filmov

tv

Business Valuation 101: The Comparables Analysis Method

Показать описание

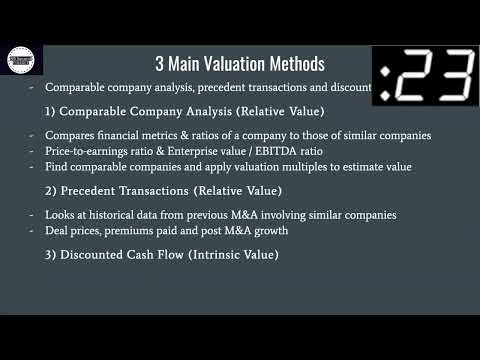

We learn how to value a company based on comparables analysis aka the multiples valuation method using an example. We also discuss how this method applies to early-stage vs. late-stage companies.

Communities:

Related Startup Videos:

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

We learn about how the comparables valuation method is used to value companies in venture capital, private equity & public markets.

Normally we would say something more like "what are the company's comps", so if you hear people reference that we are talking about the multiples valuation method.

In this lesson, we talk about multiples by growth stage, public vs. private markets, liquidity considerations, and then we do an example case study to practice valuing a company using a few different comps from the public market.

Sections:

0:18 definition of the comparables analysis valuation method

1:47 context: venture capital vs. private equity strategies & growth vs value

4:57 public vs. private market multiples

6:25 comparables valuation case study for marketplace businesses

By the end of this video, you will understand how to value a business using the market multiples valuation method - I guarantee it.

If you have questions - leave a comment below and I'll try to help. Cheers!

#comprarablesanalysis #startups #marketplaces

Communities:

Related Startup Videos:

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

We learn about how the comparables valuation method is used to value companies in venture capital, private equity & public markets.

Normally we would say something more like "what are the company's comps", so if you hear people reference that we are talking about the multiples valuation method.

In this lesson, we talk about multiples by growth stage, public vs. private markets, liquidity considerations, and then we do an example case study to practice valuing a company using a few different comps from the public market.

Sections:

0:18 definition of the comparables analysis valuation method

1:47 context: venture capital vs. private equity strategies & growth vs value

4:57 public vs. private market multiples

6:25 comparables valuation case study for marketplace businesses

By the end of this video, you will understand how to value a business using the market multiples valuation method - I guarantee it.

If you have questions - leave a comment below and I'll try to help. Cheers!

#comprarablesanalysis #startups #marketplaces

Комментарии

0:19:42

0:19:42

0:38:37

0:38:37

0:02:36

0:02:36

0:16:49

0:16:49

![[Modeling 201] 2.1.](https://i.ytimg.com/vi/rWhNDO6qEXM/hqdefault.jpg) 0:16:13

0:16:13

0:05:27

0:05:27

0:39:39

0:39:39

0:28:18

0:28:18

1:00:49

1:00:49

0:56:51

0:56:51

0:00:17

0:00:17

0:00:59

0:00:59

0:46:31

0:46:31

0:10:03

0:10:03

0:06:06

0:06:06

0:40:55

0:40:55

0:01:08

0:01:08

0:50:06

0:50:06

0:12:37

0:12:37

0:07:09

0:07:09

0:04:51

0:04:51

1:03:14

1:03:14

2:12:14

2:12:14

0:09:48

0:09:48