filmov

tv

How to Calculate Long Term Capital Gain Tax for Mutual Funds ? | Grandfathering rule Explained

Показать описание

How to calculate LTCG Tax for Mutual Fund Schemes under various scenarios?

Grandfather provision means – a grandfather clause / grandfather policy / grandfathering is a provision in which an old rule continues to apply to some existing situations while a new rule will apply to all future cases. Those exempt from the new rule are said to have grandfather rights or acquired rights, or to have been grandfathered in.

#ltcg #longtermcapitalgaintax

#mutualfunds #mutualfund #mutualfunddistributor #mutualfundsindia #mutualfundforbeginners

#tax #capitalgains #capitalgainstax #capitalgaintax #indiantax #mutualfundreturns

#taxonmutualfunds #longtermcapitalgains #mutualfundsahihai #grandfatherrule

Grandfather provision means – a grandfather clause / grandfather policy / grandfathering is a provision in which an old rule continues to apply to some existing situations while a new rule will apply to all future cases. Those exempt from the new rule are said to have grandfather rights or acquired rights, or to have been grandfathered in.

#ltcg #longtermcapitalgaintax

#mutualfunds #mutualfund #mutualfunddistributor #mutualfundsindia #mutualfundforbeginners

#tax #capitalgains #capitalgainstax #capitalgaintax #indiantax #mutualfundreturns

#taxonmutualfunds #longtermcapitalgains #mutualfundsahihai #grandfatherrule

Long Term Capital Gains Tax Explained For Beginners

Tips On How To Calculate & Reach Your Long-Term Saving Targets | Money Mind | Savings

Capital Gains Tax Explained 2021 (In Under 3 Minutes)

How to Calculate Capital Gains Tax, Indexed Cost of Acquisition

How to Calculate Short Term & Long-Term Capital Gain | Canara HSBC OBC Life Insurance

Warren Buffett Explains How To Calculate Intrinsic Value Of A Stock

How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]

How do I calculate capital gains resulting from the sale of land?

How to Analyze a Rental Property (No Calculators or Spreadsheets Needed!)

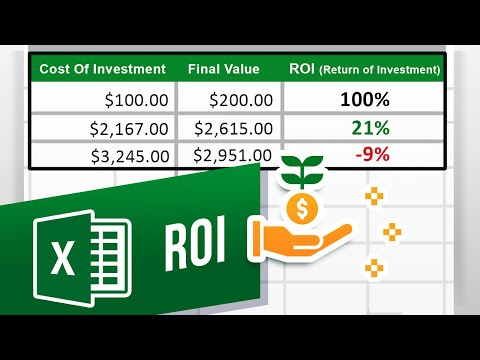

How to Calculate ROI (Return on Investment)

What Is Grandfathering Concept In Long Term Capital Gains Tax Explained By CA Rachana

How To Calculate Your Mortgage Payment

How to Calculate Tax on Long Term Capital Gain | Tax on House Property, Shares and Mutual Funds

How to Calculate Long Term Capital Gain Tax on Equity/Mutual Funds

Math Antics - Long Division with 2-Digit Divisors

Investment for beginners | Calculate investments | long term investing |

Mutual Fund Taxation | STCG Tax and LTCG Tax On Mutual Funds | Mutual Fund Tax Calculator

Long Term Capital Gain On Equity Mutual Fund - How to Calculate | Capital Gains tax on mutual fund

How to Calculate Long Term Capital Gain Tax for Mutual Funds ? | Grandfathering rule Explained

How To Calculate Capital Gains on Mutual Funds SIP | Mutual Funds Taxation | Nishant Gupta

How to divide big numbers | Division tricks for large numbers | Zero Math

How To Calculate Capital Gain Tax on SIP in Mutual Funds ?

Economies of Scale and Long-Run Costs- Micro Topic 3.3

How To Calculate Long Term Capital Gains Tax

Комментарии

0:10:58

0:10:58

0:09:14

0:09:14

0:02:23

0:02:23

0:06:55

0:06:55

0:02:05

0:02:05

0:08:56

0:08:56

0:11:27

0:11:27

0:12:14

0:12:14

0:35:11

0:35:11

0:01:53

0:01:53

0:11:34

0:11:34

0:05:10

0:05:10

0:09:11

0:09:11

0:08:26

0:08:26

0:13:05

0:13:05

0:09:28

0:09:28

0:11:52

0:11:52

0:05:44

0:05:44

0:11:39

0:11:39

0:07:03

0:07:03

0:07:49

0:07:49

0:02:32

0:02:32

0:03:55

0:03:55

0:05:07

0:05:07