filmov

tv

Quant explains how the rich exploit you

Показать описание

Humans are bad a pricing risk. This leads to poor life decisions where they’re exposed to more risk than they realize and nobody explains this to them, because those industries profit from their ignorance.

As a former Wall Street quant who worked at a Hedge Fund, I explain how the wealthy elite understand how to properly price risk in their lives, and they know how to exploit your poor decisions when the time is right, in order to take your money when you’re most desperate and have no choice but to sell to them at a deep discount.

As a former Wall Street quant who worked at a Hedge Fund, I explain how the wealthy elite understand how to properly price risk in their lives, and they know how to exploit your poor decisions when the time is right, in order to take your money when you’re most desperate and have no choice but to sell to them at a deep discount.

Quant explains how the rich exploit you

Why Independent Quants Don't Exist

Warren Buffett & Charlie Munger On Jim Simons & Quant Investing

How Much Money Do Swiss Bankers Make?

A $16B hedge fund CIO gives an easy explanation of quantitative trading

Quant to $5000: An Extreme Bull Scenario #crypto

If You Bought Just $100 of Quant (QNT) in 2018?! 🤯📈🚀 #Shorts

WARNING TO ALL QUANT (QNT) INVESTORS: DON'T GET LEFT BEHIND!!

Research Methods: Quantitative, Qualitative, and Beyond

Gary Shilling explains the only way to beat the market and win

Jim Simons: How To Achieve a 66% Return Per Year (7 Strategies)

Quantitative Easing & Inequality - BBC Newscast

Quant Conspiracy Rich vs Poor

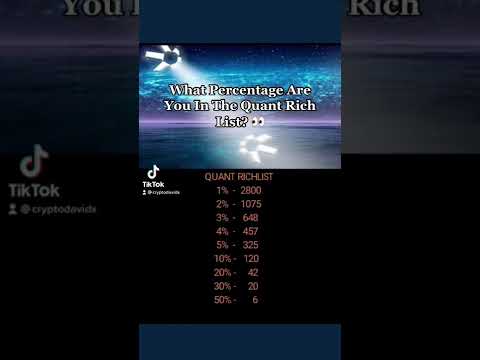

QUANT (QNT) RICH LIST🚀

10 Quant (QNT) Is Scarce !

What Is Quant? QNT Explained With Animations

The Max Supply of Quant (QNT Crypto)

Junior Bankers Need to Work 12 Hour Days, J.P. Morgan's Erdoes Says

Financial Advisor Answers Money Questions From Twitter 💰| Tech Support | WIRED

Quant Trading: Explained by a Jane Street Intern

THIS IS WHY 50 QUANT IS ENOUGH TO MAKE YOU RICH...

🚨QUANT UPDATE | How QNT is making holders RICH!

Warren Buffett Explains the 2008 Financial Crisis

‘’Just BUY 50 Quant’’ Quant CEO Talks On Quant To 100X…

Комментарии

0:13:40

0:13:40

0:10:14

0:10:14

0:01:27

0:01:27

0:00:18

0:00:18

0:00:57

0:00:57

0:00:30

0:00:30

0:00:40

0:00:40

0:00:51

0:00:51

0:10:14

0:10:14

0:03:06

0:03:06

0:15:27

0:15:27

0:13:46

0:13:46

0:09:52

0:09:52

0:00:08

0:00:08

0:00:42

0:00:42

0:10:06

0:10:06

0:00:40

0:00:40

0:03:35

0:03:35

0:14:52

0:14:52

0:08:22

0:08:22

0:16:16

0:16:16

0:11:20

0:11:20

0:05:31

0:05:31

0:11:55

0:11:55