filmov

tv

The Sharpe Ratio: Risk Adjusted Return Series part 1

Показать описание

In this video I explain the Sharpe Ratio and why it's an important risk adjusted metric to help us gauge the long-term viability of an investment. When analyzing performance, the rate of return of an investment can be deceiving because it doesn't take into account the risk required to achieve it. To get the full picture we need to factor in the risk, which will give us more information on whether the rate of return is actually sustainable. The most basic and most common risk adjusted metric is called the Sharpe Ratio.

Claim your FREE trial to the VTS Total Portfolio Solution:

Follow me on Twitter:

Chapters:

0:00 Introduction

1:10 Sharpe Ratio formula

2:17 What do Sharpe Ratio values mean?

3:35 Example using XIV vs S&P 500

4:47 Why does Sharpe Ratio matter?

Brent Osachoff , volatility trading strategies, VTS , VTS options, volatility trading , Volatility ETPs, options trading , investing , stock market, VIX, VXX, UVXY

Claim your FREE trial to the VTS Total Portfolio Solution:

Follow me on Twitter:

Chapters:

0:00 Introduction

1:10 Sharpe Ratio formula

2:17 What do Sharpe Ratio values mean?

3:35 Example using XIV vs S&P 500

4:47 Why does Sharpe Ratio matter?

Brent Osachoff , volatility trading strategies, VTS , VTS options, volatility trading , Volatility ETPs, options trading , investing , stock market, VIX, VXX, UVXY

The Sharpe Ratio: Risk Adjusted Return Series part 1

Investopedia - Risk Adjusted Return

Sharpe Ratio | Risk Adjusted Return | Mutual funds

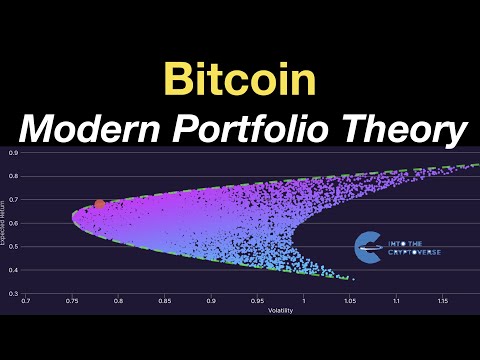

Bitcoin: Modern Portfolio Theory and The Sharpe Ratio

Risk-adjusted performance evaluation: Sharpe, Treynor, and Jensen's Alpha (Excel) (SUB)

Sharpe Ratio: Master Risk-Adjusted Returns 📈📉📚 Link in Description ⬇️

The Sharpe Ratio: How to Evaluate Investment Performance with Risk in Mind Using Python

How to Measure Mutual Fund Risk | Alpha, Beta, SD, Sharpe, R-squared, Sortino | Learn with ETMONEY

What is the Sharpe Ratio? | Sharpe Ratio Explained

What is the Sharpe Ratio & How It Can Help Us Understand Risk Adjusted Stock Market Returns!

Sharpe Ratio Explained: Measuring Risk-Adjusted Returns in 60 Seconds

Sharpe vs. Sortino: The Key to Risk-Adjusted Returns in Quant Trading

What is The Sharpe Ratio?

Understanding the Sharpe Ratio: Evaluating Risk-Adjusted Returns | L-18

Sharpe vs Sortino Ratio | Differences Explained

Sharpe Ratio, Treynor Ratio and Jensen's Alpha (Calculations for CFA® and FRM® Exams)

CFA® Level I Portfolio Management - Sharpe ratio, Treynor ratio, M2 , and Jensen’s alpha

Investment Performance Evaluation in Excel: Sharpe Ratio, Treynor Ratio & Jensen's Alpha

Sharpe Ratio - Do you know your risk?

Explained: Risk-Adjusted Return & Minimum Expectation To Have From Your Scheme

Sharpe Ratio

Sharpe Ratio and Adding an Asset

Sharpe Ratio | IronHawk

What is Sharpe Ratio? || @AASGINVESTMENTS

Комментарии

0:06:55

0:06:55

0:01:16

0:01:16

0:03:42

0:03:42

0:05:56

0:05:56

0:27:29

0:27:29

0:00:19

0:00:19

0:11:02

0:11:02

0:15:16

0:15:16

0:03:42

0:03:42

0:02:10

0:02:10

0:00:51

0:00:51

0:00:43

0:00:43

0:01:17

0:01:17

0:08:19

0:08:19

0:01:46

0:01:46

0:19:48

0:19:48

0:05:10

0:05:10

0:08:52

0:08:52

0:31:29

0:31:29

0:03:41

0:03:41

0:02:58

0:02:58

0:01:56

0:01:56

0:09:27

0:09:27

0:01:27

0:01:27