filmov

tv

CCA Calculation!

Показать описание

CCA Calculation!

CCA Calculation!

CCA Calculation: Updated

How To Reduce Taxes and Keep More Cash In Your Pocket using Capital Cost Allowance(CCA)

Understanding CCA, UCC, Recapture, and Terminal Loss for Tax

How to calculate cca battery?

CCA - Adjusted Cost of Disposal

CCA Calculations

CCA formula stuff

Capital Cost Allowance Calculation #2

Calculating the Capital Cost Allowance (CCA)

CCA - Problem 4

CCA Recapture or Terminal Loss?

Understanding Lead-Acid Battery Ratings - What is CCA? RC? AH?

CCA for Leasehold improvement

Capital Cost Allowance, Tax, and the Income Statement - Engineering Economics Lightboard

Accelerated CCA, Schedule 14, and more... - March 14, 2019

Chapter 5 CCA 2021 ML

Taxation and Capital Cost Allowance CCA

Capital Cost Allowance Calculation #3

Capital budgeting 02 -- CCA depreciation part 01

Canonical Correspondence Analysis (CCA) Past statistical software | Biostatistics | Statistics Bio7

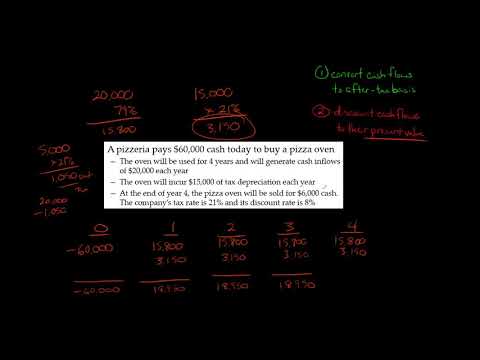

How to Calculate NPV with Taxes

How to Find the CCA Tax Shield in Capital Budgeting

Electronics: Calculating CCA of a starter battery (6 Solutions!!)

Комментарии

0:05:01

0:05:01

0:02:50

0:02:50

0:07:41

0:07:41

0:09:36

0:09:36

0:01:14

0:01:14

0:02:41

0:02:41

0:09:16

0:09:16

0:16:19

0:16:19

0:02:30

0:02:30

0:08:02

0:08:02

0:07:43

0:07:43

0:05:30

0:05:30

0:03:00

0:03:00

0:06:30

0:06:30

0:11:52

0:11:52

0:24:04

0:24:04

0:29:33

0:29:33

0:41:42

0:41:42

0:01:49

0:01:49

0:14:51

0:14:51

0:02:49

0:02:49

0:07:43

0:07:43

0:16:14

0:16:14

0:04:55

0:04:55