filmov

tv

Iron Condor Options Strategy (TUTORIAL + Trade Examples)

Показать описание

=====

The iron condor options strategy is one of the most popular options trading strategies, especially among traders who prefer selling options with limited risk and want a neutral market outlook.

Selling iron condors (referred to as a "short iron condor")is a market-neutral strategy that profits when the stock price remains within a range, which makes it a high probability trading strategy that requires no predictions in regards to which way the stock price will move.

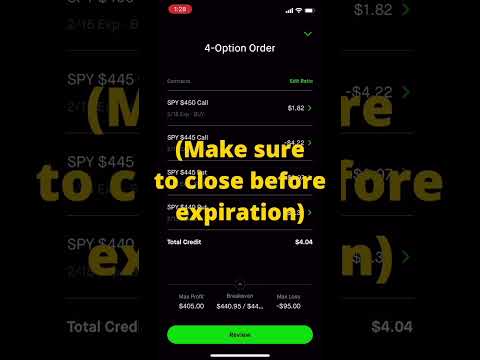

A short iron condor is constructed by selling a call spread and selling a put spread simultaneously.

Since selling a call spread is a bearish strategy (profits when the stock price remains below the call spread) and selling a put spread is a bullish strategy (profits when the stock price remains above the put spread), combining the two into a short iron condor results in a neutral position (no directional bias).

In this video, we'll cover:

- Selling iron condors explained (setup, explanation, max profit potential, max loss potential, breakevens)

- Historical trade examples so you can see exactly how the iron condor strategy performs in various scenarios.

- A demonstration of setting up an iron condor on the tastyworks trading platform. I even put the trade on and take it off so you can see how easy it is to get in and out of iron condor positions.

- How buying iron condors works.

Be sure to leave a comment down below with any questions you may have! tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Комментарии

0:25:57

0:25:57

0:11:46

0:11:46

0:11:43

0:11:43

0:10:42

0:10:42

0:05:39

0:05:39

0:15:09

0:15:09

0:29:28

0:29:28

0:14:08

0:14:08

0:14:38

0:14:38

0:09:53

0:09:53

0:14:50

0:14:50

0:24:24

0:24:24

0:20:42

0:20:42

0:18:17

0:18:17

0:17:16

0:17:16

0:01:00

0:01:00

0:11:43

0:11:43

0:08:15

0:08:15

0:17:13

0:17:13

0:00:54

0:00:54

0:18:22

0:18:22

0:00:33

0:00:33

0:00:54

0:00:54

0:13:24

0:13:24