filmov

tv

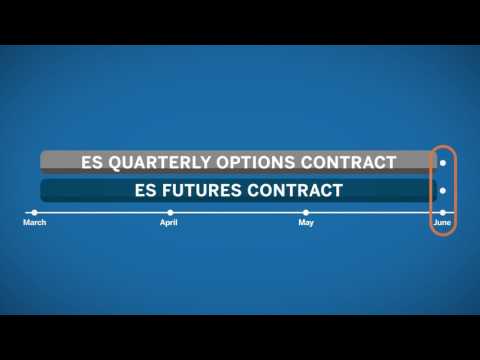

Understanding Futures Expiration & Contract Roll

Показать описание

Learn about the expiration and rollover of futures contract and what your choices are when the lifespan of a contract comes to an end.

This information is reproduced by permission of CME Group Inc. and its affiliates under license. CME Group Inc. and its affiliates accept no liability or responsibility for the information contained herein, including but not limited to the currency, accuracy and/or completeness of this information, and delays, interruptions, errors or omissions.

This information is reproduced by permission of CME Group Inc. and its affiliates under license. CME Group Inc. and its affiliates accept no liability or responsibility for the information contained herein, including but not limited to the currency, accuracy and/or completeness of this information, and delays, interruptions, errors or omissions.

Understanding Futures Expiration & Contract Roll

Lesson 9: Futures Contract Expiration & Rollover

Futures Contract Expiry - What happens when you hold contracts until the end?

Futures Market Explained

Benefits of Futures: Managing Contract Expiration

What Happens On Futures Expiration Day?

Understanding rollover in futures and options (F&O)

How To Trade Futures Contracts [Full & Live Explanation] | Trading Tutorials

Futures Trading Insights

Futures: Contracts & Trading Explained ⏱🔮

This Will Help You Understand Futures Contracts & TradingView Better

What are Futures Contracts?

How to Rollover Futures Contract | Step by Step Strategy

How to Trade Futures: The Ultimate In-Depth Guide [2024]

Managing Micro E-mini Futures Expiration

Options on Futures: Expiration Dates

FULL Futures Trading Guide for Beginners in 10 Minutes

What are Futures?

Futures Trading: How to Rollover Futures Contract when Expire?

Understanding Futures Margin

What Are Crypto Derivatives? (Perpetual, Futures Contract Explained)

What Happens When you don't square off Futures contract on the date of expiry?🤔💲#futurestrading...

Futures Contract Rollover and How to Survive it

Expiration and Settlement of Futures

Комментарии

0:02:40

0:02:40

0:13:31

0:13:31

0:09:18

0:09:18

0:04:27

0:04:27

0:01:59

0:01:59

0:07:20

0:07:20

0:05:47

0:05:47

0:50:14

0:50:14

0:59:23

0:59:23

0:12:04

0:12:04

0:05:25

0:05:25

0:04:20

0:04:20

0:08:07

0:08:07

0:26:15

0:26:15

0:03:54

0:03:54

0:02:46

0:02:46

0:09:41

0:09:41

0:10:38

0:10:38

0:14:34

0:14:34

0:07:14

0:07:14

0:08:04

0:08:04

0:02:35

0:02:35

0:08:49

0:08:49

0:01:33

0:01:33