filmov

tv

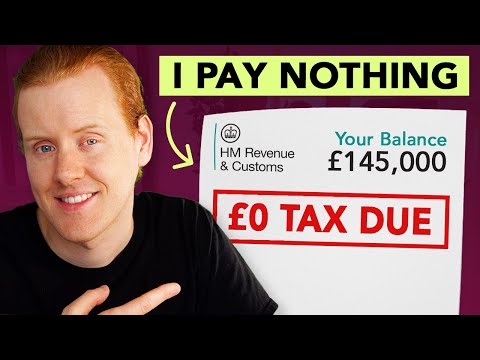

How TAX on Your Gold & Silver 'Profits' Could RUIN Your Investment Return? Reduce Your Exposure NOW!

Показать описание

#gold #silver #inflation

Are taxes eating away at your gold and silver profits? Many investors overlook the significant impact that taxation can have on their returns, potentially ruining an otherwise solid investment strategy. In this eye-opening video, we explore how taxes on gold and silver can erode your gains and, more importantly, what you can do to minimize your exposure.

Video Breakdown:

The Hidden Dangers of Taxation on Precious Metals

We kick off by explaining how taxation on gold and silver works and why it's a critical factor in determining your overall investment returns.

How Capital Gains Tax Could Slash Your Returns

Next, we dive into the specifics of capital gains tax on precious metals, including how gold and silver are taxed differently from other investments. We’ll show you real-world examples of how these taxes can significantly reduce your net returns, especially if you're not careful with your investment timing.

Strategies to Reduce Your Tax Exposure

Now that you’re aware of the risks, we focus on practical strategies to reduce your tax exposure. From holding periods to tax-advantaged accounts, we’ll guide you through actionable steps you can take to keep more of your hard-earned money.

Choosing the Right Investment Vehicle

Your choice of investment vehicle can have a big impact on your tax liability. We explore various options such as self-directed IRAs and ETFs, which can offer significant tax advantages. Learn how to structure your investments in a way that maximizes your returns while minimizing tax exposure.

Avoiding Common Tax Traps

In this section, we highlight common tax traps that investors fall into, like premature selling or ignoring tax-efficient accounts. We’ll give you tips on how to avoid these mistakes and safeguard your investment returns from unnecessary tax hits.

We conclude with a recap of the key strategies discussed in the video. By understanding and planning for the tax implications of your gold and silver investments, you can protect your returns and reduce your tax liability. Don’t let taxes ruin your investment strategy—take action now to secure your financial future!

Call to Action: If you found this video valuable, please give it a thumbs up and share it with other investors who could benefit from this knowledge! Drop a comment with your thoughts or any questions you have. Be sure to subscribe and hit the notification bell to stay updated on the latest investment tips and tax strategies!

#GoldTax #SilverTax #InvestmentReturns #TaxStrategies #PreciousMetals #WealthProtection

If you would like to support our channel please check out our shop page for all our hand poured silver.

Join the channel and show your support by becoming a BYB Rambling society member today!

or have a look at our website:

Stay safe, stay healthy all.

Thanks also to the channel sponsor The Silver Forum!

Topics covered in this video:

gold, silver, investing, money, silver stacking, gold investment, silver investment, precious metals, capital gains tax, wealth building, financial planning, gold coins, silver coins, bullion, gold bullion, silver bullion, investment strategy, wealth protection, tax-efficient investing, gold IRA, silver IRA, investment tips, financial security, gold bars, silver bars, precious metals investing, long-term investing, tax planning, wealth management, gold stacker, silver stacker

Are taxes eating away at your gold and silver profits? Many investors overlook the significant impact that taxation can have on their returns, potentially ruining an otherwise solid investment strategy. In this eye-opening video, we explore how taxes on gold and silver can erode your gains and, more importantly, what you can do to minimize your exposure.

Video Breakdown:

The Hidden Dangers of Taxation on Precious Metals

We kick off by explaining how taxation on gold and silver works and why it's a critical factor in determining your overall investment returns.

How Capital Gains Tax Could Slash Your Returns

Next, we dive into the specifics of capital gains tax on precious metals, including how gold and silver are taxed differently from other investments. We’ll show you real-world examples of how these taxes can significantly reduce your net returns, especially if you're not careful with your investment timing.

Strategies to Reduce Your Tax Exposure

Now that you’re aware of the risks, we focus on practical strategies to reduce your tax exposure. From holding periods to tax-advantaged accounts, we’ll guide you through actionable steps you can take to keep more of your hard-earned money.

Choosing the Right Investment Vehicle

Your choice of investment vehicle can have a big impact on your tax liability. We explore various options such as self-directed IRAs and ETFs, which can offer significant tax advantages. Learn how to structure your investments in a way that maximizes your returns while minimizing tax exposure.

Avoiding Common Tax Traps

In this section, we highlight common tax traps that investors fall into, like premature selling or ignoring tax-efficient accounts. We’ll give you tips on how to avoid these mistakes and safeguard your investment returns from unnecessary tax hits.

We conclude with a recap of the key strategies discussed in the video. By understanding and planning for the tax implications of your gold and silver investments, you can protect your returns and reduce your tax liability. Don’t let taxes ruin your investment strategy—take action now to secure your financial future!

Call to Action: If you found this video valuable, please give it a thumbs up and share it with other investors who could benefit from this knowledge! Drop a comment with your thoughts or any questions you have. Be sure to subscribe and hit the notification bell to stay updated on the latest investment tips and tax strategies!

#GoldTax #SilverTax #InvestmentReturns #TaxStrategies #PreciousMetals #WealthProtection

If you would like to support our channel please check out our shop page for all our hand poured silver.

Join the channel and show your support by becoming a BYB Rambling society member today!

or have a look at our website:

Stay safe, stay healthy all.

Thanks also to the channel sponsor The Silver Forum!

Topics covered in this video:

gold, silver, investing, money, silver stacking, gold investment, silver investment, precious metals, capital gains tax, wealth building, financial planning, gold coins, silver coins, bullion, gold bullion, silver bullion, investment strategy, wealth protection, tax-efficient investing, gold IRA, silver IRA, investment tips, financial security, gold bars, silver bars, precious metals investing, long-term investing, tax planning, wealth management, gold stacker, silver stacker

Комментарии

0:16:42

0:16:42

0:11:39

0:11:39

0:17:23

0:17:23

0:10:48

0:10:48

0:13:37

0:13:37

0:04:39

0:04:39

0:00:58

0:00:58

0:02:05

0:02:05

0:13:30

0:13:30

0:21:29

0:21:29

0:03:36

0:03:36

0:13:37

0:13:37

0:08:31

0:08:31

0:03:07

0:03:07

0:09:58

0:09:58

0:12:24

0:12:24

0:14:32

0:14:32

0:04:28

0:04:28

0:07:45

0:07:45

0:04:29

0:04:29

0:07:19

0:07:19

0:00:53

0:00:53

0:15:35

0:15:35

0:09:15

0:09:15