filmov

tv

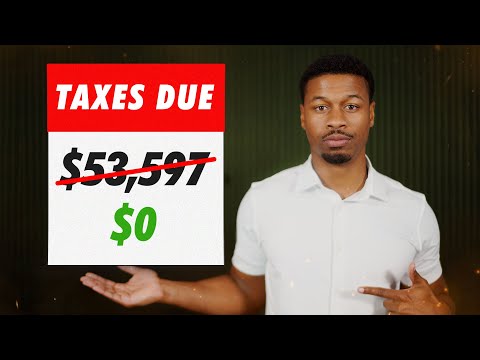

How to Avoid Paying Taxes on Settlement Money: 5 Essential Tips

Показать описание

This video explains 5 tips on how to avoid paying a huge tax bill on your legal settlement so you can maximize the amount that you will take home.

Chapters:

00:00 - Intro

01:07 - Legal Disclaimer

01:16 - Do I have to pay taxes on my settlement?

03:05 - Common types of tax-free settlements

04:34 - Tip #1: Use a Structured Settlement Annuity

05:15 - Structured Settlement Annuity Sample Settlement Payout

06:06 - Tip #2: Use the Plaintiff Recovery Trust

06:19 - The Tax Cuts and Jobs Act of 2017

06:35 - Case types that allow for an above-the-line deduction

06:58 - Examples of taxable cases

07:14 - Sample of the impact of The Tax Cuts and Jobs Act

08:10 - The Plaintiff Recovery Trust

08:42 - Tip #3: Use an Annuity and the Plaintiff Recovery Trust

10:19 - Tip #4: Maximize the Medical Expense Exclusion

10:46 - Cases where maximizing medical expense allocation applies

10:54 - Specific case examples

12:42 - Tip #5: Allocate All Damages in the Settlement Agreement

12:58 - Settlement Portion Allocation Example

14:16 - Conclusion

14:40 - Free 15-minute phone call for plaintiffs

15:22 - Settlement Tax Calculator

------------------------------------

YouTube Content:

------------------------------------

------------------------------------

Contact Amicus:

------------------------------------

Phone: (801) 683-5998

------------------------------------

Follow us on Social Media:

------------------------------------

------------------------------------

Blog Content:

------------------------------------

------------------------------------

Video Summary:

------------------------------------

In this video, Greg Maxwell, a practicing attorney and Certified Financial Planner, shares five legal tax-saving strategies for individuals receiving legal settlements. The IRS typically considers settlement money as taxable income unless proven otherwise. Taxation depends on the nature of the lawsuit and its origin. Settlements for personal, physical injuries are generally tax-free under Section 104(a)(2) of the Internal Revenue Code.

Here are the five key tax-saving strategies:

1. Use a Structured Settlement Annuity: This method involves receiving settlement funds in smaller installments over time, lowering the overall tax burden and potentially saving thousands in taxes.

2. Use the Plaintiff Recovery Trust: The Tax Cuts and Jobs Act of 2017 changed the deductibility of legal fees. Plaintiffs in certain cases can no longer deduct legal fees, resulting in higher taxes. The Plaintiff Recovery Trust helps avoid the "Plaintiff Double Tax Trap" by excluding attorney fees from taxable income.

3. Combine a Structured Settlement Annuity and the Plaintiff Recovery Trust: Combining these two strategies maximizes tax savings by spreading income over time and excluding legal fees.

4. Maximize the Medical Expense Exclusion: Even in cases not related to personal injuries, plaintiffs can allocate settlement funds to past and future medical expenses, reducing the overall tax liability.

5. Allocate All Damages in the Settlement Agreement: Plaintiffs can allocate specific amounts to tax-favored categories, such as personal, physical injuries, reimbursement for lost investments, or medical costs. Customized allocations can significantly reduce tax payments.

Chapters:

00:00 - Intro

01:07 - Legal Disclaimer

01:16 - Do I have to pay taxes on my settlement?

03:05 - Common types of tax-free settlements

04:34 - Tip #1: Use a Structured Settlement Annuity

05:15 - Structured Settlement Annuity Sample Settlement Payout

06:06 - Tip #2: Use the Plaintiff Recovery Trust

06:19 - The Tax Cuts and Jobs Act of 2017

06:35 - Case types that allow for an above-the-line deduction

06:58 - Examples of taxable cases

07:14 - Sample of the impact of The Tax Cuts and Jobs Act

08:10 - The Plaintiff Recovery Trust

08:42 - Tip #3: Use an Annuity and the Plaintiff Recovery Trust

10:19 - Tip #4: Maximize the Medical Expense Exclusion

10:46 - Cases where maximizing medical expense allocation applies

10:54 - Specific case examples

12:42 - Tip #5: Allocate All Damages in the Settlement Agreement

12:58 - Settlement Portion Allocation Example

14:16 - Conclusion

14:40 - Free 15-minute phone call for plaintiffs

15:22 - Settlement Tax Calculator

------------------------------------

YouTube Content:

------------------------------------

------------------------------------

Contact Amicus:

------------------------------------

Phone: (801) 683-5998

------------------------------------

Follow us on Social Media:

------------------------------------

------------------------------------

Blog Content:

------------------------------------

------------------------------------

Video Summary:

------------------------------------

In this video, Greg Maxwell, a practicing attorney and Certified Financial Planner, shares five legal tax-saving strategies for individuals receiving legal settlements. The IRS typically considers settlement money as taxable income unless proven otherwise. Taxation depends on the nature of the lawsuit and its origin. Settlements for personal, physical injuries are generally tax-free under Section 104(a)(2) of the Internal Revenue Code.

Here are the five key tax-saving strategies:

1. Use a Structured Settlement Annuity: This method involves receiving settlement funds in smaller installments over time, lowering the overall tax burden and potentially saving thousands in taxes.

2. Use the Plaintiff Recovery Trust: The Tax Cuts and Jobs Act of 2017 changed the deductibility of legal fees. Plaintiffs in certain cases can no longer deduct legal fees, resulting in higher taxes. The Plaintiff Recovery Trust helps avoid the "Plaintiff Double Tax Trap" by excluding attorney fees from taxable income.

3. Combine a Structured Settlement Annuity and the Plaintiff Recovery Trust: Combining these two strategies maximizes tax savings by spreading income over time and excluding legal fees.

4. Maximize the Medical Expense Exclusion: Even in cases not related to personal injuries, plaintiffs can allocate settlement funds to past and future medical expenses, reducing the overall tax liability.

5. Allocate All Damages in the Settlement Agreement: Plaintiffs can allocate specific amounts to tax-favored categories, such as personal, physical injuries, reimbursement for lost investments, or medical costs. Customized allocations can significantly reduce tax payments.

Комментарии

0:06:07

0:06:07

0:10:41

0:10:41

0:20:19

0:20:19

0:00:46

0:00:46

0:13:54

0:13:54

0:03:59

0:03:59

0:21:34

0:21:34

0:11:08

0:11:08

0:00:35

0:00:35

0:04:09

0:04:09

0:08:09

0:08:09

0:13:37

0:13:37

0:10:29

0:10:29

0:00:41

0:00:41

0:10:15

0:10:15

0:18:58

0:18:58

0:04:00

0:04:00

0:27:35

0:27:35

0:07:20

0:07:20

0:14:40

0:14:40

0:09:53

0:09:53

0:38:18

0:38:18

0:03:19

0:03:19

0:11:32

0:11:32