filmov

tv

How Much Should You Risk Per Trade with Futures?

Показать описание

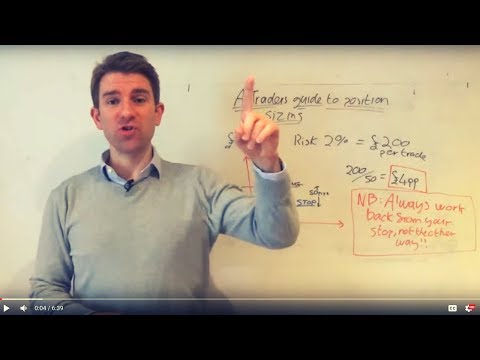

A focus on risk management is what separates professional traders from the retail crowd!

In this video, Mark breaks down the importance of correct position sizing and offers some guidelines for newer traders.

In addition to this, we also show you how to optimize your risk per trade once you have more experience so that you can effectively manage risk while scaling up your positions.

------------------

🔔 Subscribe for FREE daily morning news updates at 9AM before the US market opens to trade.

👍 LIKE our video to let us know to keep up the good work.

___________________

Sign up to our FREE Trader training.

Do you want to know what you will learn when you sign up to TRADEPRO Academy?💻🗠

You will receive the first lesson of our 6 valuable courses.

___________________

Every morning we trade the US Open with our members.

Want to join us in our exclusive live trading room (Pro & Elite)?

Sign up to be a TRADEPRO member here:

⬇️ ⬇️ ⬇️ ⬇️

✅ Follow on Twitter

✅ Follow on Instagram

✅ Join Private Facebook Page

Want to signup for a TRADEPRO subscription and experience the edge?

All subscriptions come with a 14-day money-back guarantee! Try the world's best trader development risk-free.

Check out our professional options trader course, included in the swing trader package here:

If you want to learn how to trade in the stock market, our beginner foundations course is available in any of our packages, learn more below:

In this video, Mark breaks down the importance of correct position sizing and offers some guidelines for newer traders.

In addition to this, we also show you how to optimize your risk per trade once you have more experience so that you can effectively manage risk while scaling up your positions.

------------------

🔔 Subscribe for FREE daily morning news updates at 9AM before the US market opens to trade.

👍 LIKE our video to let us know to keep up the good work.

___________________

Sign up to our FREE Trader training.

Do you want to know what you will learn when you sign up to TRADEPRO Academy?💻🗠

You will receive the first lesson of our 6 valuable courses.

___________________

Every morning we trade the US Open with our members.

Want to join us in our exclusive live trading room (Pro & Elite)?

Sign up to be a TRADEPRO member here:

⬇️ ⬇️ ⬇️ ⬇️

✅ Follow on Twitter

✅ Follow on Instagram

✅ Join Private Facebook Page

Want to signup for a TRADEPRO subscription and experience the edge?

All subscriptions come with a 14-day money-back guarantee! Try the world's best trader development risk-free.

Check out our professional options trader course, included in the swing trader package here:

If you want to learn how to trade in the stock market, our beginner foundations course is available in any of our packages, learn more below:

Комментарии

0:15:35

0:15:35

0:11:31

0:11:31

0:08:08

0:08:08

0:08:42

0:08:42

0:05:56

0:05:56

0:01:36

0:01:36

0:06:40

0:06:40

0:06:24

0:06:24

0:16:22

0:16:22

0:07:56

0:07:56

0:14:20

0:14:20

0:19:19

0:19:19

0:19:50

0:19:50

0:05:45

0:05:45

0:16:53

0:16:53

0:15:22

0:15:22

0:10:35

0:10:35

0:07:39

0:07:39

0:10:10

0:10:10

0:09:59

0:09:59

0:13:15

0:13:15

0:06:19

0:06:19

0:04:38

0:04:38

0:08:48

0:08:48