filmov

tv

Dividend Discount Model (Formula, Example) | Calculate Stock Value using DDM

Показать описание

In this video on Dividend Discount Model, we discuss what is Dividend discount model, formula and examples. Here we also look at stock value calculation using DDM Method.

Dividend Discount Model assumes that we can calculate the fair value of a stock by finding the present value of its dividends.

Here we are assuming that the company is a dividend paying mature company and gives yearly dividends. We cannot apply this concept to companies like Apple or Google that have never paid dividends.

Dividend Discount Model Formula (zero growth model) = Stock’s Intrinsic Value = Annual Dividends / Required Rate of Return

Dividend Discount Model Formula (Constant Growth) = Dividend(0) x (1+g) / (Ke - g)

Here, g is the constant growth rate in dividends

Ke is the cost of equity

Dividend(0) is the last year's dividend

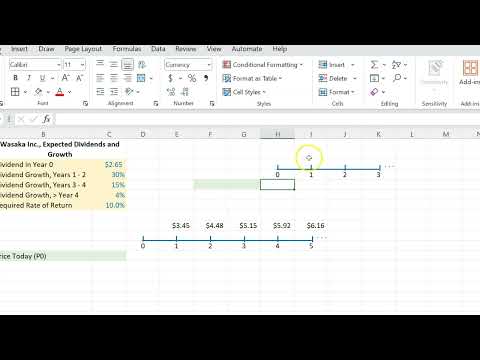

Dividend Discount Model Example -

We can apply dividend discount model on companies like Walmart. Walmart Dividends have increased in the past 3 years and are in a mature phase.

Dividend Discount Model Calculation

This years dividend paid is $4. Growth in Dividend is 6% (infinite)

What is the instrinsic value of the stock if the required rate of return is 12%?

D1 = $4 x 1.06 = $4.24

Ke = 12%

Growth rate or g = 6%

Intrinsic stock price = $4.24 / (0.12 – 0.06) = $4/0.06 = $70.66

Dividend Discount Model assumes that we can calculate the fair value of a stock by finding the present value of its dividends.

Here we are assuming that the company is a dividend paying mature company and gives yearly dividends. We cannot apply this concept to companies like Apple or Google that have never paid dividends.

Dividend Discount Model Formula (zero growth model) = Stock’s Intrinsic Value = Annual Dividends / Required Rate of Return

Dividend Discount Model Formula (Constant Growth) = Dividend(0) x (1+g) / (Ke - g)

Here, g is the constant growth rate in dividends

Ke is the cost of equity

Dividend(0) is the last year's dividend

Dividend Discount Model Example -

We can apply dividend discount model on companies like Walmart. Walmart Dividends have increased in the past 3 years and are in a mature phase.

Dividend Discount Model Calculation

This years dividend paid is $4. Growth in Dividend is 6% (infinite)

What is the instrinsic value of the stock if the required rate of return is 12%?

D1 = $4 x 1.06 = $4.24

Ke = 12%

Growth rate or g = 6%

Intrinsic stock price = $4.24 / (0.12 – 0.06) = $4/0.06 = $70.66

Комментарии

0:05:09

0:05:09

0:04:34

0:04:34

0:10:57

0:10:57

0:20:52

0:20:52

0:05:04

0:05:04

0:07:53

0:07:53

0:19:53

0:19:53

0:12:16

0:12:16

0:05:57

0:05:57

0:08:25

0:08:25

0:24:03

0:24:03

0:11:06

0:11:06

0:11:23

0:11:23

0:05:08

0:05:08

0:06:23

0:06:23

0:09:43

0:09:43

0:12:00

0:12:00

0:03:27

0:03:27

0:11:10

0:11:10

0:08:06

0:08:06

0:00:04

0:00:04

0:12:27

0:12:27

0:04:10

0:04:10

0:13:43

0:13:43