filmov

tv

Bank FD Sahi Hai

Показать описание

With Finance Minister Nirmala Sitharaman urging public sector banks to boost deposit growth, a shift from debt mutual funds to bank fixed deposits (FDs) is becoming increasingly attractive. In this video, Debashis Basu explains why bank FDs are now more appealing than ever, thanks to recent tax changes and the inherent safety they offer. Discover how these factors could lead to a significant inflow of funds into bank deposits and what needs to be done to encourage this trend.

#fixeddeposit #debashisbasu #moneylife

#fixeddeposit #debashisbasu #moneylife

Bank FD Sahi Hai

PNB FD Interest Rates November 2024 | Punjab National Bank Fixed Deposit Interest Rates 2024

Mutual Funds or FD - Where to invest in 2023 after New Tax Rules?

Axis Bank Online Savings Account Opening & Fixed Deposit Interest Rates #shorts #bankingawarenes...

Mutual Funds & Share Market Returns vs Fixed Deposit (FD) | Recession 2020, Corona Crisis in Ind...

HDFC Bank Fixed Deposit Interest Monthly Payment Of Rs.1 Lakh FD | HDFC Bank FD interest Rates

Are Small Finance Banks Safe? #LLAShorts 174

Loan Against Fixed Deposit (FD) - Hindi

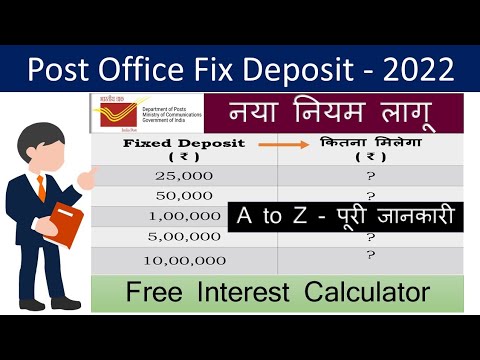

Post Office Fixed Deposit (FD) Scheme 2022 with Latest Interest Rate and Calculator | Post Office FD

Fixed Deposit Karna Sahi Hai Ya Nahi? Must Know Before You Regret! (FD) Fixed Deposit in 2024-25

Are Payments Banks Safe? #LLAShorts 175

SBI Annuity Deposit Scheme For Regular Monthly Income | Download Calculator

How to close/break fixed deposit online in HDFC BANK | HDFC BANK FD PREMETURE CLOSE THROUGH NET BAN.

Never invest in residential properties as compared to commercial properties 👍 #shorts

#fd #post #TD#postoffice saving scheme #paisa bachaane ka sahi tareeka #paisa double #best invest

Fixed Deposit Explain in Hindi | By Ishan

7% of PPF Better than 11% of Mutual Funds. HOW? #LLAShorts 108

Guaranteed Monthly Income | SBI Annuity Deposit Scheme | Best Investment Plan for Monthly Income

Fixed Deposit vs Recurring Deposit | Kaun Sahi Hai RD or FD ?[BY Harshit Sachan] [Hindi]

12% Returns with Zero Risk?

Mutual Fund for beginners - What is mutual funds - mutual funds Malayalam - 2024

Kya Chit Funds sahi hai? #LLAShorts 180

ULIP vs Mutual Funds #LLAShorts 01

This bank is not safe #LLAShorts 146

Комментарии

0:10:54

0:10:54

0:08:49

0:08:49

0:08:35

0:08:35

0:01:00

0:01:00

0:08:38

0:08:38

0:04:41

0:04:41

0:01:00

0:01:00

0:12:06

0:12:06

0:10:57

0:10:57

0:03:32

0:03:32

0:01:00

0:01:00

0:07:41

0:07:41

0:03:19

0:03:19

0:01:00

0:01:00

0:00:05

0:00:05

0:08:58

0:08:58

0:01:00

0:01:00

0:06:37

0:06:37

0:03:42

0:03:42

0:00:59

0:00:59

0:08:12

0:08:12

0:00:58

0:00:58

0:01:00

0:01:00

0:01:00

0:01:00