filmov

tv

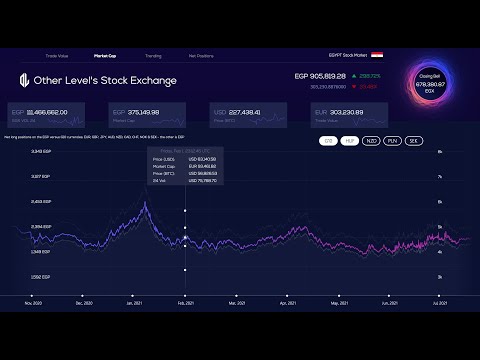

LIVE Stock Portfolio Dashboard in Excel in 30 Minutes!

Показать описание

Looking to master your stock portfolio management in Excel? In this easy-to-follow guide, "LIVE Stock Portfolio Dashboard in Excel in 30 Minutes!", we cover everything you need to know to set up a real-time stock portfolio tracker. From creating a transaction log and calculating returns to breaking down sector and market cap allocations with beautiful pie charts, this tutorial is your go-to resource for all things investing and Excel. Whether you're a novice or seasoned investor, this video will equip you with the tools to calculate gains, losses, dividends, and more, all in a live, up-to-date Excel dashboard.

👉 CORRECTION: I made one mistake @15:03. C4 in the denominator (# of shares purchased), should actually be E4 (# of shares sold). You should also remove the double quotes ,"") at the end of the IF statement from that same formula.

👨💼 My Freelance Financial Modeling Services:

Chapters:

0:00 – Overview of the Live Stock Dashboard in Excel

0:39 – Create a Transaction Log

2:47 – Begin Constructing Portfolio Dashboard

4:11 – Retrieve the Sector of Each Stock in the Portfolio

4:46 – Find the Market Cap Size of Each Company

6:22 – Calculate the Percentage Allocated to Each Share

8:22 – Retrieve the Beta of Each Stock

9:13 – Calculate Today’s Return on Each Share

10:31 – Calculate Average Purchase Price Per Share

14:22 - Calculate Average Sale Price Per Share

15:24 – Calculate Total Dividends Received

16:45 – Calculate Realized Gain or Loss on Each Stock

17:37 – Calculate Total Gain or Loss on Each Stock

18:30 – Calculate Unrealized Gain or Loss on Each Stock

19:52 – Calculate Total Portfolio Gains and Losses

22:45 – Conditionally Format Gains & Losses

23:44 – Create Market Cap Size Pie Chart

26:33 – Create Sector Allocation Pie Chart

27:29 – Create Individual Securities Holdings Pie Chart

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

👉 CORRECTION: I made one mistake @15:03. C4 in the denominator (# of shares purchased), should actually be E4 (# of shares sold). You should also remove the double quotes ,"") at the end of the IF statement from that same formula.

👨💼 My Freelance Financial Modeling Services:

Chapters:

0:00 – Overview of the Live Stock Dashboard in Excel

0:39 – Create a Transaction Log

2:47 – Begin Constructing Portfolio Dashboard

4:11 – Retrieve the Sector of Each Stock in the Portfolio

4:46 – Find the Market Cap Size of Each Company

6:22 – Calculate the Percentage Allocated to Each Share

8:22 – Retrieve the Beta of Each Stock

9:13 – Calculate Today’s Return on Each Share

10:31 – Calculate Average Purchase Price Per Share

14:22 - Calculate Average Sale Price Per Share

15:24 – Calculate Total Dividends Received

16:45 – Calculate Realized Gain or Loss on Each Stock

17:37 – Calculate Total Gain or Loss on Each Stock

18:30 – Calculate Unrealized Gain or Loss on Each Stock

19:52 – Calculate Total Portfolio Gains and Losses

22:45 – Conditionally Format Gains & Losses

23:44 – Create Market Cap Size Pie Chart

26:33 – Create Sector Allocation Pie Chart

27:29 – Create Individual Securities Holdings Pie Chart

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

Комментарии

0:29:38

0:29:38

0:27:06

0:27:06

0:22:51

0:22:51

0:42:43

0:42:43

0:29:41

0:29:41

0:56:00

0:56:00

0:13:59

0:13:59

0:08:13

0:08:13

9:47:31

9:47:31

0:25:59

0:25:59

0:19:11

0:19:11

0:22:35

0:22:35

0:06:30

0:06:30

1:06:25

1:06:25

0:47:18

0:47:18

0:29:51

0:29:51

0:26:09

0:26:09

0:39:52

0:39:52

0:30:37

0:30:37

0:15:38

0:15:38

0:26:29

0:26:29

0:11:47

0:11:47

0:43:53

0:43:53

0:03:00

0:03:00