filmov

tv

Correctly Pricing Your Options Strategies - Options Pricing

Показать описание

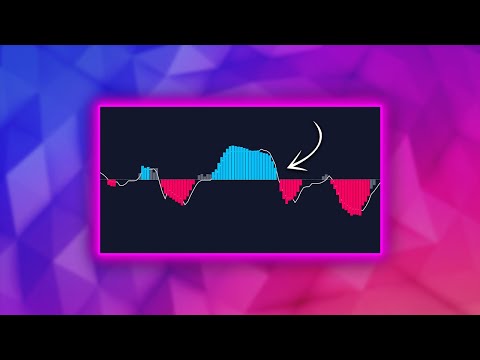

Properly pricing a trade to make enough money to cover the probability risk is one of the most overlooked aspects of selling options for monthly income. In this video, I'll show you exactly why most trades are frustrated and losing money long-term even though they are trading with a very high probability of success. Skip this video and you'll join their ranks.

Correctly Pricing Your Options Strategies - Options Pricing

Correctly Pricing Your Options Strategies

Options Trading MYSTERY: How to Choose Your Strike Price 🔍

Options Trading: Understanding Option Prices

4 steps to becoming a profitable options trader ! SECRETS GURUS WON’T TELL YOU

How To Profitably Day Trade $SPY Options (CHEATSHEET)

Option Contracts | Tricks for Choosing Options That Profit

The ONLY #1 Options Strategy You Need with Tom Sosnoff

Picking Your Option Strike Price || Day Trading Options

Options Trading For Beginners | Step By Step

Choosing The Correct Options Expiration Date | Real Trade Example

3 Options Trading Strategies for Consistent Profits

How To Find The Perfect Stock Options Contract In 30 Seconds

Using the Greeks to Help Select Your Options Strategy

SELLING OPTIONS FOR INCOME / $1,500 A WEEK

👆 REPEAT AFTER ME | Olymp Trade Strategy For Pocket Option to Get Out of Comfort Zone

I Tested This Trading Strategy & It Made 310%

My FAVORITE Options Strategy - The Iron Condor

Our Favorite Options Trading Strategy - The Strangle

Option Trading Strategy for Beginners

How to Choose the BEST Options Strategy - Options Trading Strategies

How to Avoid False Breakouts (My Secret Technique)

Intraday Option Trading Strategies | Call & Put Options Trading for beginners | No Loss strategy

ATM/OTM/ITM - How To Decide In Options Buying

Комментарии

0:24:18

0:24:18

0:24:18

0:24:18

0:10:55

0:10:55

0:07:31

0:07:31

0:10:04

0:10:04

0:12:06

0:12:06

0:27:17

0:27:17

1:00:04

1:00:04

0:15:18

0:15:18

0:22:23

0:22:23

0:10:33

0:10:33

0:21:29

0:21:29

0:11:59

0:11:59

0:44:20

0:44:20

0:05:39

0:05:39

0:09:28

0:09:28

0:01:00

0:01:00

0:11:43

0:11:43

0:09:13

0:09:13

0:07:28

0:07:28

0:20:17

0:20:17

0:08:24

0:08:24

0:12:44

0:12:44

0:11:21

0:11:21