filmov

tv

Ground Leases Explained

Показать описание

Ground Leases Explained // Once you've been underwriting commercial real estate properties for a while, you're bound to run into a unique deal structure called a ground lease. And ground leases can be tricky (and somewhat difficult to understand), so in this video, we're going to break down what a ground lease is in real estate investing, and what to look out for as a commercial real estate investor when analyzing a real estate investment with a ground lease component.

Want to learn the technical skills you need to know to land a top-tier job in the CRE investment field? You NEED to know Excel and how to use it to analyze deals. But don’t worry – you’re covered. You can grab my real estate financial modeling crash course for FREE below:

Enroll in Commercial Real Estate Investing 101 here:

Want access to all courses, models, and additional one-on-one support? Enroll in Break Into CRE Academy here:

Subscribe and hit the notification bell to get first dibs on every new video!

––––––––––––––––––––––––––––––

––––––––––––––––––––––––––––––

Want to learn the technical skills you need to know to land a top-tier job in the CRE investment field? You NEED to know Excel and how to use it to analyze deals. But don’t worry – you’re covered. You can grab my real estate financial modeling crash course for FREE below:

Enroll in Commercial Real Estate Investing 101 here:

Want access to all courses, models, and additional one-on-one support? Enroll in Break Into CRE Academy here:

Subscribe and hit the notification bell to get first dibs on every new video!

––––––––––––––––––––––––––––––

––––––––––––––––––––––––––––––

Ground Leases Explained

Ground Leases 101 - What is a ground lease in real estate and how does it work

WHAT IS A LAND LEASE? WHAT ARE THE PROS AND CONS?

Ground Lease Structures Explained

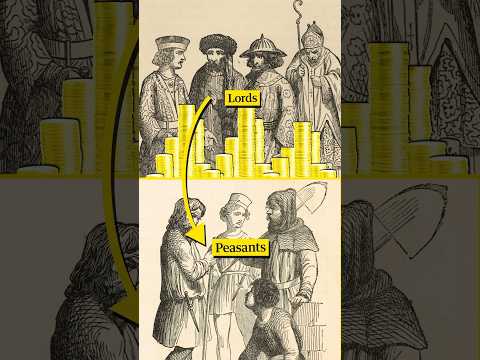

How leasehold properties keep people poor

Episode 137 - Maximizing Profits with Ground Leases: The Million Dollar Strategy Explained

What Is A Ground Lease?

Ground Lease Explained

Why A Ground Lease?

The Benefits of GROUND LEASES 💸 - 2023 Commercial Real Estate Investing Advice

What are Ground Leases? | @Crexi CRE Word of the Week

The Leaseholder Scam

Analyzing Ground Leases For Profit | Building a Fortune One Lease at a Time

Real Estate Term: Ground Lease Explained #realestate #lease

Should I Purchase A Home With A Land Lease Agreement?

Land Lease? What to Know

Is Buying a House Without Land a Smart Move? Ground Lease Explained

What is a ground-lease in commercial retail leasing?

Demolishing the Building for a New Structure - Ground Lease Explained

Is This a Good Lease Deal? (Former Dealer Explains)

What is ground lease (erfpacht)?

Ground Lease Explained: How You Can Build on Land You Don’t Own

Typical Commercial Lease Terms That Everyone Should Know

Ground Lease Fundamentals

Комментарии

0:05:41

0:05:41

0:03:49

0:03:49

0:02:20

0:02:20

0:02:18

0:02:18

0:00:59

0:00:59

0:30:33

0:30:33

0:05:20

0:05:20

0:04:14

0:04:14

0:04:30

0:04:30

0:00:52

0:00:52

0:00:27

0:00:27

0:00:56

0:00:56

0:01:42

0:01:42

0:00:58

0:00:58

0:05:49

0:05:49

0:11:16

0:11:16

0:06:38

0:06:38

0:01:47

0:01:47

0:01:00

0:01:00

0:11:54

0:11:54

0:01:04

0:01:04

0:00:49

0:00:49

0:06:54

0:06:54

0:02:57

0:02:57