filmov

tv

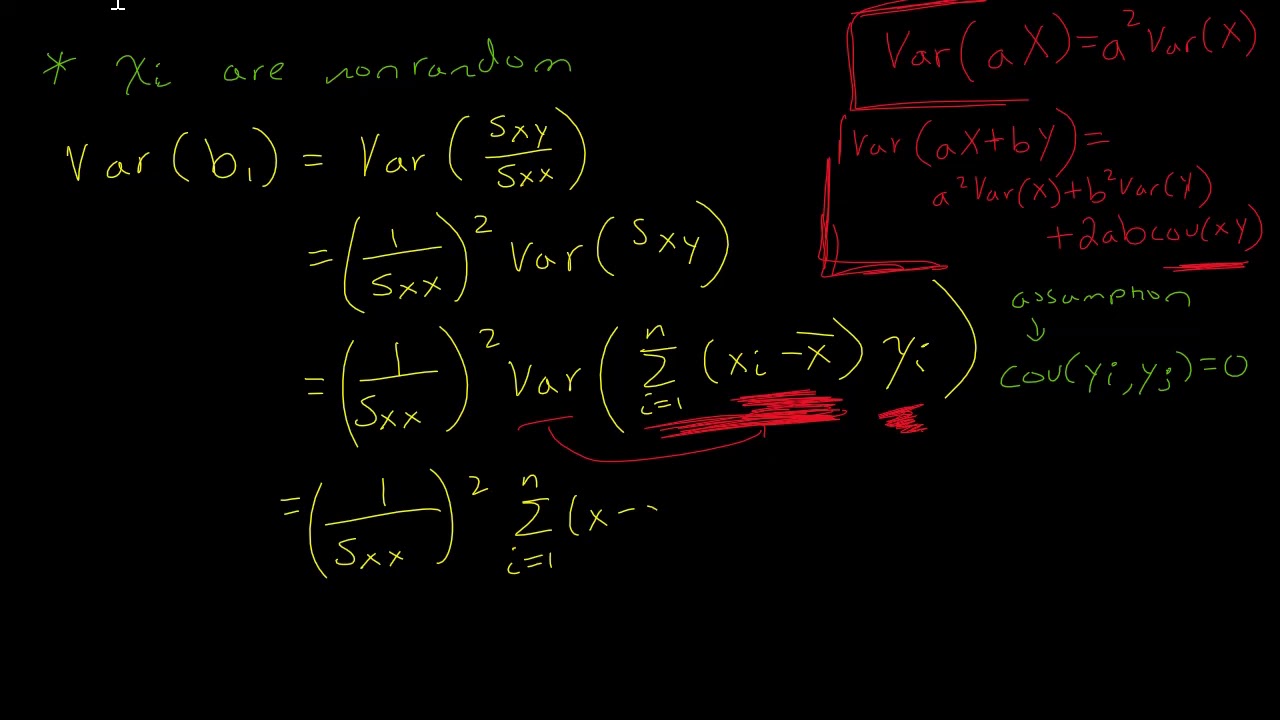

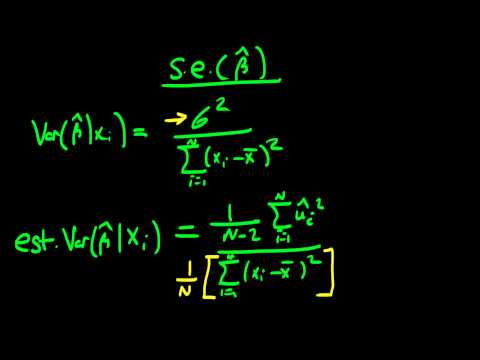

Least Square Estimators - Variance of Estimators, b0 and b1, Proof

Показать описание

** NOTE: At minute 11:48, I forgot to write the "squared" above X-bar. Later, at minute 28:26, when I summarize everything I found and solve for Var(b0), I do have X-bar squared. This was a mistake at minute 11:48, though it was not a mistake that I carried to my solution (the solution at the end of the video is correct).

Least Square Estimators - Variance of Estimators, b0 and b1, Proof

Least Square Estimators - Estimator of Variance, sigma^2

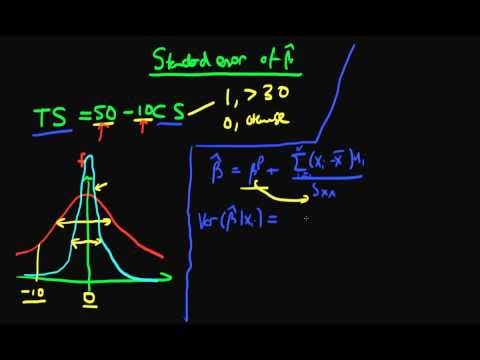

Deriving the mean and variance of the least squares slope estimator in simple linear regression

Variance of Least Squares Estimators - Matrix Form

Least Square Estimators - Variance of Estimators Using Matrices

The variance of the least squares estimator

Variance of Least Squares Estimators (Part 2) | Simple Linear Regression

Variance of Least Squares Estimators (Part 1) | Simple Linear Regression

Linear regression full course tutorials part 14

Multiple Linear Regression Variance of Least Squares Estimator, b

Deriving the least squares estimators of the slope and intercept (simple linear regression)

Least Squares Estimators as BLUE

Variance of OLS estimators - part one

Linear Regression Using Least Squares Method - Line of Best Fit Equation

Estimating the Variance of the Error Term in a Least Squares Regression Line, problem 3

3.17 - The Variance of OLS Estimators

Least Squares Estimator - Unbiased Estimator and Variance

14 - Variance of Least Squares Estimators - Matrix Form

MLE vs OLS | Maximum likelihood vs least squares in linear regression

Lecture 9: Statistical Properties of Least Square Estimators

Estimated variance of OLS estimators - intuition behind maths

Least Square Estimators - Unbiased Proof

Lecture 11: Estimation of Sigma Square

Variance of the OLS estimator (Part 1)

Комментарии

0:30:11

0:30:11

0:09:04

0:09:04

0:10:54

0:10:54

0:05:32

0:05:32

0:07:52

0:07:52

0:06:23

0:06:23

0:10:07

0:10:07

0:04:39

0:04:39

8:17:43

8:17:43

0:08:49

0:08:49

0:12:13

0:12:13

0:07:19

0:07:19

0:07:10

0:07:10

0:15:05

0:15:05

0:06:22

0:06:22

0:03:35

0:03:35

0:25:37

0:25:37

0:05:32

0:05:32

0:13:48

0:13:48

0:08:06

0:08:06

0:03:52

0:03:52

0:12:00

0:12:00

0:05:34

0:05:34

0:02:16

0:02:16