filmov

tv

Market Risk Premium | Formula | Calculation | Examples

Показать описание

In this video on Market Risk Premium, we are going to learn what is market risk premium? formula to calculate market risk premium, calculations with practical examples.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦?

------------------------------------------------------

Market Risk Premium is the difference between the expected return from the investment and the risk free rate.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

------------------------------------------------------

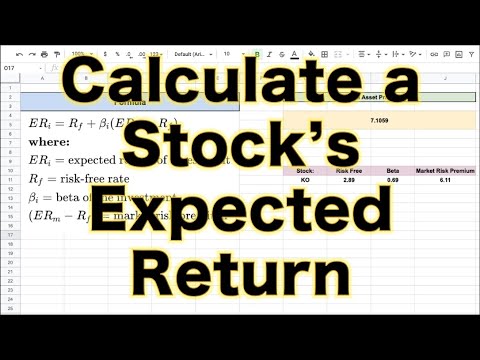

Below is the formula to calculate market risk premium.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗶𝘀𝗸 𝗣𝗿𝗲𝗺𝗶𝘂𝗺 𝗙𝗼𝗿𝗺𝘂𝗹𝗮 = 𝗘𝘅𝗽𝗲𝗰𝘁𝗲𝗱 𝗥𝗲𝘁𝘂𝗿𝗻 – 𝗥𝗶𝘀𝗸-𝗙𝗿𝗲𝗲 𝗥𝗮𝘁𝗲

𝐑𝐞𝐚𝐥 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

----------------------------------------------------------------

Real Market Risk Premium formula = (1 + Nominal Rate / 1 + Inflation Rate) – 1

𝐄𝐱𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧

---------------------------------------------------------------------------------

Here in the below given example, we have two investments and we have also the information for expected return and risk free rate.

Expected Return for the Investment 1 = 20%

Expected Return for the Investment 2 = 21%

Risk free rate for the Investment 1 = 8%

Risk free rate for the Investment 2 = 8%

Now by using the formula we will calculate the Market Risk Premium

Market Risk Premium Formula = Expected Return – Risk-Free Rate

Investment 1 = 20% - 8%

Market Risk Premium for Investment 1 = 12%

Investment 2 = 21% - 8%

Market Risk Premium for Investment 2 = 13%

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦?

------------------------------------------------------

Market Risk Premium is the difference between the expected return from the investment and the risk free rate.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

------------------------------------------------------

Below is the formula to calculate market risk premium.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗶𝘀𝗸 𝗣𝗿𝗲𝗺𝗶𝘂𝗺 𝗙𝗼𝗿𝗺𝘂𝗹𝗮 = 𝗘𝘅𝗽𝗲𝗰𝘁𝗲𝗱 𝗥𝗲𝘁𝘂𝗿𝗻 – 𝗥𝗶𝘀𝗸-𝗙𝗿𝗲𝗲 𝗥𝗮𝘁𝗲

𝐑𝐞𝐚𝐥 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

----------------------------------------------------------------

Real Market Risk Premium formula = (1 + Nominal Rate / 1 + Inflation Rate) – 1

𝐄𝐱𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐢𝐬𝐤 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧

---------------------------------------------------------------------------------

Here in the below given example, we have two investments and we have also the information for expected return and risk free rate.

Expected Return for the Investment 1 = 20%

Expected Return for the Investment 2 = 21%

Risk free rate for the Investment 1 = 8%

Risk free rate for the Investment 2 = 8%

Now by using the formula we will calculate the Market Risk Premium

Market Risk Premium Formula = Expected Return – Risk-Free Rate

Investment 1 = 20% - 8%

Market Risk Premium for Investment 1 = 12%

Investment 2 = 21% - 8%

Market Risk Premium for Investment 2 = 13%

Комментарии

0:10:26

0:10:26

0:03:40

0:03:40

0:03:29

0:03:29

0:05:20

0:05:20

0:04:53

0:04:53

0:02:26

0:02:26

0:00:23

0:00:23

0:08:01

0:08:01

0:05:58

0:05:58

0:08:07

0:08:07

0:20:20

0:20:20

0:04:23

0:04:23

0:04:39

0:04:39

0:20:37

0:20:37

0:04:22

0:04:22

0:11:44

0:11:44

0:03:16

0:03:16

0:09:07

0:09:07

0:00:10

0:00:10

0:03:50

0:03:50

0:01:44

0:01:44

0:09:06

0:09:06

0:06:43

0:06:43

0:00:06

0:00:06