filmov

tv

Bankruptcy Chapter 7 and the Secret to a Mortgage Approval

Показать описание

Let's talk about getting a traditional mortgage after a chapter 7 Bankruptcy.

-------------------------------------------------------------------------------------------

3 - 📞 Call/Text - 385-250-1411

Mortgage brokers often have access to a wide range of mortgage products from various lenders, including large banks, credit unions, and private lenders. This allows them to shop around and compare different rates and terms to find the best mortgage options for their clients. Because they have relationships with many lenders, mortgage brokers can often negotiate lower interest rates and better terms than individual borrowers can obtain on their own. Additionally, mortgage brokers typically work on a commission basis, so they have an incentive to find the best deal for their clients. Overall, mortgage brokers can help borrowers find the best interest rates by leveraging their expertise, network, and negotiating skills.

NMLS 103819/3152

Miles Pitcher - Superior Lending Associates, L.C.

-------------------------------------------------------------

Other Videos you may like:

SOCIALS

________________________________________

NLMS #103819/3152

In this compelling video, we'll dive into the often misunderstood and daunting world of obtaining a mortgage after filing for Chapter 7 bankruptcy. You'll hear real stories of individuals who successfully navigated this challenging journey and achieved their dream of homeownership. We'll unravel the secrets to mortgage approval, offering valuable insights and practical tips that can make a difference in your post-bankruptcy life.

The video begins by shedding light on the emotional and financial toll of bankruptcy, emphasizing that it's not the end but a new beginning. Our experts share the essential steps you need to take to rebuild your credit and financial stability after bankruptcy. You'll discover how time plays a crucial role in improving your credit score and increasing your chances of mortgage approval.

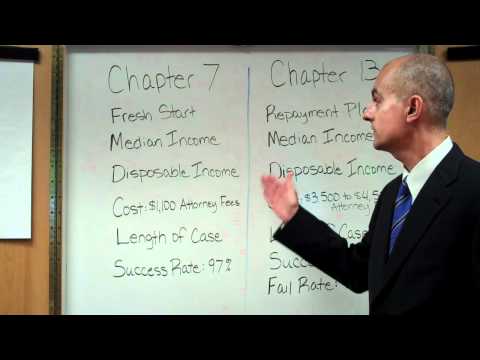

Next, we explore the various mortgage options available to those with a Chapter 7 bankruptcy history. We break down the differences between FHA, VA, and conventional loans, highlighting their eligibility criteria and benefits. You'll also gain insight into strategies for saving money and getting the best mortgage rates, regardless of your credit history.

Finally, we wrap up with success stories from real people who defied the odds and purchased homes after bankruptcy. Their experiences serve as inspiration, proving that with determination, education, and the right resources, you too can achieve homeownership and turn your financial life around.

Join us on this enlightening journey towards post-bankruptcy homeownership and learn how to unlock the mortgage code for a brighter future. Don't let bankruptcy define your path; let it be the stepping stone to a new and promising chapter in your life.

-------------------------------------------------------------------------------------------

3 - 📞 Call/Text - 385-250-1411

Mortgage brokers often have access to a wide range of mortgage products from various lenders, including large banks, credit unions, and private lenders. This allows them to shop around and compare different rates and terms to find the best mortgage options for their clients. Because they have relationships with many lenders, mortgage brokers can often negotiate lower interest rates and better terms than individual borrowers can obtain on their own. Additionally, mortgage brokers typically work on a commission basis, so they have an incentive to find the best deal for their clients. Overall, mortgage brokers can help borrowers find the best interest rates by leveraging their expertise, network, and negotiating skills.

NMLS 103819/3152

Miles Pitcher - Superior Lending Associates, L.C.

-------------------------------------------------------------

Other Videos you may like:

SOCIALS

________________________________________

NLMS #103819/3152

In this compelling video, we'll dive into the often misunderstood and daunting world of obtaining a mortgage after filing for Chapter 7 bankruptcy. You'll hear real stories of individuals who successfully navigated this challenging journey and achieved their dream of homeownership. We'll unravel the secrets to mortgage approval, offering valuable insights and practical tips that can make a difference in your post-bankruptcy life.

The video begins by shedding light on the emotional and financial toll of bankruptcy, emphasizing that it's not the end but a new beginning. Our experts share the essential steps you need to take to rebuild your credit and financial stability after bankruptcy. You'll discover how time plays a crucial role in improving your credit score and increasing your chances of mortgage approval.

Next, we explore the various mortgage options available to those with a Chapter 7 bankruptcy history. We break down the differences between FHA, VA, and conventional loans, highlighting their eligibility criteria and benefits. You'll also gain insight into strategies for saving money and getting the best mortgage rates, regardless of your credit history.

Finally, we wrap up with success stories from real people who defied the odds and purchased homes after bankruptcy. Their experiences serve as inspiration, proving that with determination, education, and the right resources, you too can achieve homeownership and turn your financial life around.

Join us on this enlightening journey towards post-bankruptcy homeownership and learn how to unlock the mortgage code for a brighter future. Don't let bankruptcy define your path; let it be the stepping stone to a new and promising chapter in your life.

Комментарии

0:08:17

0:08:17

0:09:14

0:09:14

0:11:42

0:11:42

0:12:48

0:12:48

0:04:07

0:04:07

0:06:56

0:06:56

0:08:02

0:08:02

0:17:14

0:17:14

0:05:08

0:05:08

0:11:19

0:11:19

0:07:31

0:07:31

0:08:05

0:08:05

0:09:44

0:09:44

0:03:43

0:03:43

0:09:07

0:09:07

0:08:35

0:08:35

0:13:01

0:13:01

0:12:07

0:12:07

0:17:26

0:17:26

0:02:57

0:02:57

0:08:33

0:08:33

0:10:43

0:10:43

0:07:46

0:07:46

0:06:18

0:06:18