filmov

tv

Velvet Glove, Meet Iron Fist: The China Tech Crackdown

Показать описание

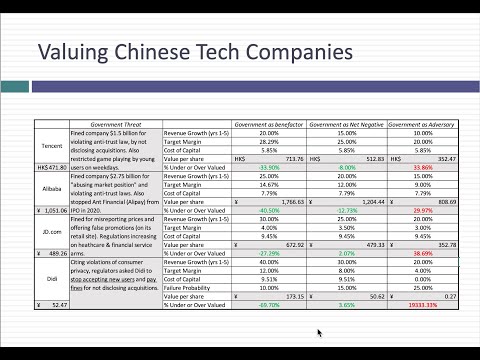

In valuation and investing, we generally do not explicitly consider the effects of the Government, when valuing and pricing companies. That practice, while justified when government policy is stable, can be problematic, when it is not, because government action or inaction can affect almost every aspect of value from increasing/decreasing revenue growth to pushing up/down margins to even changing the price of risk in equity and bond markets. In this session, I look at the Chinese government's crackdown on big Chinese tech companies, and argue that while the stated reasons are noble (protecting customer privacy and increasing competition), the real reason is control (of companies and data). I value Tencent, Alibaba, JD.com and Didi under three scenarios - a benevolent government, a government that is more net negative than positive (my base case) and an adversarial government, and find Tencent and Alibaba to be "under valued", in the base case. (My spreadsheets are linked below, if you are interested).

Valuation spreadsheets:

Valuation spreadsheets:

Комментарии

0:40:05

0:40:05

0:01:59

0:01:59

0:00:50

0:00:50

0:01:45

0:01:45

0:02:44

0:02:44

1:06:34

1:06:34

0:00:10

0:00:10

0:35:28

0:35:28

0:25:59

0:25:59

1:16:59

1:16:59

3:30:54

3:30:54

0:01:18

0:01:18

0:01:19

0:01:19

1:03:30

1:03:30

0:09:07

0:09:07

0:06:10

0:06:10

0:00:15

0:00:15

0:00:11

0:00:11

0:00:35

0:00:35

1:36:51

1:36:51

0:01:39

0:01:39

1:41:26

1:41:26

0:07:07

0:07:07

1:05:07

1:05:07