filmov

tv

CONSOLIDATED STATEMENT OF FINANCIAL POSITION -STEP BY STEP |FINAL EXAM FEB 2022|FAR320

Показать описание

In this step by step video, we will learn how to prepare consolidated statement of financial position and discuss the following consolidation issues including adjustments for:

1. Calculation of Goodwill for acquisition of ordinary shares, preference shares and debentures in the subsidiary.

2. Downstream intercompany sale of inventories and elimination of unrealised profits on unsold inventories (Parent is the Seller) . Margin is used.

3.Intercompany sale of PPE (Parent is the Seller), elimination of unrealised profits and adjustment for overprovision of depreciation. Reducing balance method is adopted.

4. Intercompany preference dividends where both parent and subsidiary HAVE NOT declared and RECORDED the preference dividends (including elimination of intercompany dividends). SITUATION 2

5. Intercompany debenture interest where both parent and subsidiary HAVE NOT declared and RECORDED the debenture interest (including elimination of intercompany debenture interests). SITUATION 2.

6. Elimination of undiscounted intercompany balances of bills payable and receivables.

7. Non controlling interest measured at proportionate share of fair value of net assets in subsidiary on the acquisition date.

8. Impairment loss of partial goodwill.

1. Calculation of Goodwill for acquisition of ordinary shares, preference shares and debentures in the subsidiary.

2. Downstream intercompany sale of inventories and elimination of unrealised profits on unsold inventories (Parent is the Seller) . Margin is used.

3.Intercompany sale of PPE (Parent is the Seller), elimination of unrealised profits and adjustment for overprovision of depreciation. Reducing balance method is adopted.

4. Intercompany preference dividends where both parent and subsidiary HAVE NOT declared and RECORDED the preference dividends (including elimination of intercompany dividends). SITUATION 2

5. Intercompany debenture interest where both parent and subsidiary HAVE NOT declared and RECORDED the debenture interest (including elimination of intercompany debenture interests). SITUATION 2.

6. Elimination of undiscounted intercompany balances of bills payable and receivables.

7. Non controlling interest measured at proportionate share of fair value of net assets in subsidiary on the acquisition date.

8. Impairment loss of partial goodwill.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 1) - IFRS 10

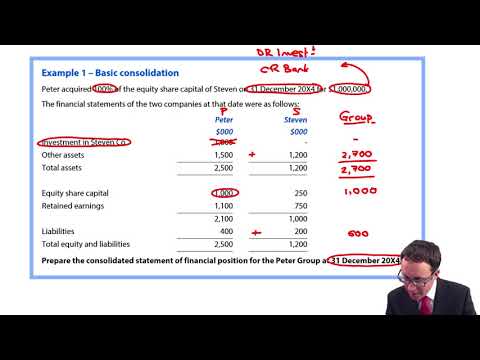

Group SFP - Basic consolidation (revision) - ACCA Financial Reporting (FR)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 2) - IFRS 10

Consolidated Statement of Financial Position (Balance Sheet) | Wholly-Owned | FULL EXAMPLE

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 5) - INTRA-GROUP ADJUSTMENTS

Consolidated financial statements

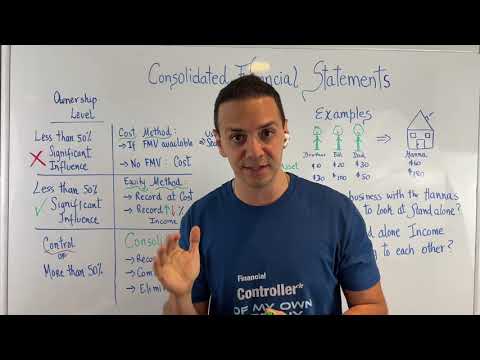

How (& When) To Consolidate Financial Statements

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 3) - IFRS 10

FR/AFR - December 2023 QN4: Cash Flow Statement (IAS 7) | CPA Exam Preparation

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 4) - IFRS 10

ACCA F7-FR - Financial Reporting - Chapter 17 - Consolidated Statement of Financial Position(Part 1)

Consolidated Statement of Financial Position| ACCA F7 / F3 | FR | CA | CPA | Commerce Specialist

Group Accounts The Consolidated Statement of Financial Position (1a) - ACCA (FA) lectures

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 6)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION -STEP BY STEP |FINAL EXAM FEB 2022|FAR320

Consolidated Financial Statements | Group Accounts | Basic Consolidation Concepts | IFRS 10 | IFRS 3

ACCA F3/FIA - Chapter 21 - Consolidation of Financial Position (Part 1)

#1 Consolidated Financial Statements (Holding Company) - Basic Concepts - CA INTER -By Saheb Academy

How to EASILY prepare a Consolidated Statement of Financial Position | ACCA FR | Question Runner

CONSOLIDATED STATEMENT OF PROFIT OR LOSS (PART 1)

Example: How To Consolidate

Intra-Group Trading | Consolidated Statement of Financial Position Examples |Wholly-owned subsidiary

ACCA P2 Basic group structure - Consolidated statement of financial position

Group consolidation subsidiary and associates

Комментарии

0:45:21

0:45:21

0:20:08

0:20:08

0:38:19

0:38:19

0:10:01

0:10:01

0:57:36

0:57:36

0:10:29

0:10:29

0:15:05

0:15:05

0:29:36

0:29:36

1:06:53

1:06:53

1:00:07

1:00:07

0:34:01

0:34:01

0:22:14

0:22:14

0:20:25

0:20:25

0:42:34

0:42:34

0:30:26

0:30:26

0:37:07

0:37:07

1:16:46

1:16:46

0:25:51

0:25:51

0:39:50

0:39:50

0:10:47

0:10:47

0:23:21

0:23:21

0:34:57

0:34:57

1:04:28

1:04:28