filmov

tv

How Joe Biden's tax plan could impact economic growth and markets

Показать описание

Garrett Watson, The Tax Foundation Senior Policy Analyst, joins The First Trade with Alexis Christoforous and Brian Sozzi to discuss how presidential candidate Joe Biden's tax plans could impact the markets and much more.

#JoeBiden #Bidentaxplan #2020election

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Connect with Yahoo Finance:

#JoeBiden #Bidentaxplan #2020election

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Connect with Yahoo Finance:

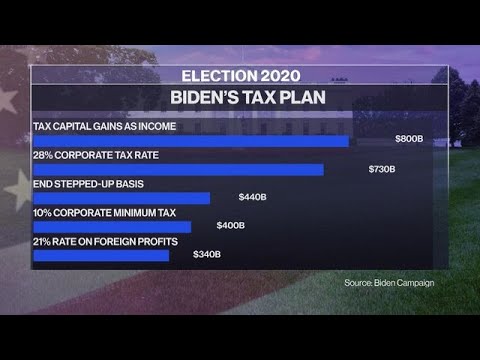

What Is in Joe Biden's Tax Plan?

How President Joe Biden's tax plan may impact U.S. companies and overseas profits

The $6T Gap Between Trump’s and Biden’s Tax Plans | WSJ

How Joe Biden's tax plan could impact economic growth and markets

Joe Biden's tax plan

Joe Biden tax plan defines wealthy at $400,000 per year or more—Is that the Goldilocks number?

Here's a break down of Democratic Candidate Joe Biden's tax plan

Joe Biden's 2025 Tax Proposal EXPLAINED

Here's how much Biden's tax plan could cost you

What to know about President Joe Biden's new death tax plan

It Started: My Thoughts On The Joe Biden Tax Plan

Biden’s Tax Plan Will Be Devastating For Democrats & The Economic Recovery - Steve Forbes | Forb...

Joe Biden's Tax Plan for Small Business Owners & Investors

How President Joe Biden's capital gains tax proposal may impact investors

My Response To Paying Higher Taxes | Joe Biden Tax Explained

Joe Biden’s New Tax Plan Explained

President Joe Biden's capital gains tax plan could backfire: 8VC founder Joe Lonsdale

Joe Biden pressed about his plan for tax cuts for the middle class at ABC town hall

Joe Biden's Tax Plan Explained

Democratic Candidate Joe Biden's tax plan would cost $4 trillion

Joe Biden’s Ambitious Tax Plan Faces Reality | WSJ

Joe Bidens Tax Plan: What It Means For Real Estate Investors

President Joe Biden's capital gains tax proposal will likely be watered down: Strategas' T...

Biden's budget plans to fund Medicare with tax hike targeting those making more than $400K

Комментарии

0:01:32

0:01:32

0:02:04

0:02:04

0:06:02

0:06:02

0:06:57

0:06:57

0:01:11

0:01:11

0:02:09

0:02:09

0:03:40

0:03:40

0:23:30

0:23:30

0:07:28

0:07:28

0:02:00

0:02:00

0:11:24

0:11:24

0:03:08

0:03:08

0:14:42

0:14:42

0:05:59

0:05:59

0:16:53

0:16:53

0:13:48

0:13:48

0:06:01

0:06:01

0:05:45

0:05:45

0:06:52

0:06:52

0:00:46

0:00:46

0:08:25

0:08:25

0:07:51

0:07:51

0:03:49

0:03:49

0:02:15

0:02:15