filmov

tv

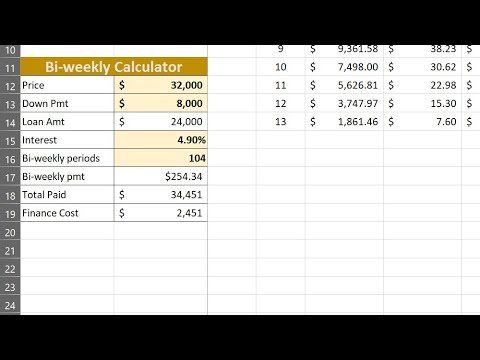

Bi-Weekly Payments 101

Показать описание

Does paying your car loan bi-weekly save you money? Watch Car Buying 101's Lawrence Alexander show you how to save thousands and how to shorten the time it takes to payoff your vehicle!

Bi-Weekly Payments 101

Calculate a Car Loan with Bi-weekly Payments Instead of Monthly

Should You Pay Your Mortgage Weekly or Monthly

The PERFECT Budget For Bi Weekly Pay! #budget #personalfinance

Biweekly Mortgage Payments vs. Monthly: Which Gets You Mortgage Free Faster?

Pros and Cons of a Bi-weekly Mortgage Payment | Is this for you?

Biweekly Mortgage Payments - How Much Will You ACTUALLY Save?

Bi-weekly mortgage payments

FY26 I Value: Hampton Budget 101 – Understanding Hampton’s Budget

Bi-weekly payment on Mortgage

Biweekly Payments, Meaning, & How to Calculate | Monthly VS. Biweekly For Car Financing

Bi-weekly Mortgage Payment?

What are Bi-weekly Mortgage Payments?

Biweekly mortgage payments are a SCAM!!

Understanding Bi-Weekly Payments

Mortgage 101 Bi Weekly Payments

How Principal & Interest Are Applied In Loan Payments | Explained With Example

How to Set Up Biweekly Payments

The difference between monthly vs. bi-weekly payments on your mortgage

Statement closing date vs. balance due date on your credit card bill! #creditcard #money #debt

bi weekly car payments - explainer

Exposed: Bi-Weekly Mortgage Payment Strategy

Accelerated Bi-weekly payments

How many paychecks is [twice per month] vs [every two weeks]

Комментарии

0:02:56

0:02:56

0:06:08

0:06:08

0:00:38

0:00:38

0:00:26

0:00:26

0:09:30

0:09:30

0:04:56

0:04:56

0:05:40

0:05:40

0:00:58

0:00:58

1:07:40

1:07:40

0:00:18

0:00:18

0:06:29

0:06:29

0:00:43

0:00:43

0:00:58

0:00:58

0:00:58

0:00:58

0:00:16

0:00:16

0:00:29

0:00:29

0:03:49

0:03:49

0:00:59

0:00:59

0:03:30

0:03:30

0:00:58

0:00:58

0:02:05

0:02:05

0:05:31

0:05:31

0:01:33

0:01:33

0:00:22

0:00:22