filmov

tv

My Millionaire Payday Routine - How to make £1Mil from a £2k Salary

Показать описание

Legal Disclaimer: Improvements to your credit score are not guaranteed. Missing payments to Loqbox or other credit accounts may harm your score.

TIME STAMPS

SECTION 1. BUDGET - 00:35

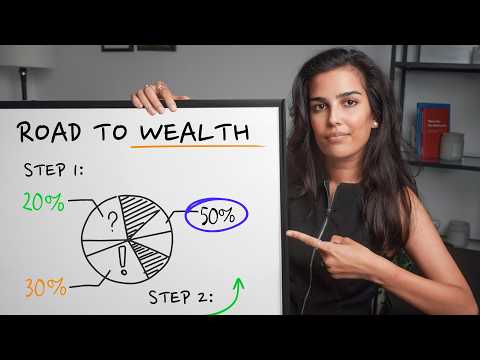

01:24 l - The 50:30:20 Rule

04:23 - Tracking Your Budget

04:41 - Debt

06:00 - Growing Your Credit History

SECTION 2. SAVE - 08:20

08:31 - Pre-Savings Check List

08:52 - Pay Off Debt

09:38 - Emergency Fund

SECTION 3. BECOME A

MILLIONAIRE - 10:22

10:24 - Investing

11:52 - Which Platform?

12:34 - Millionaire Calculations

14:02 - Automation

XTILES 50/30/20 TEMPLATE

STEPCHANGE - Free Debt Advice

FREE FINANCIAL RESOURCES

SCRAP THE NOTES E BOOK

OTHER USEFUL VIDEOS

How I manifested my dream life

MY RECIPE BOOK

WHO AM I?

My name is Faye and I’m a Doctor working in the UK

MY EQUIPMENT

(affiliate links so I do make a % commission but it doesn’t cost you any extra)

WANT TO BE FRIENDS?

@fayebate - instagram

GET IN TOUCH?

Disclaimers: Opinions expressed are mine and not representative of any organisations I am associated with

TIME STAMPS

SECTION 1. BUDGET - 00:35

01:24 l - The 50:30:20 Rule

04:23 - Tracking Your Budget

04:41 - Debt

06:00 - Growing Your Credit History

SECTION 2. SAVE - 08:20

08:31 - Pre-Savings Check List

08:52 - Pay Off Debt

09:38 - Emergency Fund

SECTION 3. BECOME A

MILLIONAIRE - 10:22

10:24 - Investing

11:52 - Which Platform?

12:34 - Millionaire Calculations

14:02 - Automation

XTILES 50/30/20 TEMPLATE

STEPCHANGE - Free Debt Advice

FREE FINANCIAL RESOURCES

SCRAP THE NOTES E BOOK

OTHER USEFUL VIDEOS

How I manifested my dream life

MY RECIPE BOOK

WHO AM I?

My name is Faye and I’m a Doctor working in the UK

MY EQUIPMENT

(affiliate links so I do make a % commission but it doesn’t cost you any extra)

WANT TO BE FRIENDS?

@fayebate - instagram

GET IN TOUCH?

Disclaimers: Opinions expressed are mine and not representative of any organisations I am associated with

Комментарии

0:16:46

0:16:46

0:00:50

0:00:50

0:16:36

0:16:36

0:12:53

0:12:53

0:11:21

0:11:21

0:09:23

0:09:23

0:09:12

0:09:12

0:17:20

0:17:20

0:12:34

0:12:34

0:11:23

0:11:23

0:15:07

0:15:07

0:12:36

0:12:36

0:10:04

0:10:04

0:14:59

0:14:59

0:18:03

0:18:03

0:13:31

0:13:31

0:11:09

0:11:09

0:10:01

0:10:01

0:14:05

0:14:05

0:07:33

0:07:33

0:17:08

0:17:08

0:15:46

0:15:46

0:15:27

0:15:27

0:12:45

0:12:45