filmov

tv

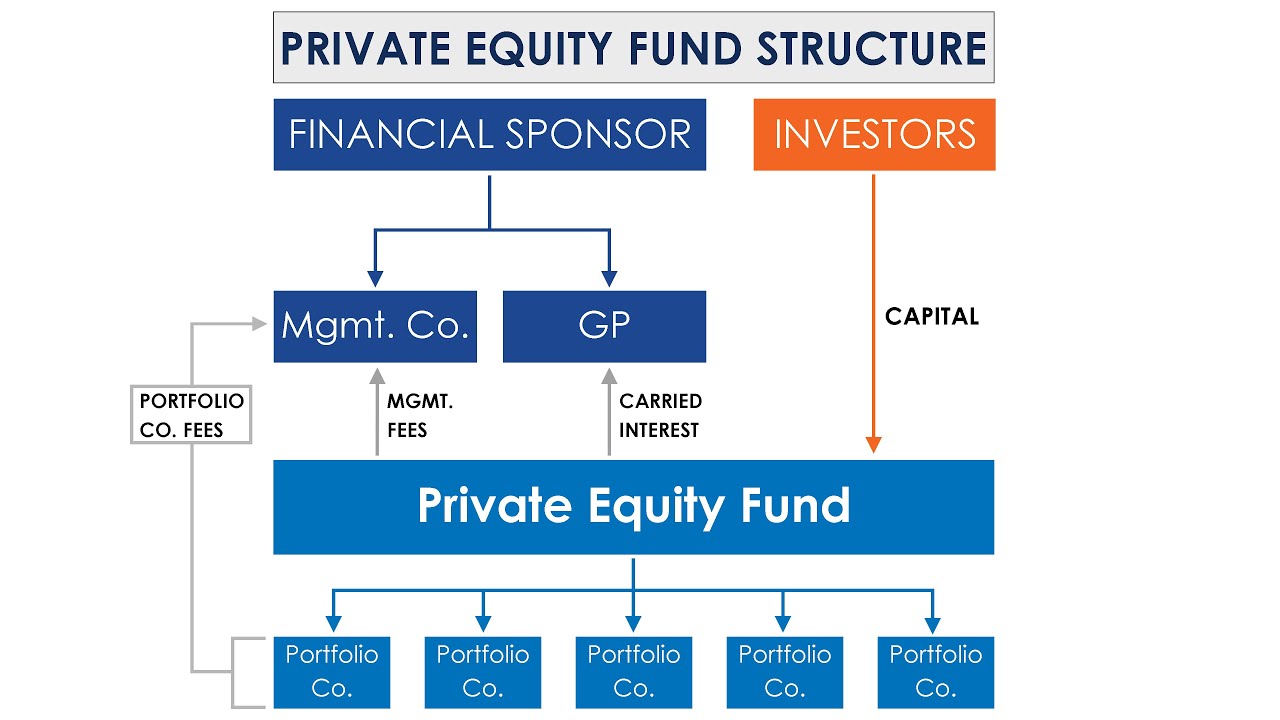

Private Equity Fund Structure

Показать описание

This video explains how a private equity firm is structured.

Introduction to Private Equity Playlist:

Private Equity Training:

Financial Modeling Curriculum:

MORE PRIVATE EQUITY CONTENT ON YOUTUBE

Private Equity Industry Due Diligence (Real Example)

Private Equity Bidding Strategy

Private Equity Sourcing Funnel

Favorite LOI Negotiation Story

The Working Capital Adjustment Explained

The Stock Purchase Agreement

Purchase Price in Private Equity

Introduction to Private Equity Playlist:

Private Equity Training:

Financial Modeling Curriculum:

MORE PRIVATE EQUITY CONTENT ON YOUTUBE

Private Equity Industry Due Diligence (Real Example)

Private Equity Bidding Strategy

Private Equity Sourcing Funnel

Favorite LOI Negotiation Story

The Working Capital Adjustment Explained

The Stock Purchase Agreement

Purchase Price in Private Equity

Private Equity Fund Structure Explained

Private Equity Fund Structure

What REALLY is Private Equity? What do Private Equity Firms ACTUALLY do?

6 Things Private Equity will do After They Buy Your Business

How To Start A Private Equity Fund From Scratch

10 Private Equity Terms Explained In Basic English

Introduction to Private Equity Funds with Simpson Thacher

How Do Private Equity Funds Evaluate Businesses?

Private EQUITY FUND Structures

Warren Buffett: Private Equity Firms Are Typically Very Dishonest

Private Equity Explained

How PRIVATE EQUITY Funds Are Structured! (REVEALING)

Why Does a Private Equity Fund have a GP and a Management Company

Why Private Equity SUCKS for (almost) Everyone

Private Equity Fund Structure - I

Structure of a Private Equity Waterfall 🤯

Private Equity vs Hedge Funds vs Venture Capital... How to tell them apart.

Masterclass | PRIVATE EQUITY and INVESTMENT FUNDS | LawCareers.Net

Private Equity Limited Partnership Structure in 90 Seconds

The BEST Beginner's Guide to Hedge Funds, Private Equity, and Venture Capital!

How Private Equity Investors Make SO MUCH MONEY

Private Equity Fund Structure Part - II

Introduction to Private Equity

Introduction To Venture Capital & Private Equity#3: Fee Structure In Funds and Carried Interest

Комментарии

0:12:15

0:12:15

0:04:23

0:04:23

0:07:23

0:07:23

0:02:17

0:02:17

0:29:24

0:29:24

0:13:20

0:13:20

0:55:32

0:55:32

0:23:38

0:23:38

0:04:44

0:04:44

0:06:05

0:06:05

0:02:22

0:02:22

0:07:02

0:07:02

0:03:25

0:03:25

0:18:50

0:18:50

0:04:32

0:04:32

0:06:19

0:06:19

0:08:38

0:08:38

0:59:42

0:59:42

0:01:33

0:01:33

0:15:09

0:15:09

0:07:57

0:07:57

0:05:23

0:05:23

0:09:15

0:09:15

0:14:58

0:14:58