filmov

tv

What's the difference between a Cash ISA and a savings account? | Millennial Money

Показать описание

Lauren speaks to our resident financial expert Damien Fahy about the difference between a Cash ISA and a savings account.

---------------------------------------------------------------------------

Since 2010 Money to the Masses has been helping people with their personal finances for FREE. Every year it helps over a million people but that's not enough. Help me help more people by sharing Money to the Masses with your family, friends and colleagues.

---------------------------------------------------------------------------

Follow Money to the Masses on social media:

---------------------------------------------------------------------------

Since 2010 Money to the Masses has been helping people with their personal finances for FREE. Every year it helps over a million people but that's not enough. Help me help more people by sharing Money to the Masses with your family, friends and colleagues.

---------------------------------------------------------------------------

Follow Money to the Masses on social media:

What’s the difference between a scientific law and theory? - Matt Anticole

The Difference Between a Democracy and a Republic | 5 Minute Video

The difference between A and AN in English | Learn English Grammar Rules about A vs. AN

What`s the difference between a dialect and a language?

Democracy Vs Republic | What's the difference between a Democracy and Republic? Democracy Expla...

Sociopathy vs Psychopathy - What's The Difference?

What's the difference between a solar and lunar eclipse?

Is there a difference between art and craft? - Laura Morelli

Democrats Vs Republicans | What is the difference between Democrats and Republicans?

Sociopath vs Psychopath - What's The Difference?

What's The Difference Between Shia And Sunni Islam?

Laws and Rules for Kids | What is the difference between a rule and a law?

What's the Difference Between Latino and Hispanic?

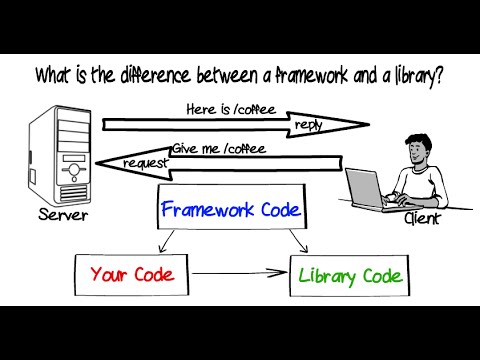

What is the difference between a framework and a library?

The Difference Between Aston Martin And Lamborghini

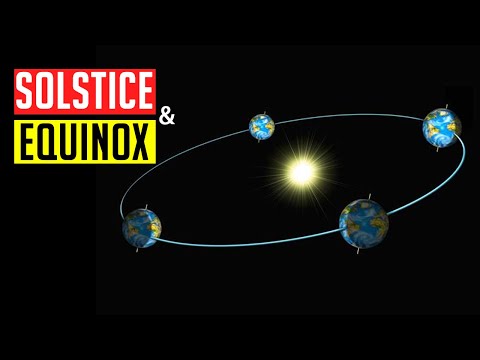

What's the Difference Between a Solstice and an Equinox?

Modem vs Router - What's the difference?

Hurricane, Tornado, Cyclone – What’s the Difference?

Poison vs. venom: What's the difference? - Rose Eveleth

Alligator VS Crocodile - What's the Difference?

The difference between oceans, seas and billabongs | Did You Know?

The Difference between the UK, Great Britain & England Explained

What are Creoles and Pidgins? And What`s the Difference?

Difference between AC and DC Current Explained | AddOhms #5

Комментарии

0:05:12

0:05:12

0:05:55

0:05:55

0:06:09

0:06:09

0:07:37

0:07:37

0:04:10

0:04:10

0:04:45

0:04:45

0:04:35

0:04:35

0:05:31

0:05:31

0:05:32

0:05:32

0:08:09

0:08:09

0:00:45

0:00:45

0:07:11

0:07:11

0:09:13

0:09:13

0:02:51

0:02:51

0:00:53

0:00:53

0:03:01

0:03:01

0:07:00

0:07:00

0:10:02

0:10:02

0:03:56

0:03:56

0:04:39

0:04:39

0:04:28

0:04:28

0:05:15

0:05:15

0:05:47

0:05:47

0:04:23

0:04:23