filmov

tv

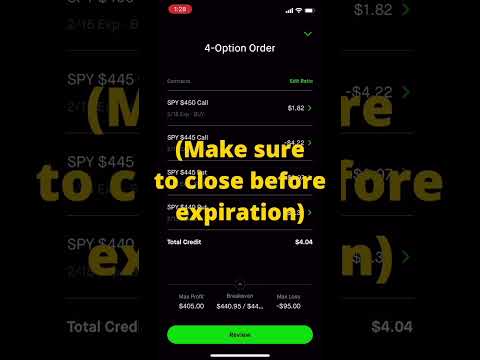

+28% Monthly Return Trading Iron Condor Options 🐍

Показать описание

🔗 LINKS 🔗

📈 Patreon: Join my Patron list for live trade alerts, one-on-one consulting, & much more!

🧠 Premium Discord: Learn more about options with instant trade alerts, one-on-one teaching, & more starting at just $10 / month using the links below:

🧠 Options Trading Tutorials Playlist:

🙏🏻 Support the channel with these referral links

📱 Social Media:

Instagram: @gregtalksmoney

Twitter: @gregtalksmoney

TikTok: @gregtalksmoney

🏷 TAGS 🏷

monthly passive income,options for passive income,options for monthly passive income,passive income options trading,options trading strategies for passive income,options strategies for passive income,passive income options strategies,options trading for passive income,trading options for passive income,passive income trading options,options trading strategies to make passive income,options trading,options trading strategies,iron condor,iron condor options

⚠️ DISCLAIMER ⚠️

I am not a financial advisor. This video is for entertainment and educational purposes only. You (and only you) are responsible for the financial decisions that you make.

Комментарии

0:01:00

0:01:00

0:00:54

0:00:54

0:29:28

0:29:28

0:00:22

0:00:22

0:00:27

0:00:27

0:00:16

0:00:16

0:01:00

0:01:00

0:00:50

0:00:50

0:10:02

0:10:02

0:00:17

0:00:17

0:00:21

0:00:21

0:01:01

0:01:01

0:00:12

0:00:12

0:00:10

0:00:10

0:01:01

0:01:01

0:00:28

0:00:28

0:00:27

0:00:27

0:00:37

0:00:37

0:00:10

0:00:10

0:05:54

0:05:54

0:00:28

0:00:28

0:01:01

0:01:01

0:01:01

0:01:01

0:00:15

0:00:15