuity is rare but they are not non-existent. Around 1871 the British government issued a Bond that was a true perpetuity known as a Consol. The purchaser of a Consol was entitled to receive an annual coupon payment at a fixed rate forever. You may wonder why or how a government or any entity would want to agree to such a long-term commitment of payments. They do this because they can guarantee payment by reinvesting the money from the purchaser into Investment s that earn a higher return.

A perpetuity is a steady stream of Cash Flow s of equal amounts that are to be received or paid indefinitely. A perpetuity is a form of an ordinary annuity and is sometimes called a perpetuity annuity. A true perpetuity is rare but they are not non-existent. Around 1871 the British government issued a Bond that was a true perpetuity known as a Consol. The purchaser of a Consol was entitled to receive an annual coupon payment at a fixed rate forever. You may wonder why or how a government or any entity would want to agree to such a long-term commitment of payments. They do this because they can guarantee payment by reinvesting the money from the purchaser into Investment s that earn a higher return.

Perpetuity Lesson/Tutorial: Definition, Present Value of a Perpetuity Formula & Examples

Present Value of a Perpetuity (aka Ordinary Perpetuity)

Perpetuity: What is Perpetuity

Perpetuity and Its Present Value

Present Value of Perpetuity Formula

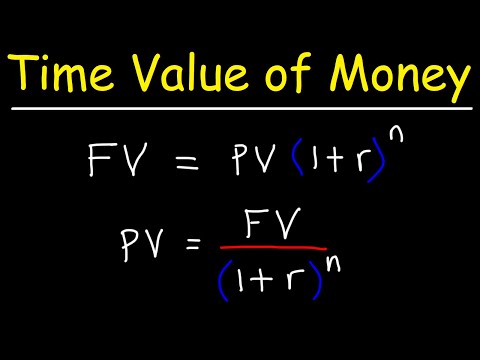

Time Value of Money - Present Value vs Future Value

Present value of a perpetuity - Example 1

What is Perpetuity? - Financial Definition, Formula and Examples.

Present value of a perpetuity

Present Value and Perpetuity Formulas

TVM 14: Perpetuity

Present value of Perpetual cash flow

Perpetuities

How to derive the present value formula for annuity and perpetuity

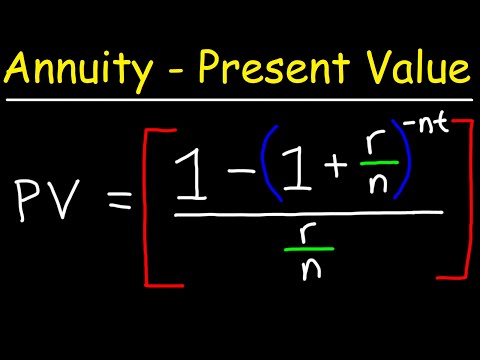

Present value of an annuity

Present value of perpetuity

PERPETUITIES

Net Present Value (NPV) explained

Present Value of a Perpetuity

Perpetuity: Concept and Calculation

How To Calculate The Present Value of an Annuity

Module 3 Annuities and Perpetuities

Time Value of Money Finance - TVM Formulas & Calculations - Annuities, Present Value, Future Val...

Present Value of Ordinary Perpetuity and Perpetuity-due

Комментарии

0:05:16

0:05:16

0:09:59

0:09:59

0:03:23

0:03:23

0:06:00

0:06:00

0:03:47

0:03:47

0:05:14

0:05:14

0:02:28

0:02:28

0:02:49

0:02:49

0:05:30

0:05:30

0:06:16

0:06:16

0:05:53

0:05:53

0:04:17

0:04:17

0:02:20

0:02:20

0:03:03

0:03:03

0:07:17

0:07:17

0:03:02

0:03:02

0:03:41

0:03:41

0:05:26

0:05:26

0:04:32

0:04:32

0:04:36

0:04:36

0:16:15

0:16:15

0:10:53

0:10:53

0:21:53

0:21:53

0:02:34

0:02:34