filmov

tv

Asset Allocation: Building a Better Balanced Portfolio (Personal Finance Symposium IV - 2012)

Показать описание

Presentation by Craig Israelsen, PhD, Brigham Young University at Financial Symposium IV. The symposium was held on April 25, 2012 at the University of Missouri.

Jack Bogle: How to Create UNBEATABLE Asset Allocation - (John C. Bogle)

Asset Allocation: Building a Better Balanced Portfolio (Personal Finance Symposium IV - 2012)

9 Most Popular Investment Portfolio Strategies

What Does the Optimal Portfolio Look Like? (Asset Allocation by Age)

Why It Might Be Time To Rethink Lifecycle Asset Allocation

How to Have the Perfect Portfolio in Investment - John Bogle’s view

ASSET ALLOCATION: The Ultimate Guide To Build Your PERFECT Portfolio at ANY Age

Is Your Portfolio Optimized for Your Age? The Perfect Strategy And Portfolio

How Dividend Investing Can Help You Achieve Financial Freedom

Asset Allocation Strategies: Building a Strong Investment Portfolio

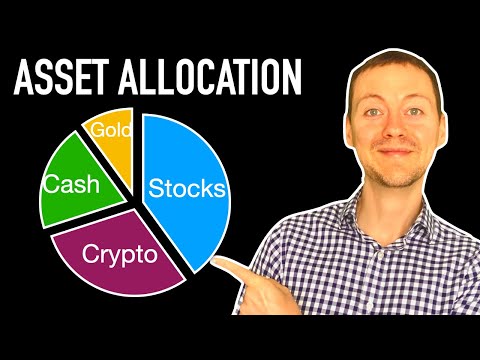

Asset Allocation | What You Need To Know

How to build the best investment portfolio with $100

How To Build an Investment Portfolio - Asset Allocation!

Retirement Portfolio Lies: Why Asset Allocation Is A Scam

Asset Allocation: Building a Portfolio

How Asset Allocation Improves Returns while Reducing Risk | 5 Asset Allocation Portfolio Strategies

How To Build An Investment Portfolio for Beginners // Asset Allocation

9.2 Optimal Asset Allocation Building a Portfolio

The 3 Fund Portfolio - Simple Investing for Beginners

88% Of Your Roth IRA Returns Depend On This

Asset Allocation | How To Build Your Investment Portfolio

Building your ETF Portfolio Part 1 – Risk and asset allocation

Ken Fisher Discusses Asset Allocation and the 60/40 Debate

Why asset allocation matters: 4 steps to a successful investment portfolio

Комментарии

0:13:38

0:13:38

1:15:04

1:15:04

0:14:08

0:14:08

0:15:04

0:15:04

0:08:56

0:08:56

0:10:20

0:10:20

0:22:22

0:22:22

0:16:09

0:16:09

0:07:34

0:07:34

0:26:18

0:26:18

0:09:51

0:09:51

0:00:26

0:00:26

0:15:56

0:15:56

0:17:23

0:17:23

0:10:55

0:10:55

0:15:28

0:15:28

0:12:53

0:12:53

0:09:24

0:09:24

0:12:57

0:12:57

0:13:26

0:13:26

0:12:53

0:12:53

1:00:26

1:00:26

0:00:56

0:00:56

0:05:27

0:05:27