filmov

tv

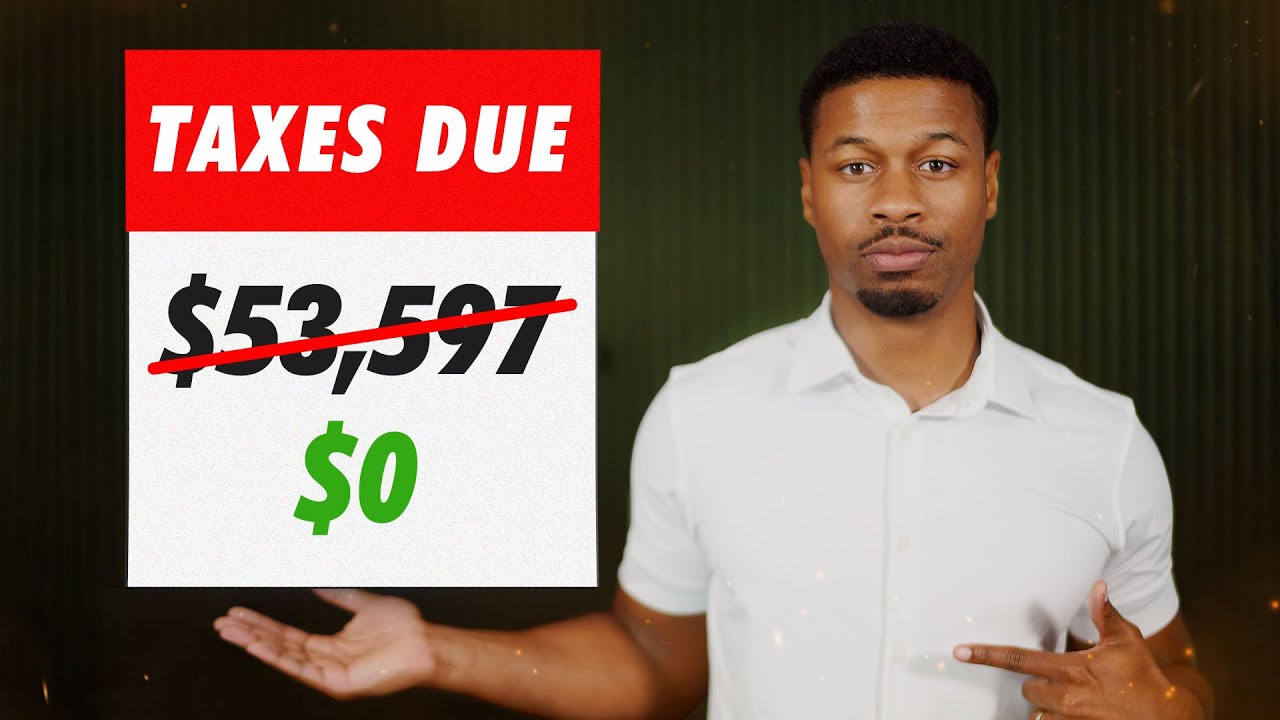

CPA EXPLAINS How To Avoid Paying Taxes (LEGALLY) Do This Now!

Показать описание

By a Trusted CPA: How To Never Pay Taxes Again.

What if you NEVER had to pay income taxes?

And no, I’m not talking about cheating, lying, stealing, or committing tax evasion which could put you behind bars with hefty penalties.

No, I’m talking about using what is literally in the tax law, to avoid paying taxes…like Jeff Bezos, Elon Musk, Warren Buffet, and other Billionaires.

There are over 70,000 pages in the tax code and inside these pages lie the answer to how regular people like you and me can legally avoid paying any taxes like the ultra wealthy.

And today I am going to give you the most simplistic, easiest to understand explanation of how you can accomplish this in a few simple steps.

Please be sure to give this video a like and subscribe to our channel so you don't miss out on future videos!

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

What if you NEVER had to pay income taxes?

And no, I’m not talking about cheating, lying, stealing, or committing tax evasion which could put you behind bars with hefty penalties.

No, I’m talking about using what is literally in the tax law, to avoid paying taxes…like Jeff Bezos, Elon Musk, Warren Buffet, and other Billionaires.

There are over 70,000 pages in the tax code and inside these pages lie the answer to how regular people like you and me can legally avoid paying any taxes like the ultra wealthy.

And today I am going to give you the most simplistic, easiest to understand explanation of how you can accomplish this in a few simple steps.

Please be sure to give this video a like and subscribe to our channel so you don't miss out on future videos!

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

Комментарии

0:09:18

0:09:18

0:20:18

0:20:18

0:07:49

0:07:49

0:10:27

0:10:27

0:08:47

0:08:47

0:08:42

0:08:42

0:08:06

0:08:06

0:08:01

0:08:01

0:08:18

0:08:18

0:11:17

0:11:17

0:37:42

0:37:42

0:08:33

0:08:33

0:07:41

0:07:41

0:07:12

0:07:12

0:18:16

0:18:16

1:25:49

1:25:49

0:09:16

0:09:16

0:13:19

0:13:19

0:07:04

0:07:04

0:04:04

0:04:04

0:08:48

0:08:48

0:10:46

0:10:46

0:11:49

0:11:49

0:08:39

0:08:39