filmov

tv

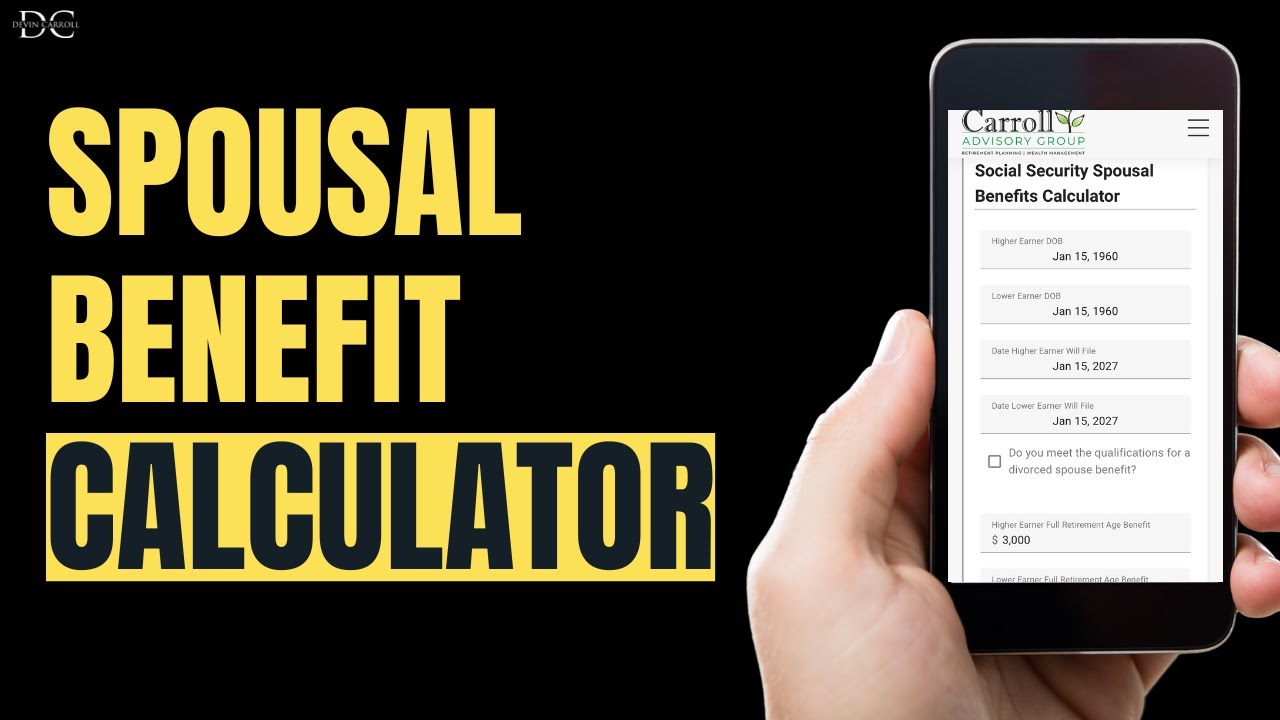

The Social Security Spousal Benefits Calculator (One-of-a-Kind)

Показать описание

Today, I'm going to show you a tool I made that helps you understand Social Security benefits for spouses. It's unique and easy to use, especially since figuring out these benefits can be confusing. Let's clear up that confusion together.

📜 HEAR YE HEAR YE: Some of my videos contain links to third party products, apps, and services. If you click through, I may receive a small referral fee to my media company (Carroll Media Properties) through their referral program. Rest assured, I only recommend products or services that I believe will be helpful and informative to my audience.

⭐⚠️⭐Please read this⭐⚠️⭐

⚠️I am not an attorney, SSDI advocate, or affiliated with the Social Security Administration or any other entity of the US Federal Government. I am a practicing financial planner, but I’m not YOUR financial planner and since I don’t really know you, I can’t give you advice. So please don’t take this video as specific advice for your specific situation. Consult your own tax, legal and financial advisors. 🙇🙇🙇🙇🙇

-----------------------------------------------------------------------------------------------------

📜 HEAR YE HEAR YE: Some of my videos contain links to third party products, apps, and services. If you click through, I may receive a small referral fee to my media company (Carroll Media Properties) through their referral program. Rest assured, I only recommend products or services that I believe will be helpful and informative to my audience.

⭐⚠️⭐Please read this⭐⚠️⭐

⚠️I am not an attorney, SSDI advocate, or affiliated with the Social Security Administration or any other entity of the US Federal Government. I am a practicing financial planner, but I’m not YOUR financial planner and since I don’t really know you, I can’t give you advice. So please don’t take this video as specific advice for your specific situation. Consult your own tax, legal and financial advisors. 🙇🙇🙇🙇🙇

-----------------------------------------------------------------------------------------------------

Комментарии

0:07:23

0:07:23

0:02:02

0:02:02

0:08:14

0:08:14

0:05:42

0:05:42

0:17:30

0:17:30

0:13:10

0:13:10

0:20:43

0:20:43

0:19:16

0:19:16

0:45:03

0:45:03

0:10:46

0:10:46

0:07:09

0:07:09

0:14:35

0:14:35

0:03:54

0:03:54

0:07:04

0:07:04

0:08:00

0:08:00

0:08:36

0:08:36

0:04:36

0:04:36

0:12:15

0:12:15

0:21:23

0:21:23

0:22:40

0:22:40

0:05:04

0:05:04

0:06:28

0:06:28

0:11:07

0:11:07

0:09:30

0:09:30