filmov

tv

Capital Cost Comparison: Present Worth Analysis

Показать описание

Compares the cost of two equipment options using the concept of present worth. Made by faculty at the University of Colorado Boulder Department of Chemical and Biological Engineering.

Check out our Process Design playlist at

Check out our Process Design playlist at

Capital Cost Comparison: Present Worth Analysis

Present Worth Method for Mutually Exclusive Alternatives - Engineering Economics Lightboard

Present Worth and Annual Worth Explained Engineering Economics Live Class Recording

Ch.5 PW analysis | part (1) - present worth analysis

EngEcon Ch5 - Present Worth

Capitalized Cost Explained

Capital Cost Comparison: Capitalized Cost Analysis

Present Worth Analysis for evaluating alternatives - Engineering Economy

Present Worth - Fundamentals of Engineering Economics

Net Present Value (NPV) explained

Present worth method

Present Worth Analysis

Present Worth Analysis Calculations Applying Cashflow Diagram Table and MS Excel Functions

Present Worth Using Repeated Lives - Live Class Recording

VTU ECONOMY PRESENT WORTH COMPARISONS ( DIFFERENT PROBLEMS)

🔴 3 Minutes! Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

Present Worth Analysis Ch5 Part I

128 L7 P4 - Present Worth and Future Worth Methods

Present Value Analysis - How to accommodate different analysis periods?

Ch 4 problem 4 Capitalized Cost Analysis PW for infinity project

Engineering Economics: clip#1 Present Worth Analysis

Capitalized Costs in Engineering Economics

Mang & Eco : Introduction to different comparison method I Present Worth Comparison Method

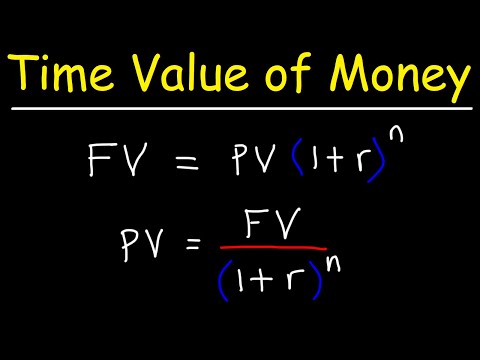

Time Value of Money - Present Value vs Future Value

Комментарии

0:07:37

0:07:37

0:08:40

0:08:40

0:24:26

0:24:26

0:33:51

0:33:51

1:37:57

1:37:57

0:04:37

0:04:37

0:07:40

0:07:40

0:27:04

0:27:04

0:12:22

0:12:22

0:05:26

0:05:26

0:39:23

0:39:23

0:24:39

0:24:39

0:05:11

0:05:11

0:23:26

0:23:26

0:22:45

0:22:45

0:02:16

0:02:16

0:21:13

0:21:13

0:11:24

0:11:24

0:08:17

0:08:17

0:13:08

0:13:08

0:05:14

0:05:14

0:19:16

0:19:16

0:36:22

0:36:22

0:05:14

0:05:14