filmov

tv

Accounting Rate of return | Accounting Rate of Return (ARR) Made Easy with Example |

Показать описание

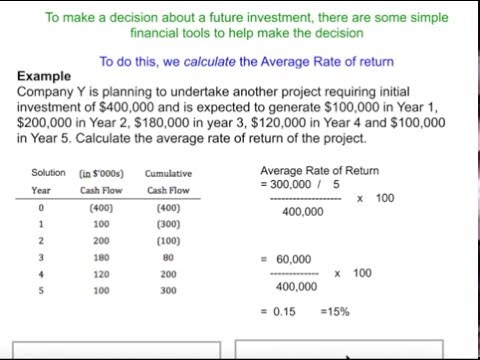

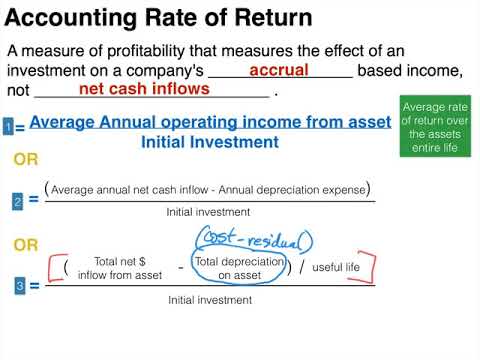

The Accounting Rate of Return (ARR) is a financial ratio used to measure the profitability of an investment, based on the accounting information rather than cash flows. ARR calculates the return expected on an investment by comparing the average annual profit to the initial or average investment cost.

Formula for ARR:

ARR

=

(

Average Annual Profit

Initial or Average Investment

)

×

100

ARR=(

Initial or Average Investment

Average Annual Profit

)×100

Key Points:

Average Annual Profit: This is the average profit earned by the project over its lifespan, calculated by summing the profits for all years and dividing by the number of years.

Initial or Average Investment: This refers to the capital invested in the project. If the investment depreciates or has a salvage value, the average investment is considered.

Example:

Let’s say a company invests ₹1,000,000 in a project expected to generate the following annual profits for 4 years:

Year 1: ₹200,000

Year 2: ₹250,000

Year 3: ₹300,000

Year 4: ₹350,000

Step 1: Calculate Total Profit:

₹200,000 + ₹250,000 + ₹300,000 + ₹350,000 = ₹1,100,000

Step 2: Calculate Average Annual Profit:

₹1,100,000 / 4 = ₹275,000

Step 3: Assuming the initial investment is ₹1,000,000 and no residual value, the ARR is calculated as:

ARR

=

(

₹

275

,

000

₹

1

,

000

,

000

)

×

100

=

27.5

%

ARR=(

₹1,000,000

₹275,000

)×100=27.5%

Benefits:

Simplicity: Easy to calculate and understand.

Focus on Profit: Relies on accounting profit, making it useful for businesses that prioritize net income.

Limitations:

Ignores Time Value of Money: ARR doesn’t account for the time value of money, unlike discounted cash flow methods.

Based on Accounting Profit: Since it uses profit figures from financial statements, it can be affected by non-cash items like depreciation.

Accounting Rate of Return (ARR) Explained | How to Calculate ARR with Examples

In this video, we break down the concept of Accounting Rate of Return (ARR)—a simple yet effective tool for evaluating the profitability of an investment. Learn how to calculate ARR step-by-step using real-world examples, and understand its importance in financial decision-making.

🔍 What you'll learn:

What is ARR and why it's important.

How to calculate ARR using the formula.

Practical examples of ARR in action.

Pros and cons of using ARR in investment analysis.

Whether you're a student, entrepreneur, or finance enthusiast, this video will help you grasp the fundamentals of ARR and how it fits into broader investment strategies.

📊 Example Included: Investment: ₹1,000,000

Annual Profits (over 4 years): ₹200,000 to ₹350,000

💡 Subscribe for more finance tips and tutorials!

#AccountingRateOfReturn #ARR #InvestmentAnalysis #FinancialManagement #ProfitabilityRatios #investmentreturns

accounting rate of return formula,accounting rate of return,accounting rate of return method,accounting rate of return explained,average accounting rate of return,internal rate of return,accounting rate of return with depreciation,accounting rate of return example,rate of return,accounting,average rate of return,advantages and disadvantages of the accounting rate of return,how to calculate accounting rate of return example,management accounting,perfectcommercecoaching

Formula for ARR:

ARR

=

(

Average Annual Profit

Initial or Average Investment

)

×

100

ARR=(

Initial or Average Investment

Average Annual Profit

)×100

Key Points:

Average Annual Profit: This is the average profit earned by the project over its lifespan, calculated by summing the profits for all years and dividing by the number of years.

Initial or Average Investment: This refers to the capital invested in the project. If the investment depreciates or has a salvage value, the average investment is considered.

Example:

Let’s say a company invests ₹1,000,000 in a project expected to generate the following annual profits for 4 years:

Year 1: ₹200,000

Year 2: ₹250,000

Year 3: ₹300,000

Year 4: ₹350,000

Step 1: Calculate Total Profit:

₹200,000 + ₹250,000 + ₹300,000 + ₹350,000 = ₹1,100,000

Step 2: Calculate Average Annual Profit:

₹1,100,000 / 4 = ₹275,000

Step 3: Assuming the initial investment is ₹1,000,000 and no residual value, the ARR is calculated as:

ARR

=

(

₹

275

,

000

₹

1

,

000

,

000

)

×

100

=

27.5

%

ARR=(

₹1,000,000

₹275,000

)×100=27.5%

Benefits:

Simplicity: Easy to calculate and understand.

Focus on Profit: Relies on accounting profit, making it useful for businesses that prioritize net income.

Limitations:

Ignores Time Value of Money: ARR doesn’t account for the time value of money, unlike discounted cash flow methods.

Based on Accounting Profit: Since it uses profit figures from financial statements, it can be affected by non-cash items like depreciation.

Accounting Rate of Return (ARR) Explained | How to Calculate ARR with Examples

In this video, we break down the concept of Accounting Rate of Return (ARR)—a simple yet effective tool for evaluating the profitability of an investment. Learn how to calculate ARR step-by-step using real-world examples, and understand its importance in financial decision-making.

🔍 What you'll learn:

What is ARR and why it's important.

How to calculate ARR using the formula.

Practical examples of ARR in action.

Pros and cons of using ARR in investment analysis.

Whether you're a student, entrepreneur, or finance enthusiast, this video will help you grasp the fundamentals of ARR and how it fits into broader investment strategies.

📊 Example Included: Investment: ₹1,000,000

Annual Profits (over 4 years): ₹200,000 to ₹350,000

💡 Subscribe for more finance tips and tutorials!

#AccountingRateOfReturn #ARR #InvestmentAnalysis #FinancialManagement #ProfitabilityRatios #investmentreturns

accounting rate of return formula,accounting rate of return,accounting rate of return method,accounting rate of return explained,average accounting rate of return,internal rate of return,accounting rate of return with depreciation,accounting rate of return example,rate of return,accounting,average rate of return,advantages and disadvantages of the accounting rate of return,how to calculate accounting rate of return example,management accounting,perfectcommercecoaching

0:03:38

0:03:38

0:10:18

0:10:18

0:15:54

0:15:54

0:07:47

0:07:47

0:04:20

0:04:20

0:02:29

0:02:29

0:13:56

0:13:56

0:05:30

0:05:30

0:06:44

0:06:44

0:05:07

0:05:07

0:11:59

0:11:59

0:33:30

0:33:30

0:17:37

0:17:37

0:04:34

0:04:34

0:05:07

0:05:07

0:07:36

0:07:36

0:08:44

0:08:44

0:04:29

0:04:29

0:17:50

0:17:50

0:02:50

0:02:50

0:05:56

0:05:56

0:08:29

0:08:29

0:00:59

0:00:59

0:13:51

0:13:51