filmov

tv

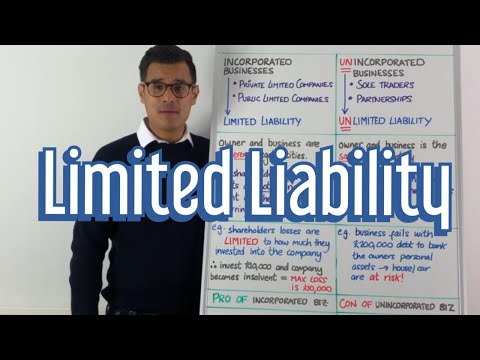

What Is A Limited Liability Partnership / LLP?

Показать описание

Operating your business as Limited Liability Partnership, also known as a LLP, can bring many benefits including greater privacy, agility and protection of your personal assets. In this video we'll go over the key elements of a LLP as well as the 5 key attractions to operating as one. We've also included a free download to help you decide if your business is better suited as a Limited Company or a Limited Liability Partnership.

Accounting & Tax Academy Free Membership Site →

Time Stamps:

0:49 - What is a limited liability partnership?

3:10 - How is a LLP taxed?

4:10 - 5 key attractions to using a LLP over a LTD company

5:47 - Which is right for your business, LLP or LTD?

Put simply, a Limited Liability Partnership is a hybrid between a limited company and a traditional partnership. It's proven very popular among accountancy firms, legal firms and other businesses where there are a small amount of partners, however, as long as there are at least 2 partners and you meet the required conditions, any business is able to operate as a LLP.

The 5 key attractions of a LLP are:

1) Protection from negligence and misconduct from other partners.

2) Another corporate entity can become a partner of a LLP, for example an existing limited company. If done correctly this can provide some attractive tax benefits.

3) Unlike a limited company, members can easily be added to an LLP, allowing you more agility than the traditional shareholder route.

4) There is no taxable benefit in kind charge on members of a LLP, the profits from the LLP are split between the members and then declared on their self assessment tax returns.

5) The list of members of a LLP are not held on public domain in the same way a limited companies' are at companies house, granting members of a limited liability partnership greater privacy.

If you're considering becoming a LLP but can't decide whether your business would be better suited as a limited company, head to our website and download our free decision tool to help you make a more informed decision.

We hope this video has helped you understand some of the basics of LLPs and taken you one step closer to knowing your numbers. Happy New Year from all of us here at The Accounting & Tax Academy.

★☆★ OUR MISSION ★☆★

Me & my team are dedicated to helping and empowering YOU to 'Know Your Numbers' so you can make calculated and informed decisions in your business, company and personal finances towards your definition of success.

★☆★ OUR PHILOSOPHY ★☆★

If you take care of your numbers (finances), your numbers will take care of you, your family and those you value the most.

🔴 DISCLAIMER

Our videos are for general guidance, education and empowerment in helping you understand accounting, tax and your numbers. They in no way constitute specific advice to your specific circumstances. Me & my team would be delighted to help you with your specific queries or accounting requirements through a formal engagement.

#LLP #limitedliabilitypartnership

Accounting & Tax Academy Free Membership Site →

Time Stamps:

0:49 - What is a limited liability partnership?

3:10 - How is a LLP taxed?

4:10 - 5 key attractions to using a LLP over a LTD company

5:47 - Which is right for your business, LLP or LTD?

Put simply, a Limited Liability Partnership is a hybrid between a limited company and a traditional partnership. It's proven very popular among accountancy firms, legal firms and other businesses where there are a small amount of partners, however, as long as there are at least 2 partners and you meet the required conditions, any business is able to operate as a LLP.

The 5 key attractions of a LLP are:

1) Protection from negligence and misconduct from other partners.

2) Another corporate entity can become a partner of a LLP, for example an existing limited company. If done correctly this can provide some attractive tax benefits.

3) Unlike a limited company, members can easily be added to an LLP, allowing you more agility than the traditional shareholder route.

4) There is no taxable benefit in kind charge on members of a LLP, the profits from the LLP are split between the members and then declared on their self assessment tax returns.

5) The list of members of a LLP are not held on public domain in the same way a limited companies' are at companies house, granting members of a limited liability partnership greater privacy.

If you're considering becoming a LLP but can't decide whether your business would be better suited as a limited company, head to our website and download our free decision tool to help you make a more informed decision.

We hope this video has helped you understand some of the basics of LLPs and taken you one step closer to knowing your numbers. Happy New Year from all of us here at The Accounting & Tax Academy.

★☆★ OUR MISSION ★☆★

Me & my team are dedicated to helping and empowering YOU to 'Know Your Numbers' so you can make calculated and informed decisions in your business, company and personal finances towards your definition of success.

★☆★ OUR PHILOSOPHY ★☆★

If you take care of your numbers (finances), your numbers will take care of you, your family and those you value the most.

🔴 DISCLAIMER

Our videos are for general guidance, education and empowerment in helping you understand accounting, tax and your numbers. They in no way constitute specific advice to your specific circumstances. Me & my team would be delighted to help you with your specific queries or accounting requirements through a formal engagement.

#LLP #limitedliabilitypartnership

Комментарии

0:03:12

0:03:12

0:03:22

0:03:22

0:07:29

0:07:29

0:03:27

0:03:27

0:02:19

0:02:19

0:04:30

0:04:30

0:07:02

0:07:02

0:09:58

0:09:58

0:01:01

0:01:01

0:01:41

0:01:41

0:01:23

0:01:23

0:02:00

0:02:00

0:04:48

0:04:48

0:10:43

0:10:43

0:04:20

0:04:20

0:04:13

0:04:13

0:15:47

0:15:47

0:07:42

0:07:42

0:03:50

0:03:50

0:09:01

0:09:01

0:14:15

0:14:15

0:11:50

0:11:50

0:09:43

0:09:43

0:01:27

0:01:27