filmov

tv

Buying Put Options: How to Pick the Right Strike Price ☝

Показать описание

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

Buying Put Options: How to Pick the Right Strike Price

You have XYZ stock trading at $50 and you believe its going lower. The good thing about put options is that the price could go to $1000 and you still don't lose more than what you've paid for the option. (as opposed to a straight short where you are losing every time the stock goes up a dollar).

How do we decide what strike to take?

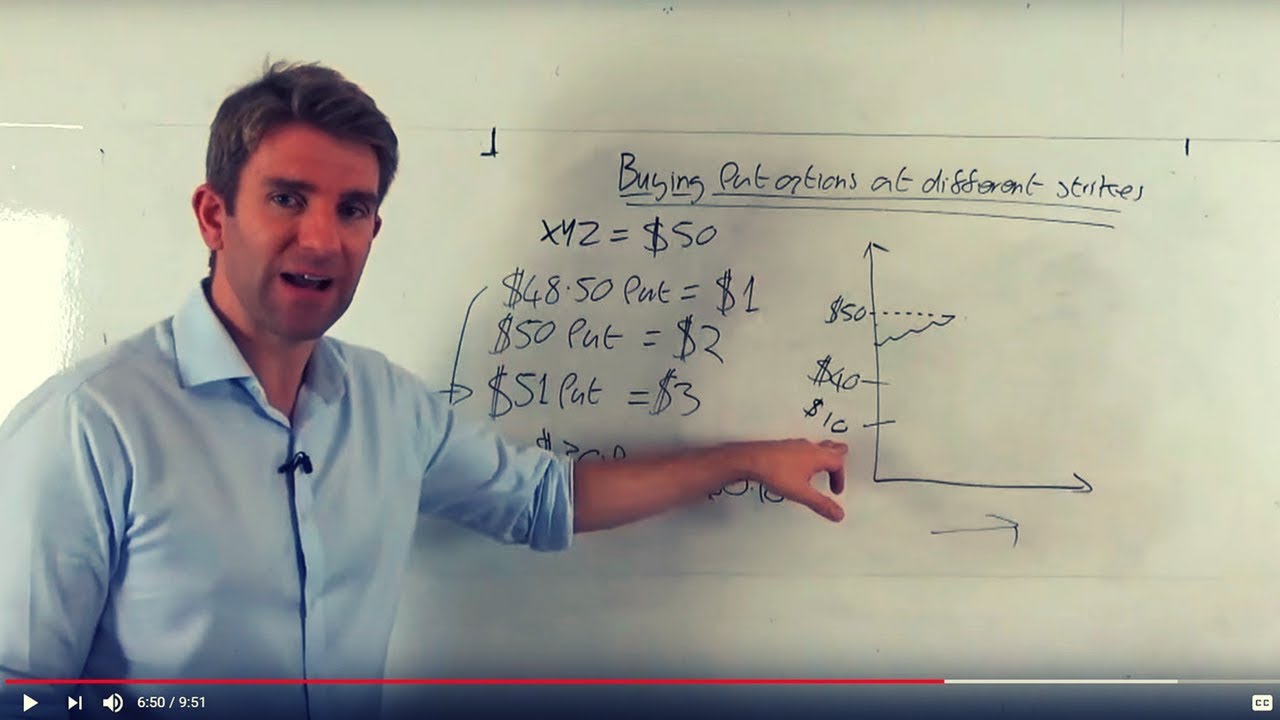

Buying put options at different strike prices:

You have XYZ stock trading at $50

A $48.50 put is priced at $1

A $50 put is priced at $2

A $51 put is priced at $3

A $30 put is priced at $0.10

An option's price is generally made of intrinsic and extrinsic value; intrinsic value being the value in the deal. For instance the $51 put option has an instrinsic value of $1. Extrinsic value is made up of the time we have until the contract expires, the strike price and the implied volatility. Do we buy the put that is already 'in-the-money' but is the most expensive or the least expensive!?

Complete Options Trading Course

Check the rest of the videos on our Options Trading videos playlist at

Buying Put Options: How to Pick the Right Strike Price

You have XYZ stock trading at $50 and you believe its going lower. The good thing about put options is that the price could go to $1000 and you still don't lose more than what you've paid for the option. (as opposed to a straight short where you are losing every time the stock goes up a dollar).

How do we decide what strike to take?

Buying put options at different strike prices:

You have XYZ stock trading at $50

A $48.50 put is priced at $1

A $50 put is priced at $2

A $51 put is priced at $3

A $30 put is priced at $0.10

An option's price is generally made of intrinsic and extrinsic value; intrinsic value being the value in the deal. For instance the $51 put option has an instrinsic value of $1. Extrinsic value is made up of the time we have until the contract expires, the strike price and the implied volatility. Do we buy the put that is already 'in-the-money' but is the most expensive or the least expensive!?

Complete Options Trading Course

Check the rest of the videos on our Options Trading videos playlist at

Комментарии

0:09:54

0:09:54

0:12:57

0:12:57

0:13:52

0:13:52

0:04:25

0:04:25

0:12:37

0:12:37

0:07:27

0:07:27

0:08:42

0:08:42

0:13:29

0:13:29

0:17:21

0:17:21

0:11:37

0:11:37

0:09:52

0:09:52

0:13:06

0:13:06

0:41:12

0:41:12

0:07:25

0:07:25

0:11:47

0:11:47

0:13:25

0:13:25

0:11:45

0:11:45

0:14:37

0:14:37

0:07:30

0:07:30

0:09:32

0:09:32

0:14:42

0:14:42

0:01:00

0:01:00

0:07:56

0:07:56

0:25:41

0:25:41