filmov

tv

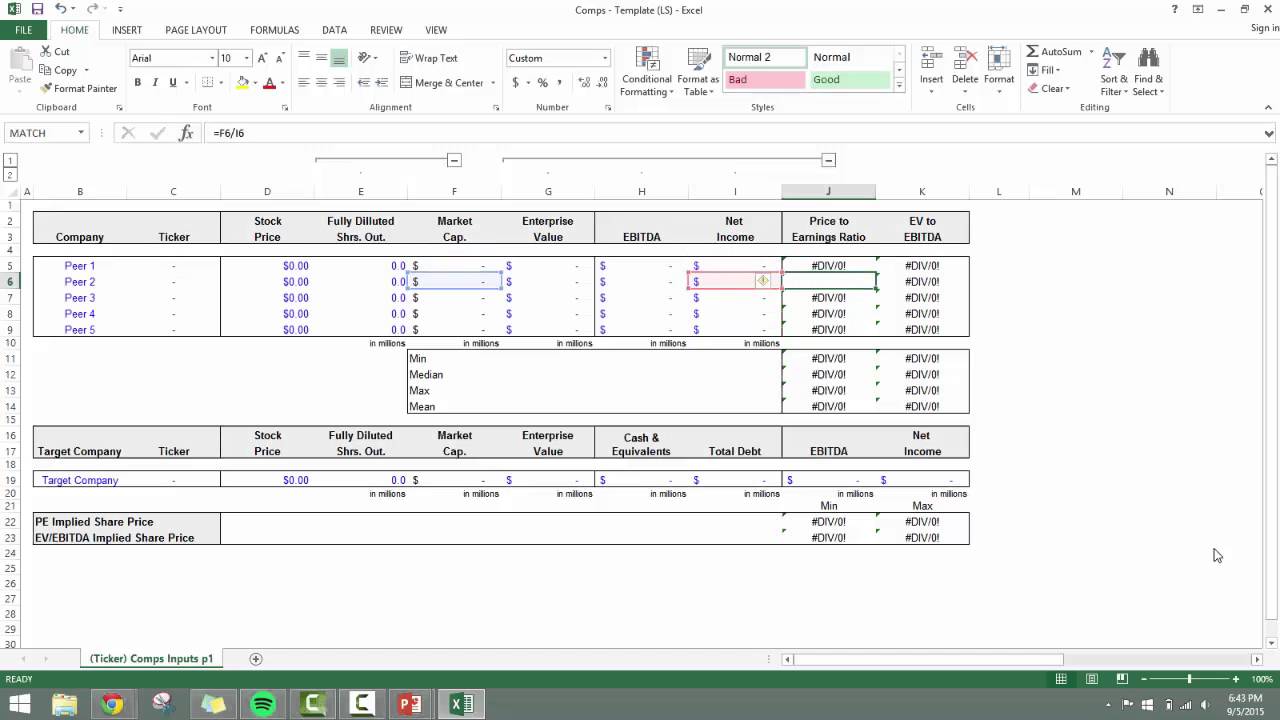

Comparable Company Analysis

Показать описание

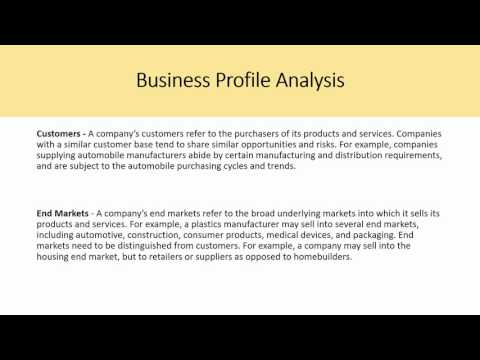

A basic tutorial on how the logic of how a Comps Analysis works. Great for anyone interviewing for investment banking.

Update 2021:

Please find the models and walkthroughs here for download:

We've since taken our site - Valuation University - down, and there won't be new content. Thanks for all the love over the years, our goal was to simplify concepts and create an easy-to-grasp educational platform for anyone breaking into finance, and we hope that we did just that. Good luck to everyone :)

Update 2021:

Please find the models and walkthroughs here for download:

We've since taken our site - Valuation University - down, and there won't be new content. Thanks for all the love over the years, our goal was to simplify concepts and create an easy-to-grasp educational platform for anyone breaking into finance, and we hope that we did just that. Good luck to everyone :)

Comparable Company Analysis (CCA) Tutorial

Comparable Company Analysis (Multiples Analysis)

How to Perform Comparable Company Analysis

Comparable Company Analysis (CCA): How Is It Used in Investing?

Comparable Company Analysis for Beginners

Comparable Company Analysis

Trading Comps Valuation Tutorial From Former JP Morgan Investment Banker! (Excel Template Included)

Comparable Company Analysis

Bazaar: The Most Comprehensive Show On Stock Markets | Full Show | December 31, 2024 | CNBC TV18

How to do Comps Valuation like a Banker

Valuation Series Part 2 : Comparable Company Analysis

How to Value a Company - Comparable Analysis [4 Basic Steps]

Comparable Company Analyse | Unternehmensbewertung mit Multiplikatoren | einfach erklärt

Comparable Companies Analysis – CH 1 Investment Banking Valuation Rosenbaum

What Are The Steps Involved In A Comparable Companies Analysis?

How to value a company using multiples - MoneyWeek Investment Tutorials

Business Valuation 101: The Comparables Analysis Method

Pros And Cons Of A Comparable Companies Analysis

Comparable Companies Analysis In A Nutshell By FourWeekMBA

Private Company Valuation

Corporate Valuation Methods: Discounted Cash Flow (DCF) and Comparable Company Analysis

How to Value a Stock Using the Multiples Valuation Method! (Comparables Valuation Method)

Semiconductor Industry Comparable Companies Analysis Shows Its Overvalued Among Other Things.

How to do a Comparable Company Analysis [Auto Manufacturers]

Комментарии

0:21:37

0:21:37

0:02:31

0:02:31

0:02:01

0:02:01

0:03:11

0:03:11

0:28:08

0:28:08

0:03:33

0:03:33

0:46:31

0:46:31

0:10:57

0:10:57

2:02:50

2:02:50

0:10:23

0:10:23

0:04:34

0:04:34

0:06:50

0:06:50

0:07:26

0:07:26

1:04:49

1:04:49

0:07:12

0:07:12

0:09:23

0:09:23

0:19:42

0:19:42

0:09:17

0:09:17

0:05:30

0:05:30

0:03:32

0:03:32

0:02:35

0:02:35

0:03:36

0:03:36

0:04:45

0:04:45

0:14:04

0:14:04