filmov

tv

Management & Cost Accounting: Strategy & The Master Budget - L11- Professor Noel Cooperberg

Показать описание

Management & Cost Accounting

Lecture 11: Strategy & The Master Budget (Part 1)

(Chapter 10)

Professor Noel Cooperberg

The learning of this lecture include the role of budgets in the management process. The budgeting process involves preparing a master budget and its supporting schedules and dealing with uncertainty in the budgeting process. Other learning objectives include understanding the budgeting process in service companies, alternative approaches to budgeting, and behavioral considerations in budgeting.

Video Begins with Overview of Strategy and Master Budget:

Overview of Learning Objectives: 3:27

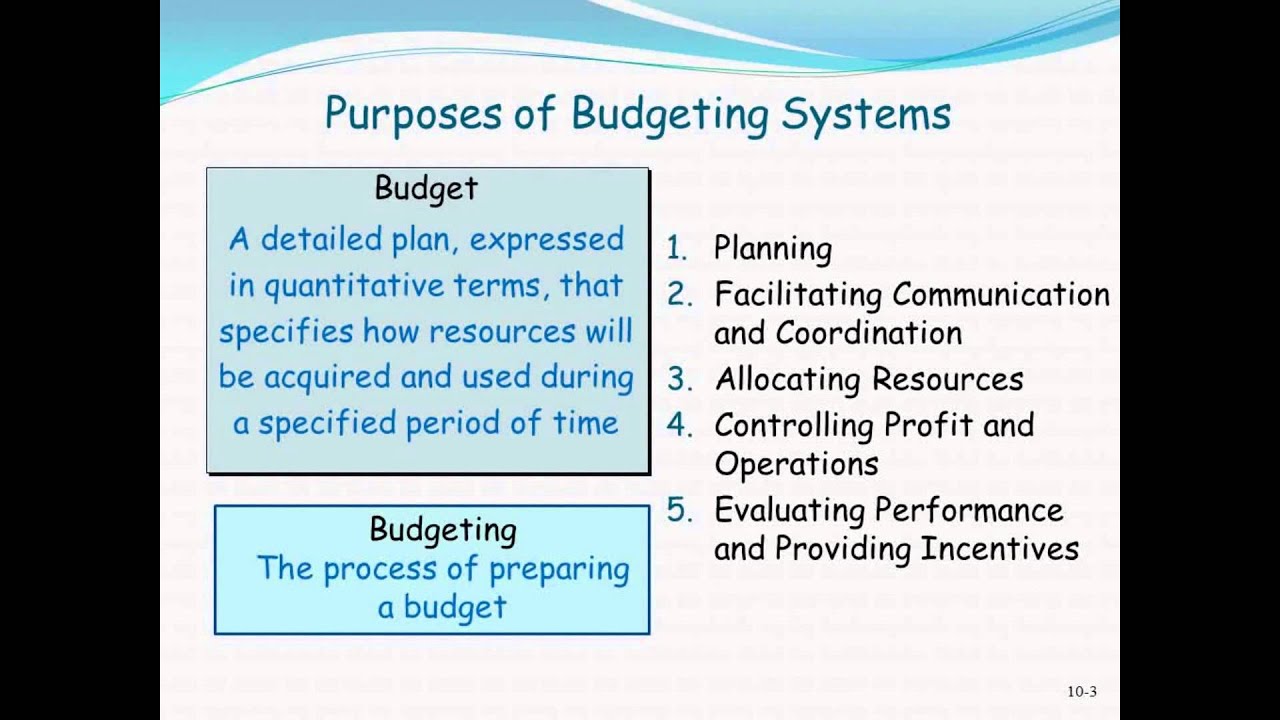

Purposes of Budgeting Systems: 4:18

Strategic Goals: 6:16

Budgets and Strategy: 6:56

Types of Budgets: 8:03

The Master Budget: 9:41

A budget is a detailed plan, expressed in quantitative terms, that specifies how resources will be acquired and used during a specified period of time. It involves planning, facilitating communication and coordination, allocating resources, controlling profit and operations, and evaluating performance and providing incentives.

Budgeting originates from the organization's strategy. A strategy usually includes long-range plans defining actions over a 5 to 10 year period. Strategic goals and long-term objectives are reflected in a capital budget and master budget. Strategic budget expenditures are those that will lead to long-term value and competitive advantage.

The master budget reflects the grand plan of action that the company plans to take. It translates short-term objectives into action steps. It culminates in the preparation of pro-forma financial statements, communicates to employees and managers the expectations from top management, and helps coordinate sub-unit activities.

The master budget is comprised of operating budgets (plans that identify resources needed to carry out the budgeted activities, including production, purchasing, personnel and marketing budgets, and a budgeted income statement) and financial budgets (plans that identify sources and uses of funds for the budgeted operations, including a cash budget, budgeted statement of cash flows, the budgeted balance sheet, and the capital expenditures budget).

The budget committee is the highest authority related to the budget. The budget period is generally a fiscal year with sub budgets prepared for quarters or months. A continuous (rolling) budget is set for a number of months, quarters, or years at all times (as one period ends, another is added). Budgeting normally begins at the responsibility center and is rolled up to the corporate level. Multiple iterations are required to reach agreement, often requirement 2-3 months to complete.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

Lecture 11: Strategy & The Master Budget (Part 1)

(Chapter 10)

Professor Noel Cooperberg

The learning of this lecture include the role of budgets in the management process. The budgeting process involves preparing a master budget and its supporting schedules and dealing with uncertainty in the budgeting process. Other learning objectives include understanding the budgeting process in service companies, alternative approaches to budgeting, and behavioral considerations in budgeting.

Video Begins with Overview of Strategy and Master Budget:

Overview of Learning Objectives: 3:27

Purposes of Budgeting Systems: 4:18

Strategic Goals: 6:16

Budgets and Strategy: 6:56

Types of Budgets: 8:03

The Master Budget: 9:41

A budget is a detailed plan, expressed in quantitative terms, that specifies how resources will be acquired and used during a specified period of time. It involves planning, facilitating communication and coordination, allocating resources, controlling profit and operations, and evaluating performance and providing incentives.

Budgeting originates from the organization's strategy. A strategy usually includes long-range plans defining actions over a 5 to 10 year period. Strategic goals and long-term objectives are reflected in a capital budget and master budget. Strategic budget expenditures are those that will lead to long-term value and competitive advantage.

The master budget reflects the grand plan of action that the company plans to take. It translates short-term objectives into action steps. It culminates in the preparation of pro-forma financial statements, communicates to employees and managers the expectations from top management, and helps coordinate sub-unit activities.

The master budget is comprised of operating budgets (plans that identify resources needed to carry out the budgeted activities, including production, purchasing, personnel and marketing budgets, and a budgeted income statement) and financial budgets (plans that identify sources and uses of funds for the budgeted operations, including a cash budget, budgeted statement of cash flows, the budgeted balance sheet, and the capital expenditures budget).

The budget committee is the highest authority related to the budget. The budget period is generally a fiscal year with sub budgets prepared for quarters or months. A continuous (rolling) budget is set for a number of months, quarters, or years at all times (as one period ends, another is added). Budgeting normally begins at the responsibility center and is rolled up to the corporate level. Multiple iterations are required to reach agreement, often requirement 2-3 months to complete.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

0:06:33

0:06:33

0:04:02

0:04:02

0:07:10

0:07:10

0:58:11

0:58:11

0:13:10

0:13:10

0:40:09

0:40:09

0:01:40

0:01:40

![[Strategic Cost Management]](https://i.ytimg.com/vi/9mQFoKhYNzA/hqdefault.jpg) 1:13:22

1:13:22

0:00:48

0:00:48

0:21:29

0:21:29

0:15:14

0:15:14

0:38:25

0:38:25

0:58:02

0:58:02

0:05:17

0:05:17

1:23:05

1:23:05

0:52:56

0:52:56

1:23:47

1:23:47

0:18:14

0:18:14

0:07:51

0:07:51

0:00:36

0:00:36

0:00:56

0:00:56

0:03:03

0:03:03

0:00:37

0:00:37

0:00:53

0:00:53