filmov

tv

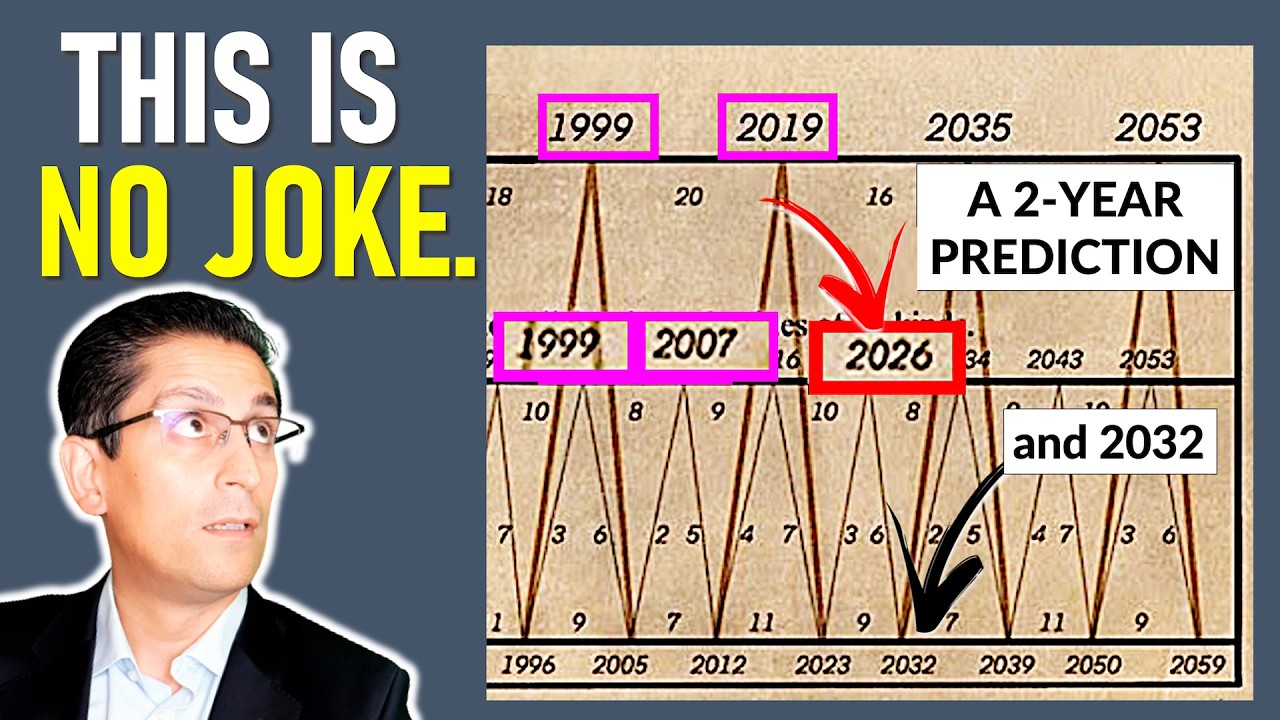

This UNBELIEVABLE Market Cycle is About to Repeat (it was predicted 150 years ago)

Показать описание

This unbelievable market cycle is about to repeat (it was predicted 150 years ago). The stock market seems to repeat a very interesting and powerful pattern every few years. This is called the Benner cycle which was devised by Samuel Benner nearly 150 years ago in 1875. But what could this predict for the stock market in the next few years and possibly the next decade? Is it bullish for the stock market or the opposite? We discuss with analyst Robert Prechter. #stockmarket #sp500 #alessiorastani

For Bob Prechter’s special offer and discount:

For our membership (including the 3 months extra offer):

For more visit:

Follow Alessio Rastani:

Watch more Alessio Rastani:

DISCLAIMER and RISK WARNING:

Trading has large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. We are neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational purposes. Nothing in this channel, videos and the information provided in it should be construed as a recommendation to buy or sell stocks, ETFs, futures, indices, forex, cryptocurrencies, commodities or any market. The past performance of any trading system or methodology is not necessarily indicative of future results. Current analysis can change due to future market events. Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated, therefore anyone considering it should be prepared to lose their entire investment.

For Bob Prechter’s special offer and discount:

For our membership (including the 3 months extra offer):

For more visit:

Follow Alessio Rastani:

Watch more Alessio Rastani:

DISCLAIMER and RISK WARNING:

Trading has large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. We are neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational purposes. Nothing in this channel, videos and the information provided in it should be construed as a recommendation to buy or sell stocks, ETFs, futures, indices, forex, cryptocurrencies, commodities or any market. The past performance of any trading system or methodology is not necessarily indicative of future results. Current analysis can change due to future market events. Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated, therefore anyone considering it should be prepared to lose their entire investment.

Комментарии

0:14:28

0:14:28

0:13:45

0:13:45

0:41:43

0:41:43

0:11:09

0:11:09

0:45:48

0:45:48

0:42:04

0:42:04

0:09:32

0:09:32

0:00:15

0:00:15

0:00:30

0:00:30

0:00:18

0:00:18

0:09:55

0:09:55

0:00:14

0:00:14

0:00:59

0:00:59

0:00:15

0:00:15

0:00:12

0:00:12

0:00:25

0:00:25

0:00:26

0:00:26

0:00:17

0:00:17

0:00:14

0:00:14

0:00:15

0:00:15

0:55:59

0:55:59

0:24:36

0:24:36

0:00:16

0:00:16

0:00:39

0:00:39